SunSwap

取引所の手数料

入金方法

仮想通貨 (13)

SunSwap Review

What is SunSwap?

SunSwap is a decentralized exchange (DEX) that launched in the "DeFi Year" of 2020. The exchange is built on the Tron network and is used for trading TRC20 tokens. Using SunSwap, users can convert any two TRC20 tokens quickly and easily at the system price. All trading fees will be paid directly to the protocol’s liquidity providers, guaranteeing security.

TronLink Wallet

To use the SunSwap exchange, you need to set up your TronLink Wallet. It’s only possible to operate on the platform if you connect the TronLink Wallet, and if you don’t, you can quickly and easily set one up.

From JustSwap to SunSwap

SunSwap is the upgraded version of JustSwap, officially acquired by the company in October 2021. Having been bought by SUN.io, the exchange was managed by the SUN Genesis Mining group, evolving into a TRON-based platform that combines stablecoin swap, token mining, and self-governance.

Thanks to TRON’s partnership with DeFi, SUN.io’s SunSwap became the most popular and successful blockchain initiative and has grown at a rapid pace ever since. Given that it is the TRON network’s first decentralized token exchange protocol, SunSwap provides a simple and instantaneous trading platform for TRC-20 token users.

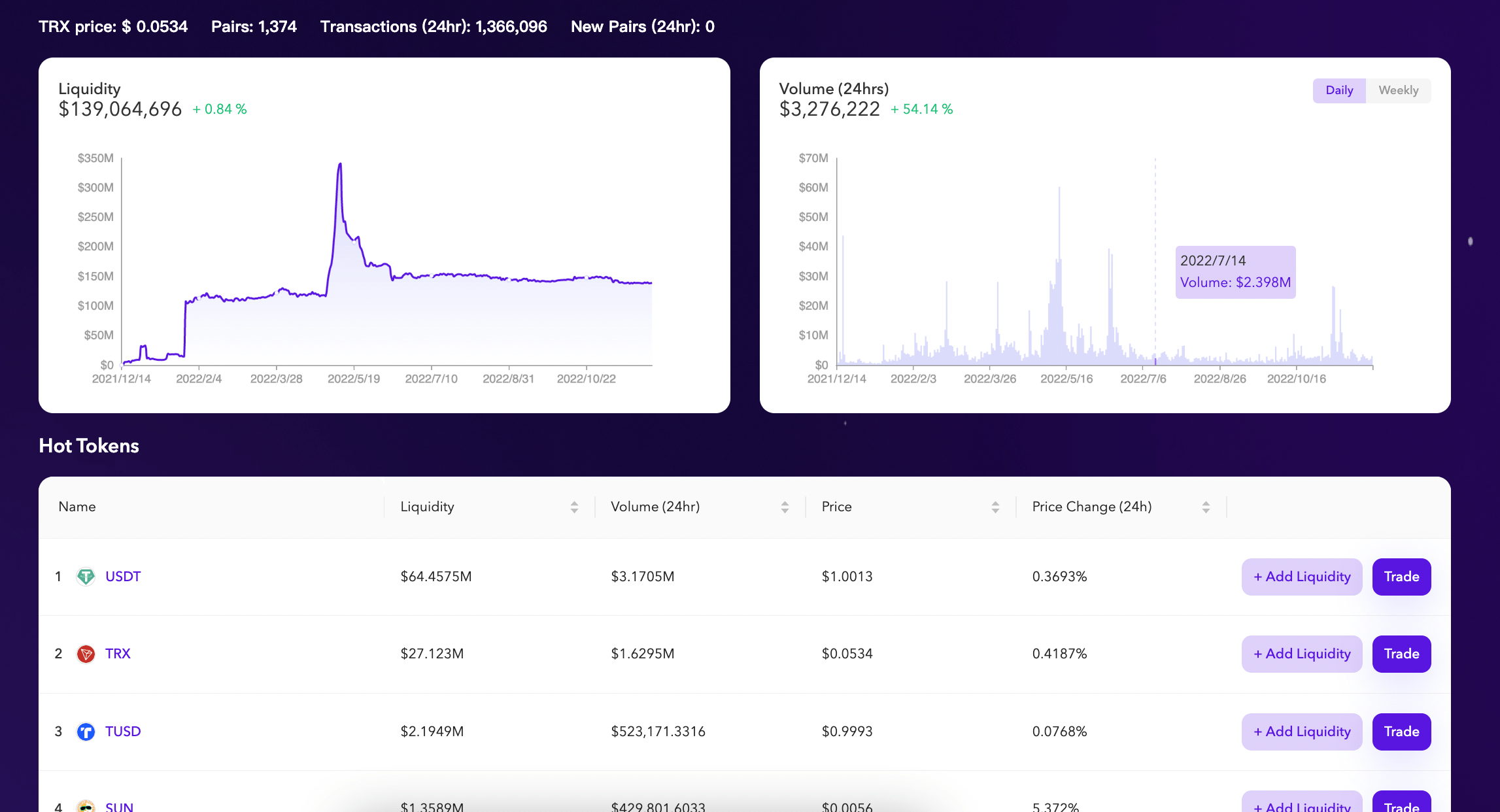

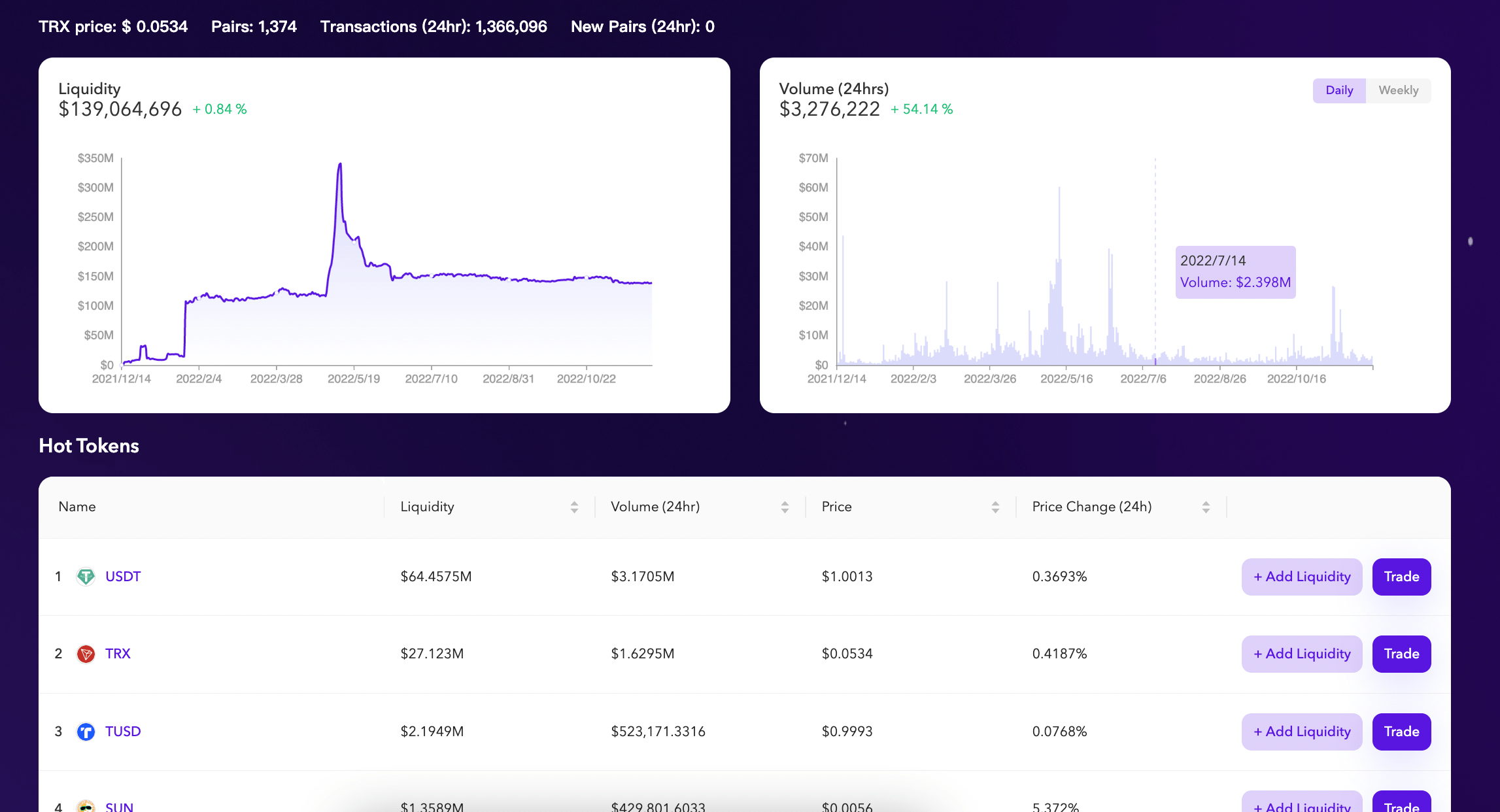

SunSwap Trading Volume

As for JustSwap, on the date of first writing this review (December 5, 2022), the 24-hour trading volume was USD 2,429,004 (according to information from nomics.com). However, the platform's trading volume has followed that of the rest of the market and has been at a low for the majority of 2022.

Does It Allow US investors?

Decentralized exchanges differ from major centralized exchanges, such as Binance and Coinbase. They never have custody of any user assets. They normally don't accept any fiat currency. In the case of SunSwap, it allows US investors as there are no real guidelines and regulatory standards that the US has towards exchanges of this kind.

