Mongolia vs Togo

Crypto regulation comparison

Mongolia

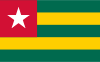

Togo

Mongolia adopted the Law on Virtual Asset Service Providers (VPSP) in December 2021, establishing a comprehensive regulatory framework. The Financial Regulatory Commission (FRC) registers and supervises crypto exchanges. Over 12 licensed exchanges serve 850,000+ customers. Crypto mining is legal and growing, with tax incentives for renewable energy use.

Togo has no specific cryptocurrency regulation. As a WAEMU member, it falls under BCEAO oversight.

Key Points

- Law on Virtual Asset Service Providers (VPSP) adopted December 2021

- FRC registers and supervises crypto exchanges under VPSP law

- Over 12 licensed exchanges serving 850,000+ customers

- Crypto exchange income is taxable and exempt from VAT

- Mongolia launched blockchain-based OTC securities trading in 2025

Key Points

- No specific national cryptocurrency legislation

- BCEAO provides regional monetary oversight

- Part of the WAEMU monetary zone using the CFA franc

- Limited crypto adoption

- No licensing framework for crypto businesses