Belgium vs Tuvalu

Crypto regulation comparison

Belgium

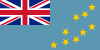

Tuvalu

Cryptocurrency is legal in Belgium and regulated under the EU's MiCA framework. Tax treatment depends on whether gains are considered normal management of private assets (tax-free), speculative (33% misc income), or professional income (progressive rates). The FSMA has banned distribution of crypto derivatives to consumers.

Tuvalu has no specific cryptocurrency regulation. Uses the Australian dollar.

Key Points

- Tax treatment depends on classification: normal portfolio management (0%), speculation (33%), or professional (up to 50%)

- FSMA banned advertising of crypto derivatives and certain crypto products to consumers in 2022

- VASPs must register with FSMA and comply with AML/KYC requirements

- MiCA regulation fully applicable from December 2024

- Belgium has a relatively active crypto community and blockchain ecosystem

Key Points

- No specific cryptocurrency legislation

- Uses the Australian dollar

- Very limited financial and internet infrastructure

- Minimal crypto adoption

- No licensing framework for crypto services