Navigating Liquidity Pools and Slippage Like a Pro January, 2026

This guide breaks down how crypto liquidity pools work and why slippage affects your trades more than you think. It covers practical strategies, examples, and tools across platforms like Binance, Bybit, Coinbase, and Phemex.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

Binance

Centralized Exchanges

|

433 | 0.10% | 0.10% | 0.0002 | 2017 |

CONSIGUE HASTA 100 USD DE BONO DE BIENVENIDA

|

Visite | |||

|

Phemex

Contract Trading Exchanges

|

153 | 0.06% | 0.01% | 0.0004 | 2019 |

CONSIGUE HASTA 180 USD DE BONIFICACIÓN POR DEPÓSITO

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||

In the ever-evolving world of crypto, one of the most overlooked factors behind winning (or losing) trades isn’t just which coin you pick, it’s how your trade actually goes through.

Whether you're swapping tokens on a decentralized exchange (DEX) or adding funds to earn passive income as a liquidity provider, two invisible forces are shaping your results: liquidity and slippage.

Liquidity determines how easily and efficiently you can enter or exit a trade. Slippage measures the price movement that occurs while your trade is being executed. Ignore these two, and you might find yourself overpaying, getting less than you expected, or unintentionally distorting the market, especially when dealing with smaller tokens or volatile moments.

Understanding these mechanics isn’t just a nice-to-have for crypto traders or DeFi explorers, it’s essential. And with more platforms like Binance, Coinbase, , and Phemex offering both centralized and DeFi-style trading environments, it’s more important than ever to know how liquidity pools and slippage affect your bottom line.

In this guide, we’ll break everything down from first principles, walk through real examples, and give you practical strategies to navigate liquidity pools like a pro, whether you're trading, investing, or providing liquidity yourself.

Let’s decode how this hidden layer of the crypto ecosystem works, and how you can use it to your advantage.

What Are Liquidity Pools?

At the core of every decentralized exchange (DEX) is a simple yet powerful mechanism: the liquidity pool. If you have ever swapped tokens on platforms like Uniswap, Sushiswap, or hybrid systems on Binance or Phemex, you have used one in practice.

A liquidity pool is a collection of two or more tokens locked in a smart contract. These tokens are provided by users, known as liquidity providers (LPs), who earn a share of the trading fees each time a trade is made using the pool. Unlike traditional exchanges that match buyers and sellers through order books, DEXs use an automated market maker (AMM) algorithm that relies entirely on these pools.

How It Works

Suppose a trader wants to swap USDC for ETH. On Uniswap, the USDC/ETH liquidity pool might hold $100,000 worth of each token. When the trader swaps USDC, the pool dispenses ETH and updates the internal ratio to reflect the change. This ratio shift alters the price, meaning the larger your trade compared to the pool size, the more price movement, which leads to what is known as slippage.

Most AMMs follow a constant product formula:

Where:

- x is the amount of Token A

- y is the amount of Token B

- k is a constant that remains unchanged during the trade

This formula ensures balance between the two tokens, but it also means that each trade slightly changes the pool’s pricing.

Key Terms

- Liquidity Provider (LP): A user who deposits tokens into a liquidity pool in exchange for trading fees.

- LP Tokens: Tokens that represent a user's share of the pool and can often be staked or used elsewhere in DeFi platforms.

- Total Value Locked (TVL): The total dollar amount of assets held within a liquidity pool or protocol.

- Pool Pair: The two tokens that make up a given liquidity pool, such as ETH/USDT or AVAX/USDC.

Centralized vs Decentralized Pools

Decentralized exchanges like Uniswap and Sushiswap depend entirely on liquidity pools and AMM logic. In contrast, centralized exchanges like Binance and Phemex now offer similar pool-based products, such as Binance Liquid Swap. These allow users to earn passive income through pooled assets, but the pools are managed centrally, which reduces user control while offering potentially more stable returns.

