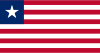

Liberia vs Mongolia

Crypto regulation comparison

Liberia

Mongolia

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Mongolia adopted the Law on Virtual Asset Service Providers (VPSP) in December 2021, establishing a comprehensive regulatory framework. The Financial Regulatory Commission (FRC) registers and supervises crypto exchanges. Over 12 licensed exchanges serve 850,000+ customers. Crypto mining is legal and growing, with tax incentives for renewable energy use.

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access

Key Points

- Law on Virtual Asset Service Providers (VPSP) adopted December 2021

- FRC registers and supervises crypto exchanges under VPSP law

- Over 12 licensed exchanges serving 850,000+ customers

- Crypto exchange income is taxable and exempt from VAT

- Mongolia launched blockchain-based OTC securities trading in 2025