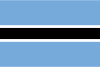

Botswana vs Saint Vincent and the Grenadines

Crypto regulation comparison

Botswana

Saint Vincent and the Grenadines

Legal

Legal

Botswana passed the Virtual Assets Act in 2022, first African country to issue crypto licenses. NBFIRA supervises VASPs. 4 licensed entities as of 2024. Penalties up to P250,000 or 5 years imprisonment.

Saint Vincent and the Grenadines has been a popular jurisdiction for offshore crypto businesses. No income or capital gains tax.

Tax Type

None

Tax Type

No tax

Tax Rate

N/A

Tax Rate

0%

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Non-Bank Financial Institutions Regulatory Authority (NBFIRA)

Regulator

Eastern Caribbean Central Bank (ECCB), Financial Services Authority

Stablecoin Rules

No stablecoin regulation

Stablecoin Rules

No specific stablecoin regulation

Key Points

- Virtual Assets Act enacted in 2022, effective Feb 22, 2022

- First African country to issue crypto licenses via NBFIRA

- 4 licensed VASPs as of December 2024

- Bank of Botswana assesses domestic crypto risks as minimal

- Unregistered crypto dealers face fines up to P250,000 or imprisonment

Key Points

- Popular jurisdiction for crypto business registration

- No income or capital gains tax

- Financial Services Authority provides oversight

- ECCB provides regional monetary oversight

- Several crypto exchanges have been registered here