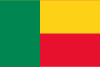

Benin vs Colombia

Crypto regulation comparison

Benin

Colombia

Benin has no specific cryptocurrency regulation. As a WAEMU member, it falls under BCEAO oversight. The BCEAO has warned against crypto but there is no formal ban.

Cryptocurrency is legal in Colombia but not recognized as legal tender or currency. The SFC has run regulatory sandbox programs for crypto-financial services, and exchanges operate under general business registration. Colombia has high crypto adoption, particularly for remittances and as an inflation hedge.

Key Points

- No specific national cryptocurrency legislation

- BCEAO provides regional monetary and regulatory oversight

- Part of the WAEMU monetary zone using the CFA franc

- Limited crypto adoption

- No licensing framework for crypto businesses

Key Points

- Crypto is legal but not recognized as currency or legal tender

- SFC operates regulatory sandboxes allowing banks to partner with crypto exchanges

- DIAN (tax authority) requires reporting and taxation of crypto gains as part of general income

- Colombia ranks among the top 20 countries globally in crypto adoption

- No comprehensive crypto-specific legislation yet; regulation evolving