Hotcoin Global

取引所の手数料

入金方法

仮想通貨 (112)

Hotcoin Global Review

What is Hotcoin Global?

Hotcoin Global is a cryptocurrency exchange from the land down under - Australia. It launched in 2017. The platform is owned by the company Hotcoin Global Exchange Pty Ltd, and two different licenses to conducts its operations from AUSTRAC (digital currency tradings and FX).

Hotcoin Global Advantages

The platform lists four things in particular as benefits. First, they say that they are stable and secure. Second, that they have a smooth and easy fiat currency deposit and withdrawal system. Third, that the platform often offers discounts and promotions. Fourth and finally, that it is a very customer focused support center that puts the user of the platform first. We feel that all of these advantages are indeed important, but we have not been able to verify any of them yet.

Trading Volume

On the date of first writing this review (16 February 2021), the platform's 24 hour trading volume according to Coinmarketcap was USD 4.8 billion. On the date of last updating this review (2 December 2021) the volume was around USD 976 million. On the same day, Binance had a trading volume of approximately USD 30 billion...

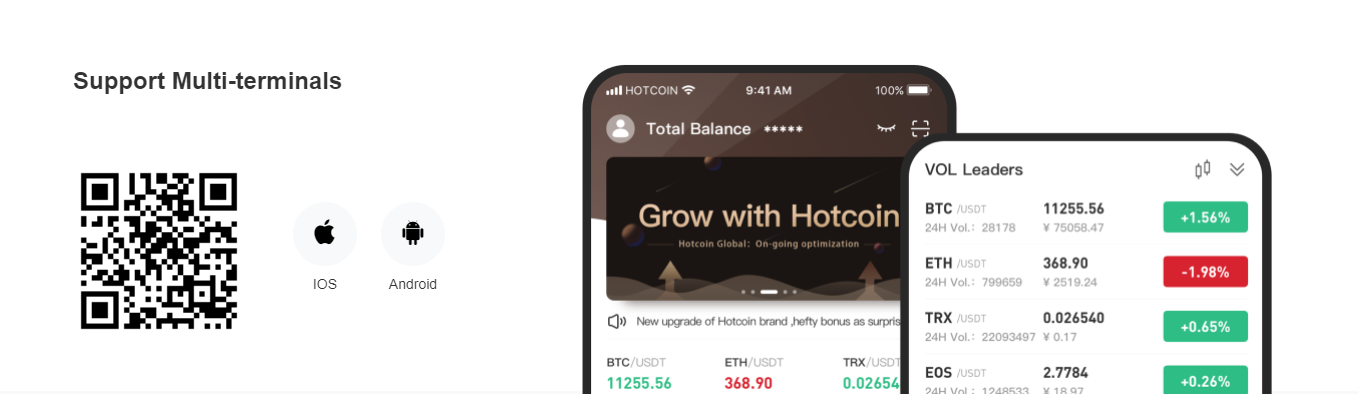

Hotcoin Global Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that Hotcoin Global’s trading platform is also available as an app. You can download it to/from both the AppStore and Google Play.

Leveraged Trading

For its crypto derivatives products, Hotcoin Global allows you to trade with leverage. This means that you can receive a higher exposure towards a certain crypto’s price increase or decrease, without actually holding the necessary amount of assets. You do this by “leveraging” your trade. In simple terms, this means that you borrow from the exchange to bet more. We are uncertain of how much leverage you can get at this platform.

Leveraged trades are risky though. For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

Hotcoin Global Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders concerning the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at Hotcoin Global:

It is up to you – and only you – to decide if the above trading view is suitable for you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Hotcoin Global Fees

Hotcoin Global Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the one who “take” an existing order from the order book.

Hotcoin Global charges what we call flat fees, meaning that both the takers and the makers pay the same fee. In this case, that fee is 0.20%. These flat fees are quite in line with, or slightly above, the global industry averages for centralized exchanges. In the largest and most recent empirical study performed on industry average crypto trading fees, we found that the industry average spot trading taker fee was 0.217% and the corresponding spot trading maker fee was 0.164%. Here, as you recall, they are both set at 0.20%.

Consequently, Hotcoin Global's trading fees are slightly below average for the takers and a bit higher than average for the makers.

Hotcoin Global Withdrawal fees

Hotcoin Global charges a withdrawal fee of 0.0005 BTC per BTC-withdrawal. The current global industry average is 0.000643 BTC per BTC-withdrawal according to this report, which is the latest such report prepared on the subject to our knowledge. Accordingly, the withdrawal fees charged by this platform are competitive.

Deposit Methods and US-investors

Deposit Methods

In order to trade here, you must have cryptocurrency to begin with. The only asset class you can deposit to Hotcoin Global is cryptocurrency. However, if you really like Hotcoin Global but you don’t have any crypto yet, you can easily start an account with an exchange that has “fiat on-ramps” (an exchange where you can deposit regular cash), buy crypto there, and then transfer it from such exchange to this exchange. Use our Exchange Filters to easily see which platforms that allow wire transfer or credit card deposits.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

It is unclear to us whether Hotcoin Global permits US investors or not. We have read their Terms and Conditions and have not found an explicit prohibition of US investors. We urge any US investors to form their own opinion on the permissibility of their trading at Hotcoin Global though.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!