Bosnia and Herzegovina vs Panama

Crypto regulation comparison

Bosnia and Herzegovina

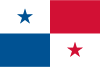

Panama

Bosnia and Herzegovina has no comprehensive crypto legislation. The Central Bank warns crypto is not legal tender and banks cannot convert crypto to BAM. Crypto trading is legal. A 2024 AML law designates VASPs as obligated entities. Republika Srpska gave crypto legal status as digital records of value in 2022. Corporate tax on crypto is 10%.

Panama passed Law 129 in 2024 regulating crypto assets, virtual asset service providers, and tokenized securities. Panama has no capital gains tax on foreign-sourced or investment income, making it attractive for crypto investors. The law provides a regulatory framework for exchanges and establishes AML/KYC obligations for VASPs.

Key Points

- No comprehensive crypto legislation at state level

- Central Bank warns crypto is not legal tender; banks cannot convert to BAM

- 2024 AML/CFT law designates VASPs as obligated entities with KYC requirements

- Republika Srpska gave crypto legal status as digital records in 2022

- 10% corporate tax on crypto profits; exchange services VAT exempt

Key Points

- Law 129 (2024) regulates crypto assets and VASPs in Panama

- No capital gains tax on investment or foreign-sourced income (territorial tax system)

- VASPs must comply with AML/KYC requirements under the new framework

- Crypto payments for commercial transactions are permitted

- Panama's territorial tax system means crypto gains from international trading are untaxed