Why It Matters

Liquidity pools are more than backend infrastructure. They impact how efficiently you can trade, how much slippage you incur, and how much risk you take on as a liquidity provider. A large pool with deep liquidity allows users to make sizable trades with minimal slippage. A shallow pool, however, can result in major price swings and expose LPs to high volatility.

Understanding how liquidity pools operate is the foundation for making smarter trading decisions and managing risk effectively in both DeFi and hybrid trading environments.

Why Liquidity Matters in Crypto

Liquidity is one of the most critical yet underappreciated elements in crypto trading. Whether you are using a decentralized exchange (DEX) or a centralized platform, liquidity directly affects your execution price, trade reliability, and risk exposure.

In simple terms, liquidity refers to how easily and efficiently an asset can be bought or sold without significantly affecting its price. High liquidity means a large number of buyers and sellers are participating in the market, enabling trades to be executed quickly at expected prices. Low liquidity means the opposite—fewer participants, less volume, and greater volatility when a trade is made.

Trading in High vs Low Liquidity Environments

Consider this scenario. You want to swap 10 ETH for USDC. On a high-liquidity pair like ETH/USDC on a platform such as Binance or Coinbase, the order will likely be filled close to the current market rate, with little to no price impact. In contrast, on a small-cap token with a shallow pool on a DEX, the same-sized trade could shift the price dramatically, costing you more than anticipated. This is where slippage becomes a major concern.

The greater the difference between your expected price and the executed price, the more value you lose during the transaction. This is especially important when trading large volumes or in volatile markets.

Liquidity in DEXs vs CEXs

On DEXs like Uniswap and Sushiswap, liquidity is provided by users through pools. These pools are decentralized and transparent, but their depth can vary widely across tokens. This makes it essential to check metrics like TVL and 24-hour volume before executing a trade.

On centralized exchanges like Coinbase and Binance, liquidity is typically deeper and more stable, especially for major trading pairs. These platforms use order books instead of AMMs, and market makers help maintain tighter spreads and smoother execution. However, CEXs may have limitations on certain token pairs or regulatory restrictions depending on your location.

The Practical Takeaway

Every time you make a trade, you are relying on available liquidity. Better liquidity usually means:

- Lower slippage

- More accurate pricing

- Faster execution

- Less risk of price manipulation

Ignoring liquidity is one of the most common mistakes new traders make. Understanding how it functions allows you to plan better entries, reduce execution risk, and trade more confidently across both centralized and decentralized platforms.

