Xena Exchange

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (7)

UPDATE 15 June 2022: Xena Exchange has decided to close down its operations, due to business reasons. They announced this on its website as follows:

Dear Xena Exchange Client,

The Xena Exchange Team has worked for you since 2017 to provide you a high speed and low risk trading environment, augmented with algorithms, centralized and decentralized custody solutions and integrations. We would like to provide you even more great solutions focused on decentralization in the near future as part of the larger company. It means that we have to temporarily suspend our services.

We kindly ask you to close all opened trading positions, disconnect your alpha10 portfolios, and withdraw your funds before 30th of June 2022

In case your withdrawal is not initiated before 30th of June 2022, we will not be able to process a refund!

Thank you for being our client

In case you have any questions, please kindly contact us on Telegram or via the chat dialogue available on the website.

Accordingly, we have marked the platform as "dead" in our Exchange Graveyard.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

Xena Exchange Review

What is Xena Exchange?

Xena Exchange is a cryptocurrency exchange from the United Kingdom. It launched in 2018.

Fastest Trading Engine?

A feather in the hat for this exchange is that it, according to information on its website, has “the fastest trading engine with a 1ms order execution and no rejects”. If this statement is true, it is naturally very impressive. An observant reader should note though that many exchanges out there claim to have the fastest trading engine.

Liquidity

On the date of last updating this review (20 September 2021), we could not find any information about Xena Exchange's liquidity. Coinmarketcap lists Xena as an Untracked exchange whereas it was not listed at all on CoinGecko. This is a big red flag for this platform...

Restricted Jurisdictions

As many other exchanges, Xena Exchange does not accept US-investors on its platform. In fact, you’re not allowed to trade at this trading platform if you’re from any of the following countries: Algeria, Bangladesh, Bolivia, Canada, Iraq, Iran, Jordan, Kuwait, Malaysia, Qatar, South Korea, Thailand, United Arab Emirates, Venezuela, Japan, Nepal, Saudi Arabia or USA. If you’re from any of the aforementioned countries and you’re looking for the trading platform that is just right for you, don’t worry. Use our Exchange Finder to find an appropriate exchange.

Xena Exchange Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. This is the trading view at Xena Exchange:

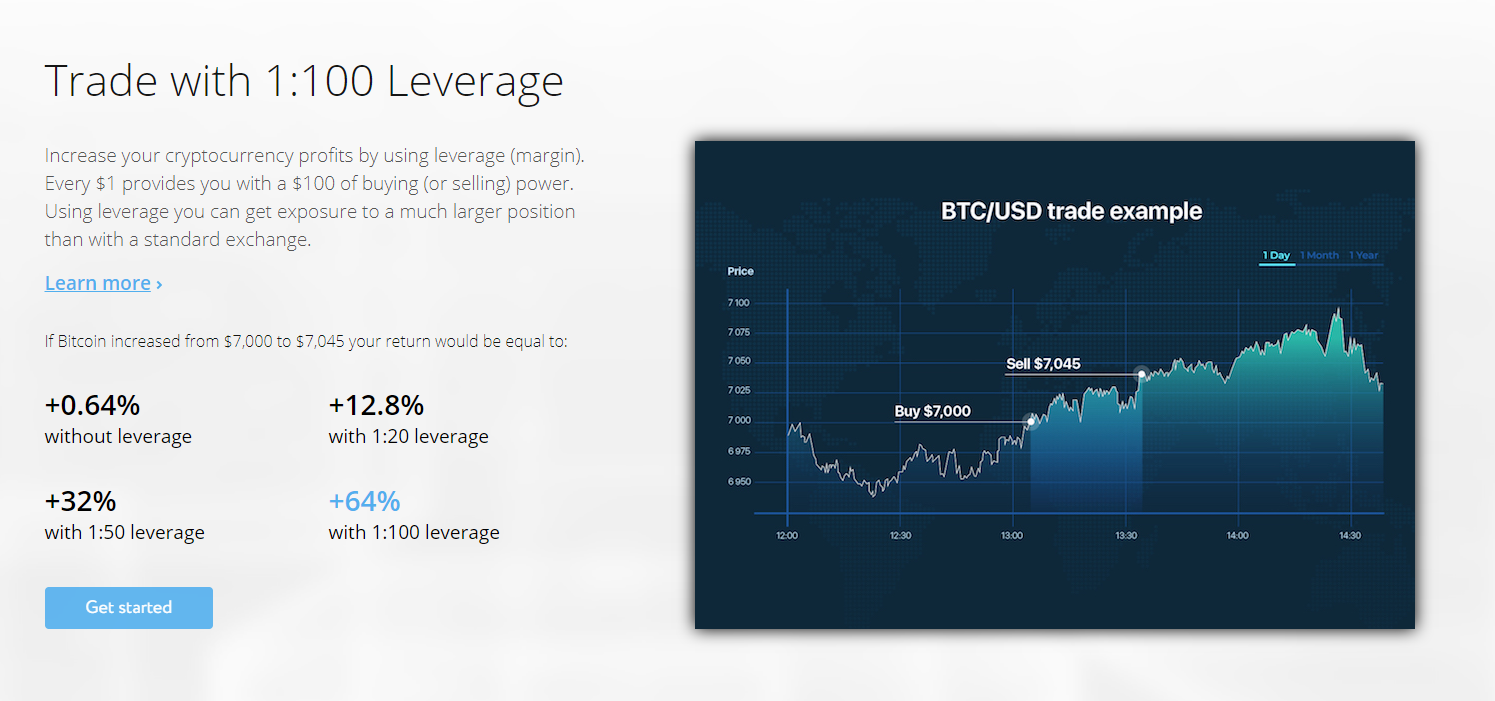

Leveraged Trading

This trading platform offers leveraged trading, up to 100x. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD if you simply held Bitcoin. Now, as you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, there is potential for huge upside but also for huge downside…

This picture from PrimeXBT’s website also illustrates the upside well:

Xena Exchange Fees

Xena Exchange Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. Makers are so named because their orders make the liquidity in a market. Takers are the ones who remove this liquidity by matching makers’ orders with their own.

Xena Exchange’s trading fee for takers is 0.10%. This fee is below the industry average. The industry average is arguably around 0.25%, but we now see more and more exchanges starting to offer even lower fees, such as 0.10% and 0.15%. Makers enjoy a slight discount on the trading fee here and trade with a trading fee of 0.05%.

Xena Exchange also offers trading fee discounts when you have a large trading volume during the preceding 30 days. Trading fees can become as low as 0.05% for takers and 0.00% (i.e., free) for makers. That is if they have a trading volume exceeding 1,000 BTC (which on the date of last updating this review, 31 March 2020, corresponded to approx. USD 6.5 million). The exact trading fee discounts are set out below:

Xena Exchange Withdrawal fees

Xena Exchange's withdrawal fee is 0.0005 BTC per BTC-withdrawal. This fee is a bit below the industry average. The global industry average BTC-withdrawal fee the last time we at Cryptowisser did a full-blown empirical study of it was approx. 0.0008 BTC per BTC-withdrawal. But today, we see more and more exchanges charging 0.0005 BTC per BTC-withdrawal, so one could argue that 0.0005 BTC is starting to become the new industry average.

Deposit Methods

This exchange does not accept any other deposit method than cryptocurrencies, so new crypto investors are restricted from trading here. If you are a new crypto investor and you wish to start trading at this exchange, you will have to purchase cryptos from another exchange first and then – as a second step – deposit them here. Don’t worry though, you can find a so called “entry-level exchange” simply by using our Exchange Finder tool.