QuickSwap Exchange

取引所の手数料

入金方法

QuickSwap Exchange Review

What is QuickSwap Exchange?

The next-gen Layer 2 DEX Quickswap Exchange is a fork of Uniswap — the pioneer automated market maker in the crypto DeFi sector. It is built on the Polygon (MATIC) protocol. Owing to the Ethereum network congestion, settlements on Quickswap is faster compared to Uniswap. QuickSwap’sAMM functionality offers permissionless P2P trading through liquidity pools.

(IMAGE DATE: 18 June 2021)

General Information on DEXs

Why do you think that DEXs are becoming increasingly more popular? It could be mostly due to the following factors:

- They do not require a third party to store your funds. Instead, DEXs gives you direct control of your coins and tokens. Additionally, users have a higher degree of control when entering into transactions to buy or sell their coins.

- Typically, they do not require you to give out personal info. This makes it possible to create an account and right away be able to start trading.

- Their servers spread out across the globe leading to a lower risk of server downtime.

- They are essentially immune to hacker attacks.

- However, DEXs normally have an order book with lower liquidity than their centralized counterparts.

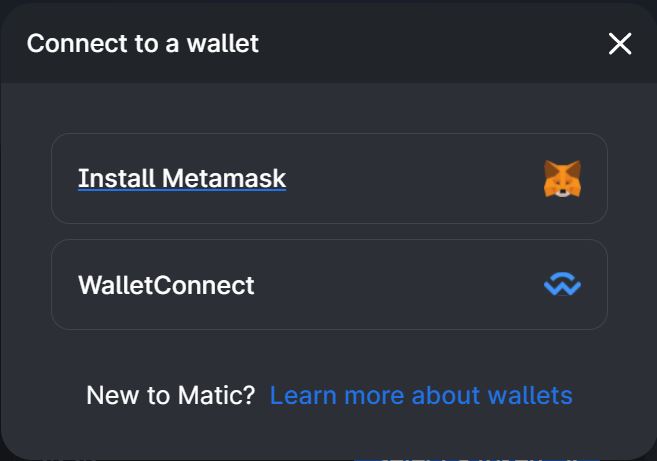

QuickSwap Exchange Compatible Wallets

In order to use QuickSwap, you need to have one of the following wallets. The platform is only possible to use if you connect your wallet to the platform.

QuickSwap Exchange Liquidity

QuickSwap’s liquidity mining protocols aim to incentivize liquidity providers in creating a sustainable ecosystem. Users can generate rewards in Quickswap’s native governance token — QUICK through the yield farming opportunities. These rewards are in addition to the rewards generated from transactions fees.

Liquidity providers can also list any new ERC 20 token pairs, that is currently not part of the exchange pool. Rewards will be paid from the fees generated through trades using these token pairs.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

Decentralized exchanges are different beings than the abovementioned examples. They never have custody of any user assets. They normally don't accept any fiat currency. As such, they are less scary for regulating authorities and the same reasons to prohibit citizens from certain countries to use them can't be applied. Accordingly, we have marked QuickSwap Exchange as "allowing US-investors" in our database.

QuickSwap Exchange Trading Interface

Every trading platform has a trading interface. The trading interface is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what is its current price. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the swap interface at QuickSwap Exchange (with no wallet connected though):

It is up to you – and only you – to decide if the above trading interface is suitable for you. Finally, there are usually many different ways in which you can change the settings to tailor the trading interface after your very own preferences.

QuickSwap Exchange Fees

QuickSwap Exchange Trading fees

When it comes to centralized exchanges, many of them charge what we call taker fees, from the takers, and what we call maker fees, from the makers. Takers are the people removing liquidity from the order book by accepting already placed orders, and makers are the ones placing those orders. The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

When it comes to decentralized exchanges, many of them don't charge any trading fees at all. This is in fact one of the big arguments that DEX-supporters use to explain why centralized exchanges are on their way out.

QuickSwap is not one of the "no fee" exchanges, but charges 0.30% per transaction regardless of whether you are a maker or a taker. They call this a liquidity fee of each trade, paid to the liquidity provider as a protocol incentive. These fees are subjected to change by community governance.

Regardless of whether you compare to DEXs or centralized exchanges, these fees are above the industry average.

QuickSwap Exchange Withdrawal fees

To our understanding, QuickSwap Exchange does - like most decentralized exchanges - not charge any transfer fees or withdrawal fees other than the network fees. The network fees are fees paid to the miners of the relevant crypto/blockchain and not fees paid to the exchange itself. Network fees vary from day to day depending on the network pressure.

A publication in October 2020 on the exchange’s FAQ section claims that the platform offers trade execution at” lightning-fast speeds with near zero gas fees”. It also boasts that its platform fees were 0.01% vis-à-vis Ethereum on 18 May 2020.

Generally speaking, to only have to pay the network fees should be considered as below the global industry average when it comes to fee levels for crypto withdrawals (if you include all exchanges, both DEXs and CEXs in the data set).

Deposit Methods

QuickSwap does not – like all (or at least close to all) other DEXs – accept any deposits of fiat currency. This means that crypto investors without any previous crypto holdings can’t trade at this trading platform. In order to purchase your first cryptos, you need a so-called entry-level exchange, which is an exchange accepting deposits of fiat currency. Find one by using our Exchange Filters!

QuickSwap Exchange Security

The servers of DEXs normally spread out across the globe. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, you normally tend to hold assets at that exchange. This is of course until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges, like QuickSwap.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!