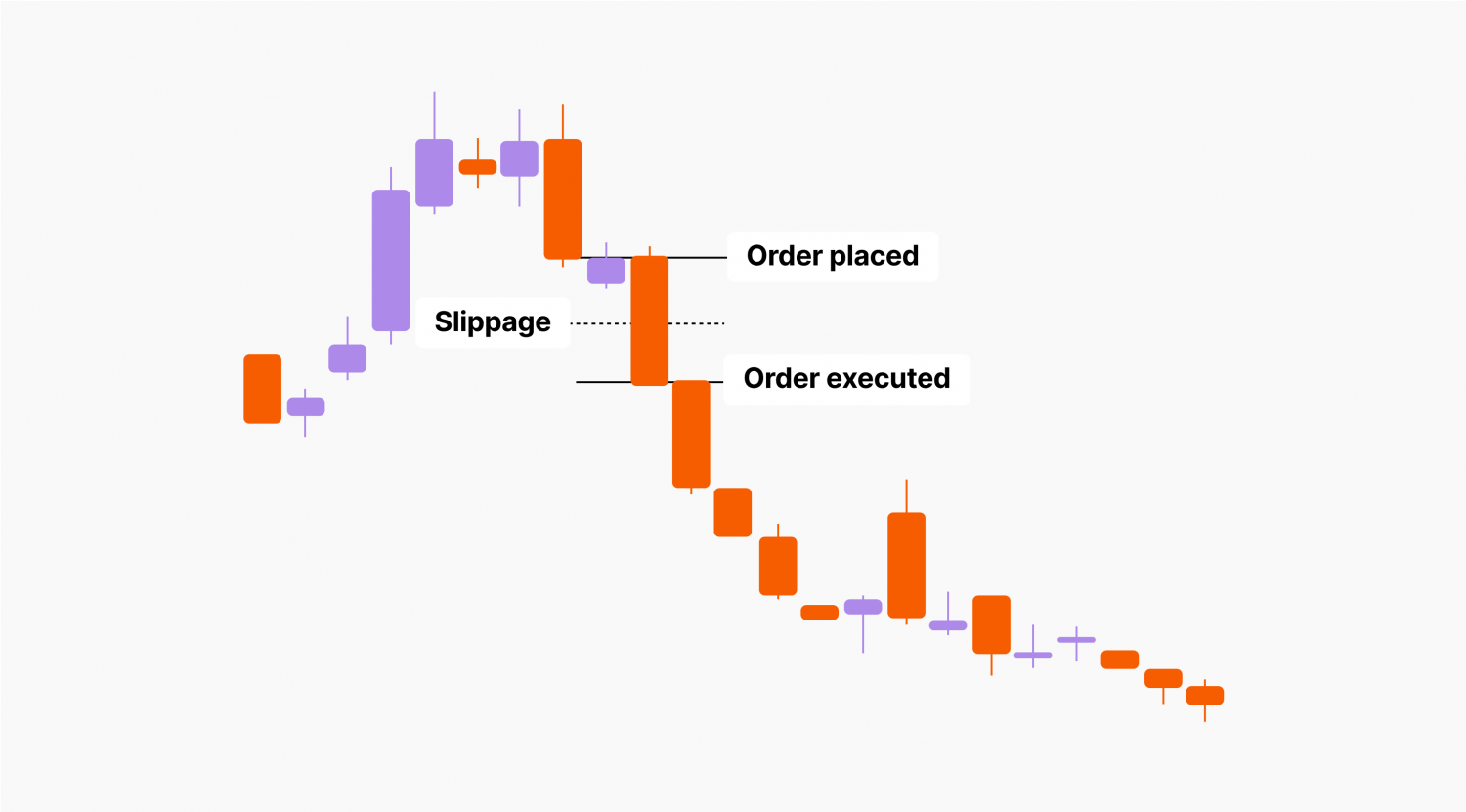

Understanding Slippage

Slippage is the difference between the price you expect to pay for a trade and the price you actually get. In fast-moving or illiquid markets, that gap can be significant. For crypto traders, especially those using decentralized exchanges (DEXs), understanding slippage is essential for protecting capital and avoiding unexpected losses.

What Causes Slippage

Slippage occurs when there is a change in price between the moment a trade is submitted and the moment it is executed. In traditional finance, slippage often results from rapid market movements. In DeFi, slippage is more closely tied to the size of your trade relative to the available liquidity in a pool.

For example, imagine trying to buy $5,000 worth of a small-cap token through a DEX. If the liquidity pool only contains $20,000 in total value, your trade will make up a large percentage of that pool. The automated market maker (AMM) must adjust the price significantly to fulfill your order, and you end up paying more than expected.

Slippage is not just a risk for buying. It applies equally when selling, especially in low-volume markets where even small exits can shift prices.

Slippage Tolerance Settings

Most DEX interfaces allow users to set a slippage tolerance, often in the range of 0.1 to 5 percent. This setting tells the protocol how much price movement you are willing to accept during a trade.

If the market moves more than your allowed tolerance, the trade will fail. This prevents you from unknowingly executing a bad deal. However, setting slippage too low can also result in frequent failed transactions, especially during high volatility.

Traders often increase slippage tolerance when dealing with popular launches or low-liquidity pairs. Conversely, for stablecoins or large-cap tokens, keeping slippage tight protects you from unnecessary loss.

Positive vs Negative Slippage

While most slippage is negative, meaning you receive a worse price than expected, it can also work in your favor. Positive slippage occurs when the market moves in your direction before execution, resulting in a better price. This is more common on centralized exchanges like Bybit, which may support more sophisticated order types and faster matching engines.

