Belarus vs Micronesia

Crypto regulation comparison

Belarus

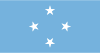

Micronesia

Belarus legalized cryptocurrency through Decree No. 8 (2017), creating a favorable environment in the Hi-Tech Park special economic zone. As of 2025, crypto transactions via HTP residents remain tax-exempt, while transactions on foreign platforms are taxed at 13%. A crypto bank framework was introduced in 2026.

Micronesia has no specific cryptocurrency regulation. Uses the US dollar as its official currency.

Key Points

- Decree No. 8 'On the Development of the Digital Economy' legalized crypto in 2017

- Income from crypto via HTP residents and mining remains tax-exempt; 13% tax on foreign platform transactions since 2025

- Crypto exchanges and businesses must operate through Hi-Tech Park residency

- Mining is legal and considered a business activity

- HTP preferential regime extended until 2049; crypto bank framework introduced in 2026

Key Points

- No specific cryptocurrency legislation

- Uses the US dollar as official currency

- Very limited financial infrastructure

- Minimal crypto adoption

- No licensing framework for crypto services