PR: Trade Bitcoin Using Leverage and Make Your Capital Grow Faster

To open trades, either short (sell) or long (buy), your trading account must have some funds. However, the funds in your account may not be sufficient to open the large trades that can earn you more profits.

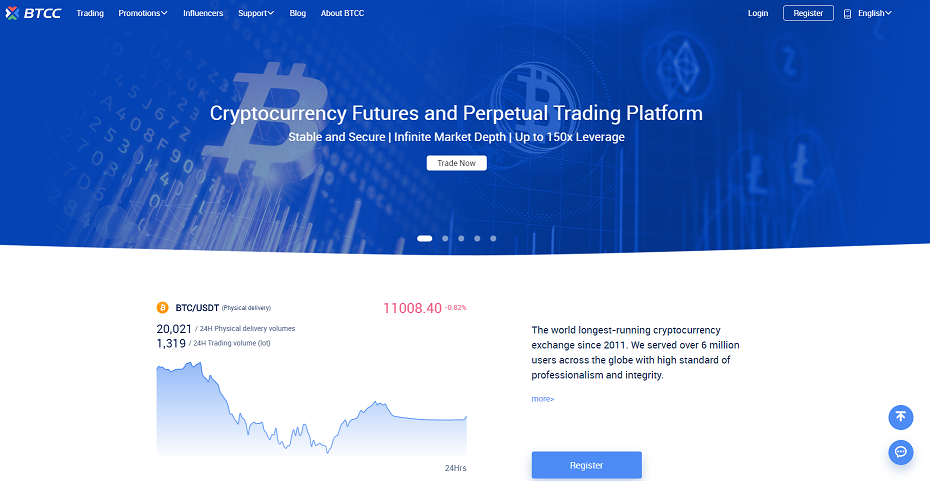

To enable traders to make more profits without necessarily funding their account with thousands or millions of dollars, exchanges like BTCC offer Bitcoin margin trading by providing traders with a selection of leverages that they can choose from when opening a contract or trade.

Leverage is a kind of a ‘loan’ that the exchange gives to a trader to enable him/her to open trades/contracts larger than what he/she is committing for the trades/contracts.

Leverages offered by crypto futures exchanges is normally shown by a value followed by a multiplication sign like 10x, 20x, 30x, 40x, 50x, etc. This is different from how leverage is represented in other financial markets Like Forex where it is given as a ratio; for instance, the 10x leverage would be represented in Forex as 1:10.

When leverage is used in Bitcoin margin trading, the amount of collateral (funds that a trader commits in a trade) is multiplied by the value of the leverage he/she chooses.

For instance, if the account balance is $100, the trader can use a 10x leverage to open a futures contract worth $500. The 10x leverage, in this case, means that the trader only needs a tenth of the $500 (which translates to $50) to open the trade of $500.

Why trade Bitcoin with leverage

The bitcoin and the whole cryptocurrency market is very volatile, and traders can take advantage of the market fluctuations to make money. And the larger the size of the Bitcoin futures contract opened, the higher the amount of profits, when correct market speculation is done.

By trading with leverage, you can open the large trades/contracts without being limited by your account balance. The leverage literary magnifies the size of the contract you can open. If you have an account that you can only fund with $200, for example, and you wish to only invest a 10th of that amount (translating to $20) per contract, you can open Bitcoin futures contracts/trades that are worth more than the $20 by using leverage. If for example, you want to open a contract worth $2000, you should select leverage of 100x since it will amplify your collateral by a factor of 100.

With that said, it is evident that the higher the leverage, the larger the trade or contract that a trader can open and the less the amount of funds required to open a trade. If a trader was to use a 150x leverage to open a margin trade (e.g. a futures contract) worth the same amount of $2000, the trader would only need a one-fiftieth of the $2000 (Which is about $13.33) to open the contract.

Besides, giving the trader the capability of opening and holding large Bitcoin trades, leverage also amplifies the profit margin. The larger the investment, the higher the returns.

Also, since the trader only small collaterals from his/her account to open trades, it becomes possible to open more trades even with a small account balance. The trader does not require a very big account balance to open several large trades/contracts.

Another advantage is that leverage trading reduces the risk of losing all the money required for trade-in case the trade closes as a loss. Let us take two traders for instance; trader A opens a Bitcoin trade/contract of $10,000 with leverage of 10x and trader B opens a similar trade/contract of $10,000 without leverage.

Trader A will use a collateral of $100 while trader B will use a collateral of $10,000. If the trades were entered at the same time and the Bitcoin price records a 60% loss, trader A would only lose $60 while trader B would lose $6,000.

Any downside in trading Bitcoin with leverage?

Leveraged trading is very lucrative when trades are closing in profits. However, when using leverage to trade, traders should also understand that it is a two-edged sword. It amplifies your profits and also does the same for your losses.

Therefore, the higher the leverage, the higher the trading risk involved.

But the question here would be since the contract is larger than the amount you invested, is it possible to lose more than you invested (that is your collateral in the trade)?

If it was in other financial markets like forex, traders that use brokers that do not offer negative account protection end up with negative account balances; meaning the will have to deposit more funds to clear the debt they owe to the broker. However, most forex brokers provide negative account protection.

With cryptocurrency exchanges, especially those like BTCC offering Bitcoin futures trading, there is always negative account protection which is stated as a Stop out ration.

The stop out ratio dictates when the exchange can automatically liquidate your loss trade. By liquidating it means closing the trade at the loss (in more technical terms it is being sold out if the trade is a long, or bought back in if the trade is short); meaning you lose the amount of money stipulated by the loss. If an exchange has a stop out ratio of let’s say 40%, it means that the exchange will initiate the automatic liquidation of your contract when you lose 70% of your collateral. That way, you cannot lose all your collateral (invested money) or more than the collateral.

Different futures exchanges have different stop out ratios. Some exchanges have higher than others. And although it is a good risk management tool, a higher stop out ratio may rob the trader a chance of closing at a profit if the trend was just about to change in a short while. That is why a low stop out ratio is more advantageous than a higher stop out ratio. BTCC has one of the lowest stop out ratios among Bitcoin futures exchanges.

Conclusion

With correct cryptocurrency market speculations, leverage trading is a great way of making profits trading cryptocurrencies like Bitcoin. However, this does not eradicate that Bitcoin leverage trading increases the risk of trading.

Nonetheless, to make the most out of leveraged trading, you should go for an exchange that offers the highest leverage. A good example of such an exchange is BTCC crypto exchange, which has 9 years of secure and stable operating history and now provides up to 150x leverage on crypto daily/weekly/perpetual contracts, to people who want to try the Bitcoin leverage trading.

***

DISCLAIMER

The views, the opinions and the positions expressed in this press release are those of the author alone and do not necessarily represent those of https://www.cryptowisser.com/ or any company or individual affiliated with https://www.cryptowisser.com/. We do not guarantee the accuracy, completeness or validity of any statements made within this press release. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author. Any liability with regards to infringement of intellectual property rights also remains with them.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!