Summary

Slippage is an invisible cost of trading, especially in DeFi. Being aware of how it works, how to control it, and how to avoid it gives you a clear edge. Always check your slippage settings before trading, and be mindful of liquidity depth to minimize unexpected losses.

Liquidity Pools in Action (With Examples)

Understanding liquidity pools is one thing. Seeing how they work in practice is what makes the concept stick. In this section, we walk through two real-world examples of liquidity pool usage: one from a decentralized exchange (DEX), and one from a centralized exchange (CEX) that has adopted similar mechanics.

These examples demonstrate the direct relationship between liquidity, slippage, and user experience—whether you're trading or providing liquidity.

Example 1: Swapping on Uniswap

Suppose you want to swap 1,000 USDC for ETH using Uniswap. When you initiate the trade, the protocol checks the current reserves in the USDC/ETH pool. Let’s say the pool holds 500,000 USDC and 300 ETH.

Your 1,000 USDC swap represents only a small portion of the pool’s size, so the price impact is minimal. You receive close to the expected amount of ETH, with low slippage.

Now consider the same trade on a small-cap token pair with only 10,000 USDC and 5 ETH in the pool. That same 1,000 USDC would move the ratio significantly, resulting in a worse exchange rate and higher slippage.

This is why checking a pool’s size—also called depth—is critical before executing a trade.

Example 2: Providing Liquidity on Binance Liquid Swap

On centralized exchanges like Binance, users can access liquidity pool products through features such as Binance Liquid Swap. These pools are centrally managed but function similarly to AMM-based systems. You deposit two tokens into a pool (for example, USDT and BUSD) and receive a share of the trading fees generated from users swapping between the two.

The key difference is in how risk is handled. Binance handles some of the backend mechanics, reducing user exposure to impermanent loss in certain cases. This appeals to users who want passive income from liquidity provision without the full complexity of DeFi platforms.

Example 3: Phemex Earn and DeFi-Style Pools

Phemex also offers a hybrid product line called Phemex Earn, where users can stake stablecoins or crypto pairs into structured liquidity pools. While not as decentralized as Uniswap, these offerings give traders a way to earn interest and fees while avoiding wallet management and gas fees associated with DeFi.

It is important to read the terms carefully. In some cases, liquidity is locked for a set period, or rewards are paid in platform-specific tokens.

Practical Tips from These Examples

- Always check the pool's total value locked (TVL) and recent trading volume before executing a trade.

- Avoid executing large trades in shallow pools. If necessary, break them into smaller orders.

- When providing liquidity, consider the volatility of the token pair. Stablecoin pairs tend to be safer but offer lower yields.

- Use limit orders when available, especially on platforms like Bybit, to reduce slippage risk.

These examples show how liquidity pools function across different platforms and trading environments. The more you understand their mechanics, the more confidently you can navigate both centralized and decentralized ecosystems.

How to Minimize Slippage

Slippage can quietly erode your profits or lead to poor entries and exits if not managed carefully. While it cannot always be avoided, there are several ways to reduce its impact when trading crypto, especially on decentralized platforms.

Adjust Slippage Tolerance Settings

Most decentralized exchanges, including Uniswap and Sushiswap, allow users to set a slippage tolerance before executing a trade. This setting defines how much price movement you are willing to accept between the time you submit the transaction and the time it is confirmed.

For stable, high-liquidity pairs, a tolerance of 0.1 to 0.5 percent is often sufficient. For volatile tokens or low-liquidity pairs, traders may need to raise the tolerance to 1 to 3 percent. However, the higher your tolerance, the more you risk paying above the intended price.

Keep in mind that if the slippage exceeds your setting, the transaction will fail, which could cost you gas fees.

Split Large Trades

Large trades create more slippage because they take a bigger bite out of the liquidity pool. Instead of executing a single large order, consider breaking it into smaller increments.

For example, if you want to convert $20,000 of USDC into ETH on a DEX with limited liquidity, splitting the trade into four or five separate transactions can help reduce the price impact on each individual swap.

