Binance DEX

Exchange Fees

Deposit Methods

Cryptos (64)

Binance DEX Review

What is Binance DEX?

Binance DEX is a decentralized exchange (DEX) that launched in February 2019.

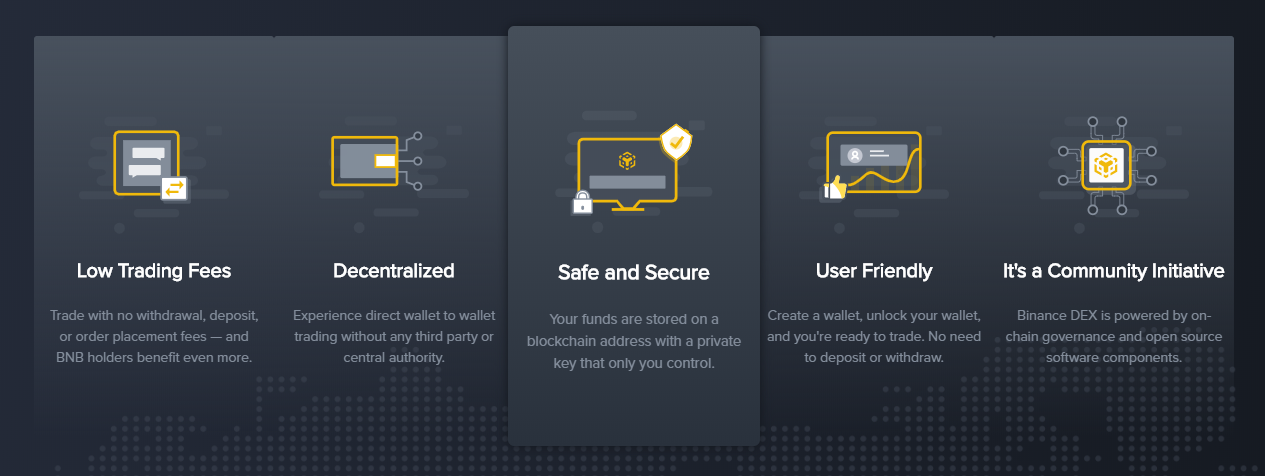

Binance DEX Advantages

As its main advantages, Binance DEX states that it has low trading fees, that it is decentralized, that it is safe and secure, that it is user friendly and that it is a community initiative. The fact that it is a community initiative is not that important to us, and there are both advantages and disadvantages with DEXs (see more on that below under General information on DEXs). Safety and security, low trading fees and user friendliness are however factors that are nothing but positive.

Binance DEX Infographic

The below infographic shows better than we ever could do how to start an account with the Binance DEX:

US-investors

As many other exchanges, Binance DEX does not accept US-investors on its platform. If you’re from the US and you’re looking for the trading platform that is just right for you, don’t worry. Use our Exchange Finder to find exchanges where US-investors can trade.

General information on DEXs

DEXs are becoming increasingly more popular, mostly due to the following factors:

- They do not require a third party to store your funds, instead, you are always directly in control of your coins and you transact directly with whoever wants to buy or sell your coins.

- They normally do not require you to give out personal info. This makes it possible to create an account and right away be able to start trading.

- Their servers spread out across the globe leading to a lower risk of server downtime.

- They are essentially immune to hacker attacks.

However, DEXs normally have an order book with lower liquidity than their centralized counterparts.

Binance DEX Liquidity

As for Binance DEX, on the date of first writing this review (18 September 2019), the 24 hour trading volume was USD 2.1 million (according to information from coinmarketcap.com). This placed it on place no. 120 on the list of the exchanges in the world with the highest 24 hour trading volumes. An interesting comparison is to its centralized equivalent, the “real Binance”, which on the same date had a 24 hour trading volume of USD 1.47 billion (that date the highest 24 hour trading volume in the world). Binance DEX’s trading volume was thus only 0.14% of regular Binance’s trading volume.

On the date of last updating this review (2 December 2021), the 24-hour trading volume was USD 6.88 million.

Binance DEX Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should decide for yourself which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you. The below is a picture of the trading view at Binance DEX:

Binance DEX Fees

Binance DEX Trading fees

Many exchanges charge what we call taker fees, from the takers, and what we call maker fees, from the makers. Takers are the people removing liquidity from the order book by accepting already placed orders, and makers are the ones placing those orders. The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

To speak about maker fees and taker fees when discussing Binance DEX would however be inaccurate. The fee system is far more complex than that. Sure, the trading fees are 0.10% if you pay the trading fees in some other asset than Binance’s own token, the BNB, and 0.04% if you pay them with the BNB. So that’s easy enough to understand. But here are a few other fees to consider when using this platform (on Mainnet):

Binance DEX Withdrawal fees

With respect to the withdrawal fees, they are set at 0.000375 BNB per transfer. There is no real industry average to compare with in this regard so we’ll have to wait and see how other exchanges evolve before we can consider its relation to industry averages. On 17 October 2019, however, 0.000375 BNB is only 0.0068 USD, which is essentially “nothing”.

All in all, the fees at Binance DEX seem very competitive indeed.

Deposit Methods

Binance DEX does not – like all (or at least close to all) other DEXs – accept any deposits of fiat currency. This means that crypto investors without any previous crypto holdings can’t trade at this trading platform. In order to purchase your first cryptos, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency. Find one by using our Exchange Finder!

Binance DEX does however have stablecoin options like Stably USD, TrueUSD/HKD/CAD, and Rupiah Token (Indonesian stablecoin). You can go to these stable coins respective websites to purchase BEP2 versions for trading on this platform.

Binance DEX Security

The servers of DEXs normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange. That is, until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges.