Dsdaq

거래소 수수료

입금 방식

지원 암호화폐 (46)

UPDATE 23 March 2023: While Dsdaq still has an active website that's possible to access, the platform has many of the hallmark characteristics that inactive platforms have. For instance, it has been changed to an "untracked listing" on Coinmarketcap.com and Dsdaq's last tweet was sent out on 16 September 2022. It just seems like the team has abandoned ship.

Accordingly, we have marked this exchange as "dead" and moved it to our Exchange Graveyard.

To find a reliable exchange, just use our Exchange List and we'll help you find the right platform for you.

Dsdaq Review

What is Dsdaq?

Dsdaq is a cryptocurrency exchange registered in Grand Pavilion Commercial Centre, Suite 24, 802 West Bay Road, P.O. Box 10281, Grand Cayman KY1-1003, Cayman Islands. With offices Hong Kong, Singapore, Bangkok, Vienna, Barcelona, Buenos Aries and Nigeria, that has been up and running since 2019.

Dsdaq focuses on derivatives trading. A derivative is an instrument priced based on the value of another asset (normally stocks, bonds, commodities etc). In the cryptocurrency world, derivatives accordingly derive its values from the prices of specific cryptocurrencies. You can engage in derivatives trading connected to more than ten different cryptos here.

Differences Between Dsdaq, BitMEX and Robinhood

The following is a table showing a few differences between Dsdaq, BitMEX and Robinhood, obtained from Dsdaq's website:

Crypto Collateral Account - The Secret of Global Markets on Dsdaq

Dsdaq Native Token

Dsdaq's native token is the BOD (Origin D Token on Binance Smart Chain). All OD token holders have switched their OD tokens on ERC20 chain to BOD. They have burned 300M OD tokens, so the total amount of the native token has decreased to 700M.

Leveraged Trading

Dsdaq also offers leveraged trading to its users. The maximum leverage level for their crypto contracts is 100x (i.e. onehundred times the relevant amount). They also highlight that they have a diverse range of products you can trade with, and low fees (more on the latter below under Dsdaq Fees).

A word of caution might be useful for someone contemplating leveraged trading. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

Dsdaq Fees

Dsdaq Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the one who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

At Dsdaq, takers and maker pay the same fee when it comes to spot trading (0.10%). For contracts trading, takers pay 0.05% and makers pay 0.02%. The spot trading fees are somewhat below the global industry average, and the contracts trading fees are quite in line with the global industry average (neither above nor below).

Dsdaq Withdrawal fees

Dsdaq charges a withdrawal fee of 0.0005 BTC per BTC-withdrawal. This fee is a bit below the global industry average. The current global industry average is around 0.0006 BTC per BTC-withdrawal according to the largest empirical study ever performed on the subject (our own).

Dsdaq Mobile Support

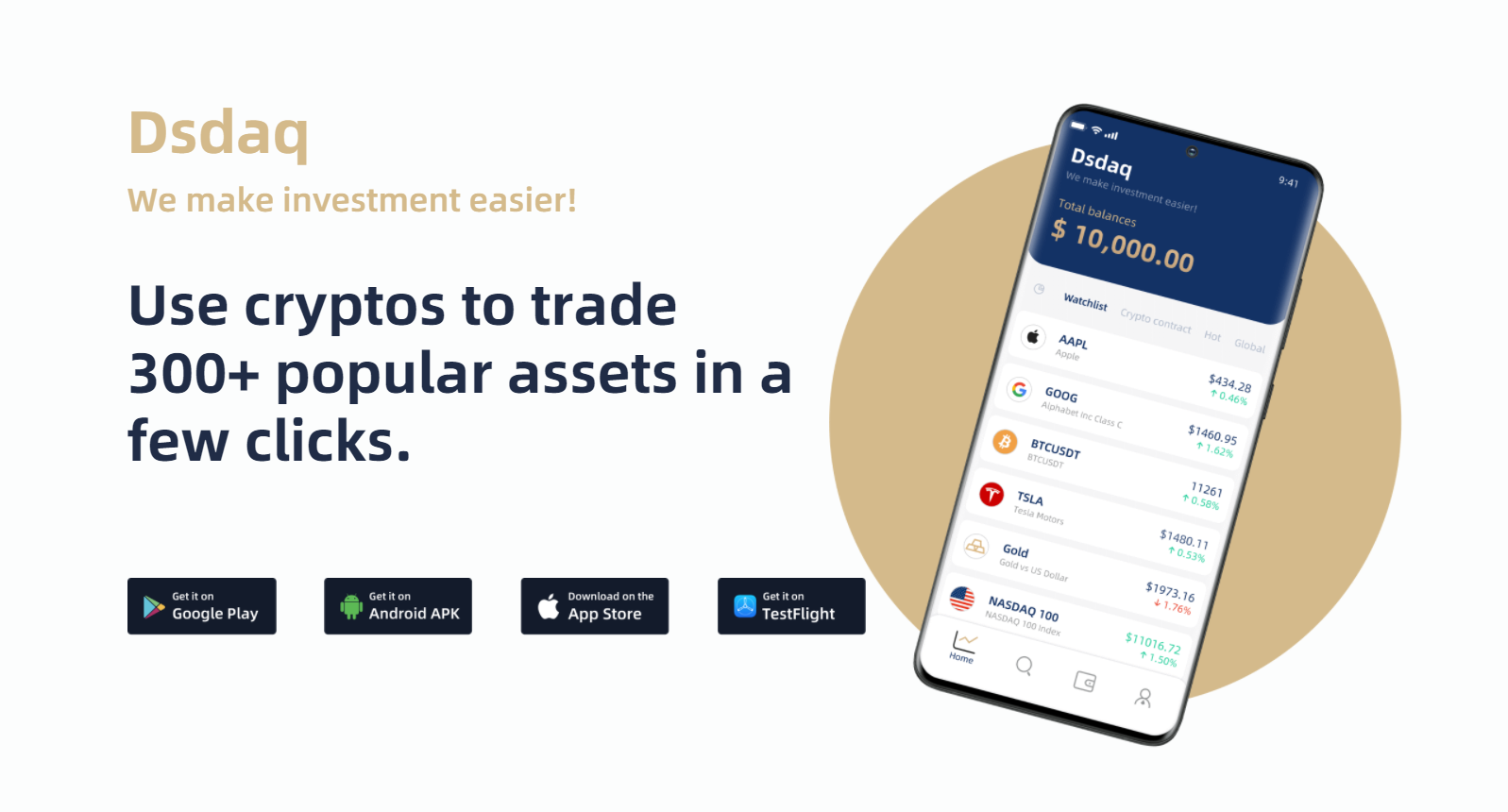

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that Dsdaq’s trading platform is also mobile compatible. You can download it to/from both the AppStore and Google Play:

Dsdaq Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at Dsdaq (from mobile):

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Deposit Methods and US-investors

Deposit Methods

Dsdaq lets you deposit assets to the exchange in many different ways, through wire transfer, debit card, and of course also by just depositing existing cryptocurrency assets.

Seeing as fiat currency deposits are possible at this trading platform, Dsdaq qualifies as an “entry-level exchange”, making an exchange where new crypto investors can start their journey into the exciting crypto world.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

Dsdaq does not allow US-investors on its exchange. So if you’re from the US and would like to engage in crypto trading, you will have to look elsewhere. Luckily for you, if you go to the Exchange List and use our Exchange Filters, you can sort the exchanges based on whether or not they accept US-investors.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!