This approach does require monitoring the market between trades and may incur slightly higher gas costs, but the overall execution price is often more favorable.

Trade During High-Volume Hours

Liquidity tends to be deeper when more traders are active. If you are using decentralized exchanges, consider aligning your trades with periods of high global activity—typically overlapping U.S. and European business hours.

More liquidity in the pool at those times means smaller price movements and more favorable conditions for execution.

Use Limit Orders on Centralized Platforms

On centralized exchanges like Bybit or Coinbase, you can place limit orders instead of market orders. A limit order allows you to specify the exact price you are willing to pay or accept. This removes slippage entirely, although there is no guarantee that the order will fill.

Limit orders are particularly useful when trading larger amounts or during periods of high volatility.

Summary

Slippage is a cost you can manage with a few proactive decisions. Whether you are using DEXs or centralized platforms, proper timing, order structuring, and slippage settings can significantly improve your results.

Risks and Rewards of Providing Liquidity

Becoming a liquidity provider can seem like a passive way to earn income in crypto. By supplying token pairs to a pool, you receive a portion of the trading fees generated. However, there are risks that every participant should understand before committing funds.

The Rewards

Liquidity providers earn a share of the transaction fees paid by traders who use the pool. On decentralized platforms like Uniswap, fees are automatically distributed based on the size of your contribution. If you provide 5 percent of the pool's total value, you earn 5 percent of the fees.

In some cases, protocols also offer additional token incentives through liquidity mining or yield farming. These bonus tokens increase your return but often come with added complexity or risk.

Stablecoin pools, such as USDC/DAI or USDT/BUSD, typically have lower yields but also lower volatility. More volatile pools like ETH/AVAX or BTC/BNB offer higher potential returns but expose the user to a greater risk of loss.

The Risks: Impermanent Loss

The most important risk in liquidity provision is impermanent loss. This occurs when the price of the two tokens in the pool changes relative to each other. If one token increases in price significantly compared to the other, your share of the pool becomes unbalanced.

When you eventually withdraw your tokens, their total value may be less than if you had simply held them in your wallet. The loss is called impermanent because it could be reversed if the token prices return to their original ratio. However, in many cases the change is permanent.

For example, if you provide equal amounts of ETH and USDC to a pool and the price of ETH rises sharply, the AMM will automatically adjust your holdings to keep the pool balanced. You end up with less ETH and more USDC than you started with.

Centralized Liquidity Pools

Some centralized platforms, such as Coinbase, offer DeFi-style liquidity services under simplified terms. These may reduce exposure to impermanent loss or offer guaranteed rates, but the trade-off is reduced transparency and fewer control options.

If you are new to liquidity provision, these centralized tools can serve as a low-risk introduction. However, they often cap the upside compared to DeFi.

Summary

Providing liquidity is a strategic decision. It offers steady, fee-based income but comes with market exposure and potential for impermanent loss. Understanding the mechanics, monitoring your pool’s performance, and choosing the right token pairs are key to managing this balance effectively.

Tools, Dashboards, and Exchanges That Help

Navigating liquidity and slippage requires the right tools. Whether you are an active trader or a liquidity provider, having access to real-time data and intuitive platforms can make a significant difference in performance and decision-making.

Exchanges with Useful Interfaces

Bybit is known for offering advanced trading features like limit orders and conditional orders that help users avoid unnecessary slippage. While it is primarily a centralized exchange, it provides strong execution speed and control, making it useful for traders who want to reduce trading friction.

Coinbase, on the other hand, offers a simplified user interface suitable for beginners. It also supports staking and access to certain DeFi products through integrations with Coinbase Wallet and other services. For users exploring liquidity provision for the first time, Coinbase can be a practical entry point.

DeFi Dashboards and Analytics Tools

If you are trading or providing liquidity on decentralized platforms, you will need visibility into metrics like pool size, trading volume, slippage history, and return on investment. A few essential tools include:

- DEXTools: Provides detailed analytics on token pairs, slippage, volume spikes, and recent transactions across multiple chains. It is especially useful for identifying risky or illiquid tokens.

