Peru vs Solomon Islands

Crypto regulation comparison

Peru

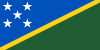

Solomon Islands

Cryptocurrency is legal in Peru but lacks comprehensive regulation. The SBS (Superintendencia de Banca, Seguros y AFP) oversees AML requirements. Peru has growing crypto adoption, particularly for remittances. Crypto gains are subject to capital gains tax at 5% for the first 5 UIT and at higher rates for larger amounts.

Solomon Islands has no specific cryptocurrency regulation.

Key Points

- No specific crypto legislation; general financial laws apply

- Capital gains tax applies to crypto profits (5% for securities, up to 30% for other income)

- SBS requires AML/KYC compliance for entities dealing in crypto

- Growing crypto adoption for remittances and as a store of value

- BCRP has warned about crypto risks but not imposed a ban

Key Points

- No specific cryptocurrency legislation

- Central bank has not addressed crypto regulation

- Very limited internet infrastructure

- Minimal crypto adoption

- No licensing framework for crypto services