SunSwap Trading View

The exchange view is part of a trading platform’s website where traders can trade cryptocurrencies. Most exchanges provide a trading view on their website. On these views, traders can check the prices of various cryptocurrencies and make trades accordingly. In addition, most trading platforms offer the possibility of placing orders.

These orders determine how much cryptocurrency should be bought or sold at a specific price within a given period. Trading platforms often also allow users to monitor the order book, i.e., show the list of open orders. A user can then choose to execute one of those orders or not. By doing so, users can either profit from their own order or cancel it if they think the market may move against them.

SunSwap Fees

Below, we dig into the various SunSwap fees, including trading, deposit, and withdrawal fees.

SunSwap Trading fees

When it comes to centralized exchanges, many will charge what we refer to as maker fees from the makers and what we refer to as taker fees from the takers. Takers are the individuals taking liquidity out of the order book by accepting orders that have already been submitted, and makers are the individuals submitting these orders. The main alternative is to charge flat fees. Flat fees mean similar amounts regardless of who takes the liquidity out of the order book and submits it.

When it comes to decentralized exchanges, many do not charge any trading fees at either end, which is one of the biggest arguments that DEX proponents use to describe why centralized exchanges are on their way down. SunSwap is one of those exchanges that does not charge any trading fees.

SunSwap Withdrawal fees

SunSwap follows a similar pattern to most DEXs and doesn’t charge any transfer or withdrawal fees, just network fees which this crypto firm doesn’t dictate. Network fees are paid to the miners of the relevant network, which vary depending on the day, time, and network pressure.

