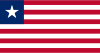

Liberia vs Russia

Crypto regulation comparison

Liberia

Russia

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Russia's crypto regulation is complex and evolving. The 2021 'On Digital Financial Assets' law recognizes crypto as property but bans its use as a means of payment. Mining was legalized and regulated in 2024 under a new mining law. Crypto is taxed as income at 13-15%. The CBR pushed for a total ban on crypto trading but was overruled by the government, which favors regulation. International sanctions have complicated Russia's crypto landscape.

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access

Key Points

- Digital Financial Assets law (2021) recognizes crypto as property but bans use as payment

- Crypto mining officially legalized and regulated under 2024 mining legislation

- Crypto income taxed at 13% (up to RUB 5M) or 15% (above RUB 5M)

- Domestic crypto exchanges not legally operating; P2P trading widespread. CBR framework Dec 2025 targeting July 2026.

- International sanctions have increased interest in crypto for cross-border transfers