Bahrain vs Lesotho

Crypto regulation comparison

Bahrain

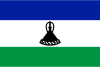

Lesotho

Bahrain is one of the most crypto-friendly jurisdictions in the Middle East. The Central Bank of Bahrain introduced a comprehensive crypto-asset regulatory framework in 2019, and there is no personal income or capital gains tax. Several major exchanges including Binance have obtained licenses.

Lesotho has no specific cryptocurrency regulation. The central bank has not issued formal guidance on crypto.

Key Points

- CBB Crypto-Asset Module provides a full regulatory framework for exchanges, custodians, and brokers

- No personal income tax or capital gains tax in Bahrain

- Licensed exchanges include Binance (CoinMENA), Rain, and others

- VASPs must meet AML/CFT requirements and obtain CBB licensing

- Bahrain positions itself as a regional fintech and crypto hub

Key Points

- No specific cryptocurrency legislation

- Central bank has not issued formal crypto guidance

- Part of the Common Monetary Area with South Africa

- Limited crypto adoption

- No licensing framework for crypto services