Israel vs Maldives

Crypto regulation comparison

Israel

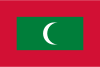

Maldives

Cryptocurrency is legal in Israel and treated as a taxable asset. The Israel Tax Authority classifies crypto as property, subject to 25% capital gains tax (or up to 50% for significant shareholders or high earners). Israel has a vibrant blockchain ecosystem with many startups and R&D centers.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- Capital gains tax of 25% on crypto profits (up to 50% including surtax for high earners)

- Israel Tax Authority classifies cryptocurrency as property, not currency

- ISA is developing a regulatory framework for digital asset trading platforms

- AML/KYC requirements apply to crypto service providers under CTMFA supervision

- Israel has one of the highest densities of blockchain startups globally

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption