Uniswap

Handelsavgift

Insättninsgmetoder

Kryptos (390)

Uniswap Review

What is Uniswap?

Uniswap is an automated token exchange, based on the Ethereum blockchain, that launched in 2018. Uniswap’s home country is the United States.

Uniswap Video Review

Tired of reading? No problem, check out our video review of Uniswap here:

US-investors

US-investors are naturally permitted to trade here seeing as the platform is from the US. But, US-investors should do their own independent assessment of any problems arising from their residency or citizenship. In a worst-case scenario, they may be prohibited by state laws to trade wherever they want to.

Incredibly Large Number of Cryptocurrencies

Another advantage with this platform is that they also support a large number of cryptocurrencies. Swaps are not limited to BTC against ETH or XRP. Many altcoins can be swapped here.

Uniswap V3

On 5 May 2021, Uniswap launched its newest version of the platform: Uniswap Version 3 (V3), on the Ethereum mainnet. Uniswap V3 is a noncustodial automated market maker that gives liquidity providers a higher degree of control. The original announcement in March 2021 said that an L2 Optimism deployment will follow shortly after the mainnet launch.

Interesting Features of Uniswap V3:

1: Concentrated Liquidity: Uniswap V3 allows liquidity providers to concentrate their liquidity using a finite price range, instead of using a blanket price range of 0 to infinity. The concentrated liquidity feature will ensure a higher capital efficiency of the asset pool. The liquidity providers will also be able to create multiple positions, each with a different price range.

2: Improved fee structure: The flexible fee structure in Uniswap V3 is designed to support the concentrated liquidity feature. Instead of a standard 0.30% fee for each token pair, V3 sets a different fee schedule for each tier of asset pools. The new fee schedule is classified into three tiers of 0.05%, 0.3% and 1% respectively. The V3 also allows the creation of new fee schedules through UNI governance.

3: Liquidity and Non Fungibility: Since the positions in Uniswap V3 are non-fungible in nature, the fees earnings are treated differently compared to the earlier versions. In Uniswap V2, fees were rerouted as deposits to the asset pool for liquidity, whereas in Uniswap V3 all fee earnings will be deposited separately as individual tokens instead of retaining them in the asset pool. The V3 pool contract does not support the standard ERC-20 token. Instead, it requires that the contracts are backed by additional logic for distributing and re-investing the fees collected.

4: Upgrades to the Time Weighted Average Price (TWAP) oracle: The latest version incorporates significant changes to the TWAP oracle. When computing TWAP in Uniswap V3, the accumulator checkpoints are brought to the core allowing external contracts to calculate on-chain TWAPs without storing accumulator checkpoints value. It is also possible for Uniswap V3 users to calculate the geometric mean TWAP.

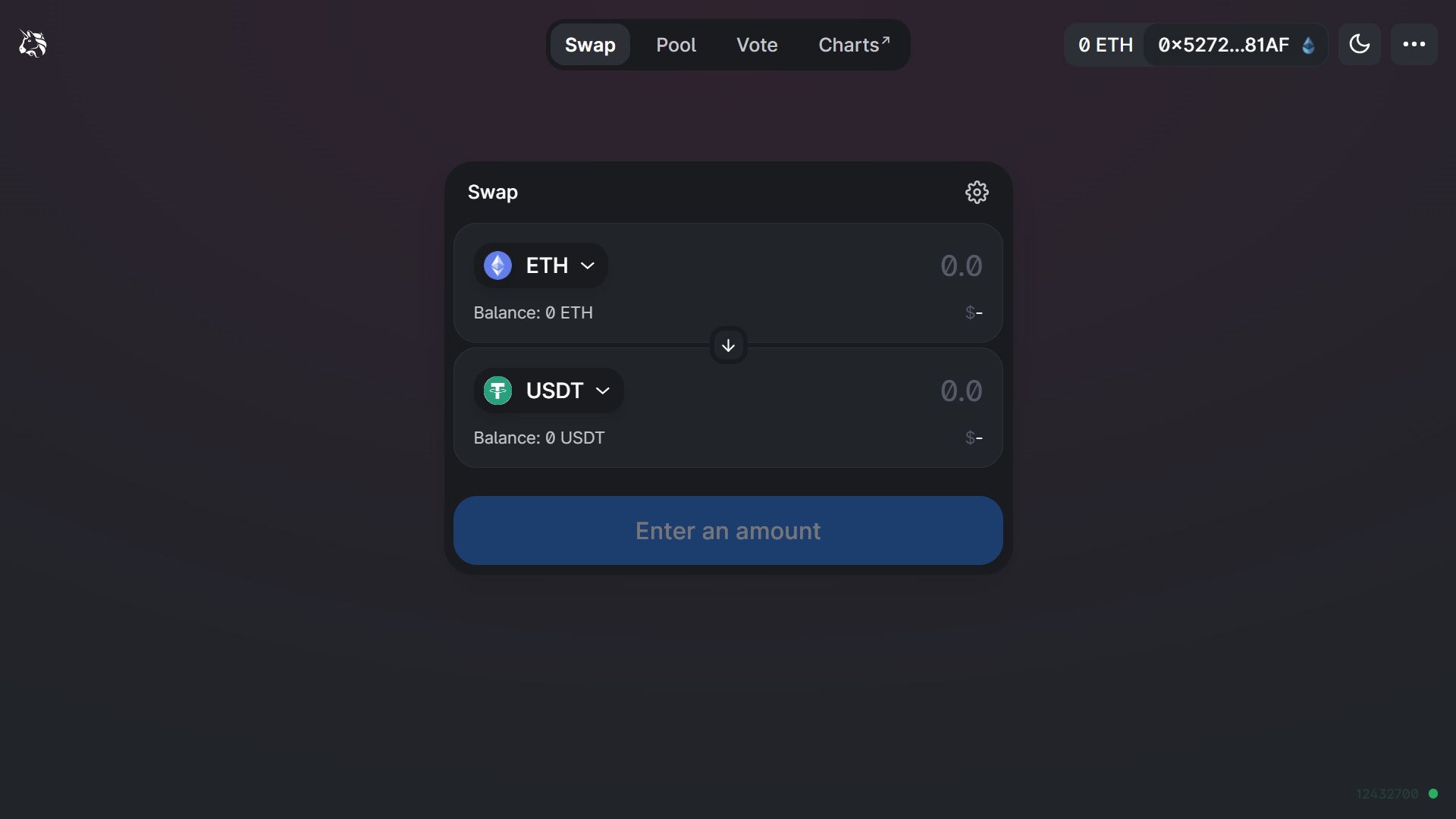

Uniswap Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you.

At this exchange, it’s not really a “trading view” per se. Rather, it is a swap interface. The interface is very simple. You connect with your wallet, you choose which token you want to swap with which other token, and then you just swap. It’s hard to imagine how this process could have been made more streamlined. The below is a picture of the swap interface at Uniswap:

Uniswap Fees

Uniswap Trading fees

Many exchanges charge what we call taker fees, from the takers, and what we call maker fees, from the makers. The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

This exchange charges a flat fee of 0.30% per trade. This is slightly above the global industry average (arguably 0.25%). So with respect to the trading fees, Uniswap has a decent offering.

Uniswap Withdrawal fees

There are exchanges out there that charge low trading fees but then hit you on your way out with high withdrawal fees. Because once you’re in, you can’t get out without paying withdrawal fees. This exchange, however, is on the opposite side of the spectrum. They only charge the network fees when you execute a transaction. The global industry BTC-withdrawal fee is 0.00053 BTC per withdrawal. The network fees vary from day to day but are roughly 15-20% of the global industry average BTC-withdrawal fee.

Accordingly, when it comes to the withdrawal fees, this exchange has a competitive offering.

Deposit Methods

Uniswap does not accept any deposits of fiat currency. This means that the new crypto investors (i.e., the investors without any previous holdings of crypto) can’t trade here. In order to purchase your first cryptos, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency. Find one by using our Exchange Finder!

Uniswap Security

The servers of DEXs are normally spread out. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that DEXs are virtually immune to attacks. This is because if you take out one of the servers, it has little to no impact on the full network of servers. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a DEX, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not the case with respect to decentralized exchanges.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!