- GeckoTerminal: Offers charts, liquidity data, and pool-level insights across decentralized exchanges and blockchain networks.

- DeFiLlama: Useful for tracking total value locked (TVL) across protocols, comparing yield opportunities, and monitoring liquidity trends.

- APY.vision: A dashboard specifically for liquidity providers. It helps track impermanent loss, rewards earned, and net return over time.

These tools allow users to verify liquidity health before executing trades and evaluate risk before providing assets to a pool.

Aggregators and Execution Optimizers

Platforms like 1inch and Matcha act as DEX aggregators. They route your trade through multiple liquidity sources to find the best price with the lowest slippage. These are especially helpful for large trades or low-liquidity pairs where price impact would otherwise be severe.

Final Tips for Pro-Level Trading with Liquidity Pools

Professional traders and liquidity providers follow specific practices to control risk, reduce slippage, and maximize returns. The following techniques reflect how advanced users approach liquidity-focused strategies.

1. Set Slippage Tolerance Strategically

Think of slippage tolerance as a risk threshold.

- For liquid pairs like ETH or BTC, keep it tight (0.1% to 0.5%).

- For volatile or low-liquidity tokens, widen it slightly if needed—but never leave it uncapped.

- Watch for platform defaults that may pre-fill high tolerances during volatile times.

2. Avoid Illiquid Trading Pairs

Trading low-liquidity tokens introduces greater price impact and unpredictability.

- Always check total value locked (TVL) and 24-hour volume before trading.

- Unless you have a specific reason, steer clear of thin pools with limited trading history.

3. Use Liquidity Depth Charts

When available, liquidity depth charts can provide clarity on market strength at different price levels.

- Use tools and dashboards to visualize where the most liquidity sits.

- Avoid placing orders near thin zones that could trigger heavy slippage.

4. Trade During Peak Volume Hours

Liquidity fluctuates throughout the day.

- Peak activity typically occurs during U.S.–Europe market overlaps.

- Avoid trading late at night or on weekends, when volumes and depth tend to drop.

5. Evaluate Liquidity Pools as Yield Products

Liquidity provision is not passive income, it is a yield strategy with risk.

- Estimate expected return considering both fees and impermanent loss.

- Tools like APY.vision can help track real-time performance and risk exposure.

- Stablecoin pools offer lower risk but also lower yield.

6. Use Limit Orders on Centralized Exchanges

Limit orders give you more control over execution.

- Exchanges like Bybit allow you to specify your entry or exit price.

- This avoids slippage entirely and can lead to better outcomes during market swings.

What You Should Take With You

Every time you trade or provide liquidity in crypto, you are interacting with a system shaped by supply, demand, and depth. Liquidity pools and slippage are not just technical details—they directly affect how much you gain, how much you lose, and how reliable your strategy is.

Knowing how liquidity pools operate, how to gauge their size and health, and how to manage slippage gives you an edge. These aren’t advanced tricks; they are core mechanics that influence every transaction on decentralized platforms and increasingly on centralized ones as well.

As crypto continues to evolve, tools like Bybit, Coinbase, Binance, and Phemex are blending elements of both DeFi and traditional markets. Regardless of where you trade, understanding how liquidity and slippage work will help you make cleaner entries, smarter exits, and more informed decisions about where to place your capital.

If you're ready to go deeper, you might explore dashboards that track impermanent loss, liquidity mining strategies, or DEX aggregators that optimize trade execution across pools. The more informed you are about how liquidity impacts your actions, the less you’ll rely on luck—and the more consistent your outcomes will become.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

Binance

Centralized Exchanges

|

433 | 0.10% | 0.10% | 0.0002 | 2017 |

CONSIGUE HASTA 100 USD DE BONO DE BIENVENIDA

|

Visite | |||

|

Phemex

Contract Trading Exchanges

|

153 | 0.06% | 0.01% | 0.0004 | 2019 |

CONSIGUE HASTA 180 USD DE BONIFICACIÓN POR DEPÓSITO

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||