Felixo

Börsen-Gebühren

Einzahlungsmethoden

Unterstützte Krypto-Währungen (17)

UPDATE 18 July 2025: Felixo has regrettably been forced to shut down its operations. They announced this through the following message on their website:

Dear Users,

In accordance with the decision of the Capital Markets Board of Türkiye (SPK) dated 18.07.2025 and numbered E-32992422-255-75468, Felixo Teknoloji ve Yazılım A.Ş. is required to terminate its crypto asset service provider activities within 15 days, cease accepting new users, and initiate a liquidation process to protect the rights of existing users.

Accordingly:

-

- All crypto asset trading, transfer, and custody services on the platform will be completely halted.

- Our current users must immediately begin the necessary steps to withdraw their crypto assets and Turkish Lira (TRY) balances.

- Users who do not make a request within one month following this announcement will have their assets converted to cash at current market value and transferred to their registered bank accounts.

In compliance with legal regulations, completion of the Know Your Customer (KYC) process is mandatory before any refund transactions. Requests from users who have not completed or have incorrectly completed the KYC process will not be processed. However, once KYC is properly completed, their balances will be refunded. In accordance with SPK regulations, a temporary freeze may be applied during the refund process for users with insufficient identity verification. Additionally, Turkish Lira (TRY) balances will only be refunded to bank accounts that are registered under the user's name on our platform.

All announcements, updates, and application processes related to the liquidation will be communicated via www.felixo.com and through your registered contact details.

For more information and support, you can reach us at [email protected] or via our customer service line.

Respectfully announced to the public.

Accordingly, we have marked this exchange as "dead" and moved it to our Exchange Graveyard.

To find a reliable exchange, just use our Exchange List and we'll help you find the right platform for you.

Felixo Review

What is Felixo?

Felixo is a cryptocurrency exchange from Turkey that has been active since 2018.

Felixo Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that Felixo’s trading platform is also available as an app. You can download it to/from both the AppStore and Google Play.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

According to information from the exchange, US-investors are not permitted to trade here. If you're from the US and want to find an exchange where you can trade, just use our Exchange Filters and we'll help you.

Felixo Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at Felixo:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Felixo Fees

Felixo Trading fees

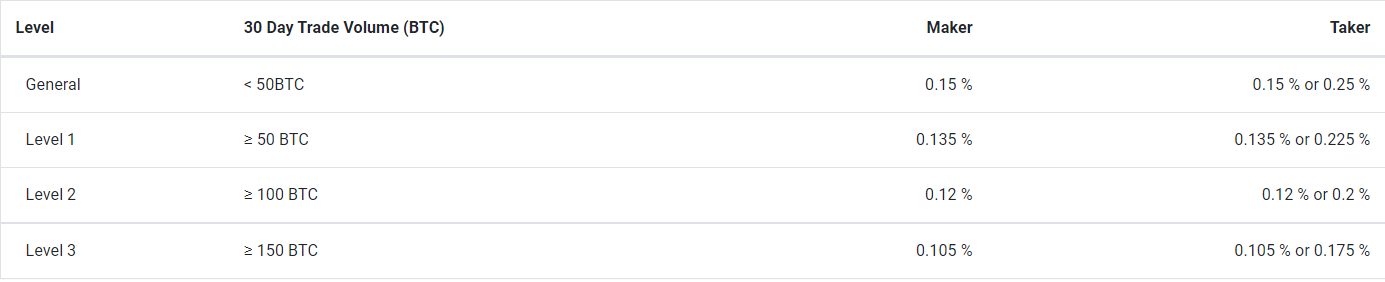

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the one who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

Felixo charges takers 0.25%, and makers 0.15%. These spot trading taker fees are quite in line with the global industry averages for centralized exchanges. Sure, industry averages have historically been around 0.20-0.25% but we now see new industry averages emerging around 0.10%-0.15%. According to Cryptowisser.com's latest empirical study, the industry average spot trading taker fees were 0.221% and the corresponding spot trading maker fees were 0.177%.

You can also receive discounts on your trading fees if you achieve a certain trading volume during the preceding 30-day period or if you hold the exchange's native token (the FLX-token). The trading levels required - and the associated trading fee discounts - are set out in the below table.

The following table shows how many FLX-tokens you need to own in order to be eligible for trading fee discounts on that basis. On the date of first writing this review (16 February 2021), 1 FLX-token was worth USD 0.0045, meaning that you had to hold USD 44.50 worth of FLX-tokens to achieve any trading fee discount at all, and USD 223,000 worth of FLX-tokens in order to trade for free (i.e., 100% discount).

Felixo Withdrawal fees

Many exchanges have competitive trading fees but then hit you on the way out with their withdrawal fees. Let’s say you have reached your investment goals and you are looking to buy house with bitcoin. In order to buy that house, you need to withdraw the funds. And when doing so, the exchange can make up for its low trading fees by charging you high withdrawal fees when you’re halfway out the door.

This exchange charges a withdrawal fee amounting to 0.0005 BTC when you withdraw BTC. This fee is quite in line with the global industry average, which - the last time we made an empirical study on the subject - was 0.00057 BTC per BTC-withdrawal.

Deposit Methods

Felixo lets you deposit assets to the exchange in many different ways, through wire transfer, debit card, and also by just depositing existing cryptocurrency assets.

Seeing as fiat currency deposits are possible at this trading platform, Felixo qualifies as an “entry-level exchange”, meaning an exchange where new crypto investors can start their journey into the exciting crypto world.