Paying just for network fees is great for users and isn’t comparable to other major platforms. Regarding fee levels for crypto withdrawals, you’ll find DEXs are often best for customers.

SunSwap Deposit Fees

SunSwap doesn’t accept fiat deposits of any kind, not even USD! Customers must be crypto investors before they can begin operating on SunSwap. You will need to have some experience with digital assets before coming to this trading platform. However, you can find a range of fiat deposit exchanges easily through our exchange filters on-site!

SunSwap Liquidity Mining

Liquidity mining is the practice of lending cryptocurrencies to exchanges to earn passive income. Traders who utilize liquidity mining services can receive rewards without having to trade cryptocurrency themselves.

For SunSwap users, there are four liquidity options, all of which allow users to earn a yield percentage over a set period. Many of these options offer auto-investing, allowing users to keep the funds back into the existing liquidity pool.

SunSwap Security

A decentralized exchange does not run on any single machine. They rely on peer-to-peer networks where users connect directly to each other without the need for an intermediary. This allows them to create much stronger security protocols and ensure they aren't vulnerable to attack. Because these platforms are so secure, they're also swift and low-cost. In addition to this, they allow people to trade coins anonymously. No personal information is ever stored or exchanged, meaning you have complete control over your funds.

In addition, no matter how good your security system is, if someone gets past it, they can steal money from your account anytime. With SunSwap, hackers cannot access your accounts because the trading platform runs on blockchain technology. They can only take control of your computer if you download an external application onto it.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!