Cryptofresh

Börsen-Gebühren

Einzahlungsmethoden

UPDATE 23 March 2023: When trying to access the exchange function of Cryptofresh's website today, we were unsuccessful. We can enter the site, but we can't seem to find the place where cryptos can be swapped, purchased or sold. Neither Coinmarketcap.com or Coingecko.com has a Cryptofresh in their respective lists of crypto exchanges either.

Accordingly, we believe that this company has removed its crypto exchange function (even though the domain is still alive). We have therefore marked it as "dead" in our Exchange Graveyard. If the company's crypto exchange function would become accessible again, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange List and we'll help you find the right platform for you.

Cryptofresh Review

What is Cryptofresh?

Cryptofresh (previously known as BitShares Asset Exchange) is a so called “decentralized exchange”. It launched in 2018.

General Information on DEXs

Decentralized exchanges are becoming increasingly more popular. They are definitely gaining market shares against their centralized counterparts.

Decentralized exchanges do not require a third party to store your funds, instead, you always directly control your coins and conduct transactions directly with buyers/sellers. Decentralized exchanges normally do not require you to give out personal information either. This makes it possible to create an account and right away be able to start trading. The servers of decentralized exchanges spread out which leads to a lower risk of server downtime. However, decentralized exchanges as opposed to regular top crypto exchanges normally have an order book with lower liquidity than the regular top crypto exchanges.

US-investors

Cryptofresh does not explicitly prohibit US-investors from trading on its exchange. In any event, all US-investors should still do their own independent analysis of any problems arising from their residency or citizenship. In a worst-case scenario, they are prohibited from trading at the best cryptocurrency exchange site for them (maybe this one).

Cryptofresh Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the trading views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The trading view of Cryptofresh looks as follows:

Cryptofresh Fees

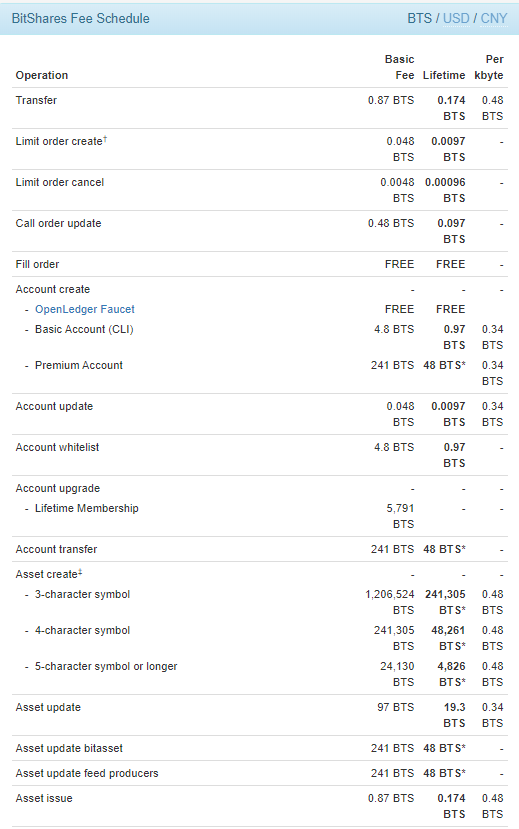

The fees at Cryptofresh are not as easy to understand as the fees at other exchanges. Normally at centralized exchanges, the exchange charges a percentage of the value of the relevant order. Industry average has for a long time been 0.25%, but we are now seeing a shift towards even lower fees, such as 0.10% or 0.15%.

Cryptofresh has small fees for each action you can take, so it’s not only completed orders that will render a fee. On the picture below, obtained from the exchange's website on 28 May 2020, you will find the fees for the most common action types and some ancillary information.

Deposit Methods

Cryptofresh does not accept any other deposit method than cryptocurrencies, so new crypto investors can’t trade there. If you are a new crypto investor and you wish to start trading at this exchange, you will have to purchase cryptos from another exchange first and then deposit them here.

Cryptofresh Security

The servers of decentralized exchanges normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that decentralized exchanges are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a decentralized exchange, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A hacker can therefore hack a centralized exchange and steal your funds held at such exchange. At a DEX, that's not possible.