BaseFEX

एक्सचेंज फीस

जमा करने के तरीके

समर्थित क्रिप्टोकरेंसी (10)

UPDATE 15 April 2022: When trying to access the website of BaseFEX today, we were unsuccessful. There have been no preceding messages on system maintenance or new websites or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

BaseFEX Review

What is BaseFEX?

BaseFEX is an exchange from the Seychelles. It has been active since 2018. It is a crypto futures exchange (i.e. you can trade on your hunch that Bitcoin is going up or down). It has been developed by pros using “cutting-edge technologies” from the world wide web. According to the company, these new technologies are better than the obsolete technical set-ups that are so common in the finance industry.

The CEO of BaseFEX is a man named Jesse Wu, and the CTO is Isaac Zeng.

BaseFEX Mobile Support

Moreover, BaseFEX has a mobile app which apparently is the world’s first mobile app specifically developed for cryptocurrency futures trading.

BaseFEX Advantages

As a few of its main advantages, the exchange lists, inter alia, that they have 24/7 live support, low trading fees and 100x leverage. 24/7 live support can be particularly helpful for the traders at a crypto exchange, seeing as the markets never close and that the traders are from essentially all of the different time zones in the world.

BaseFEX Trading View

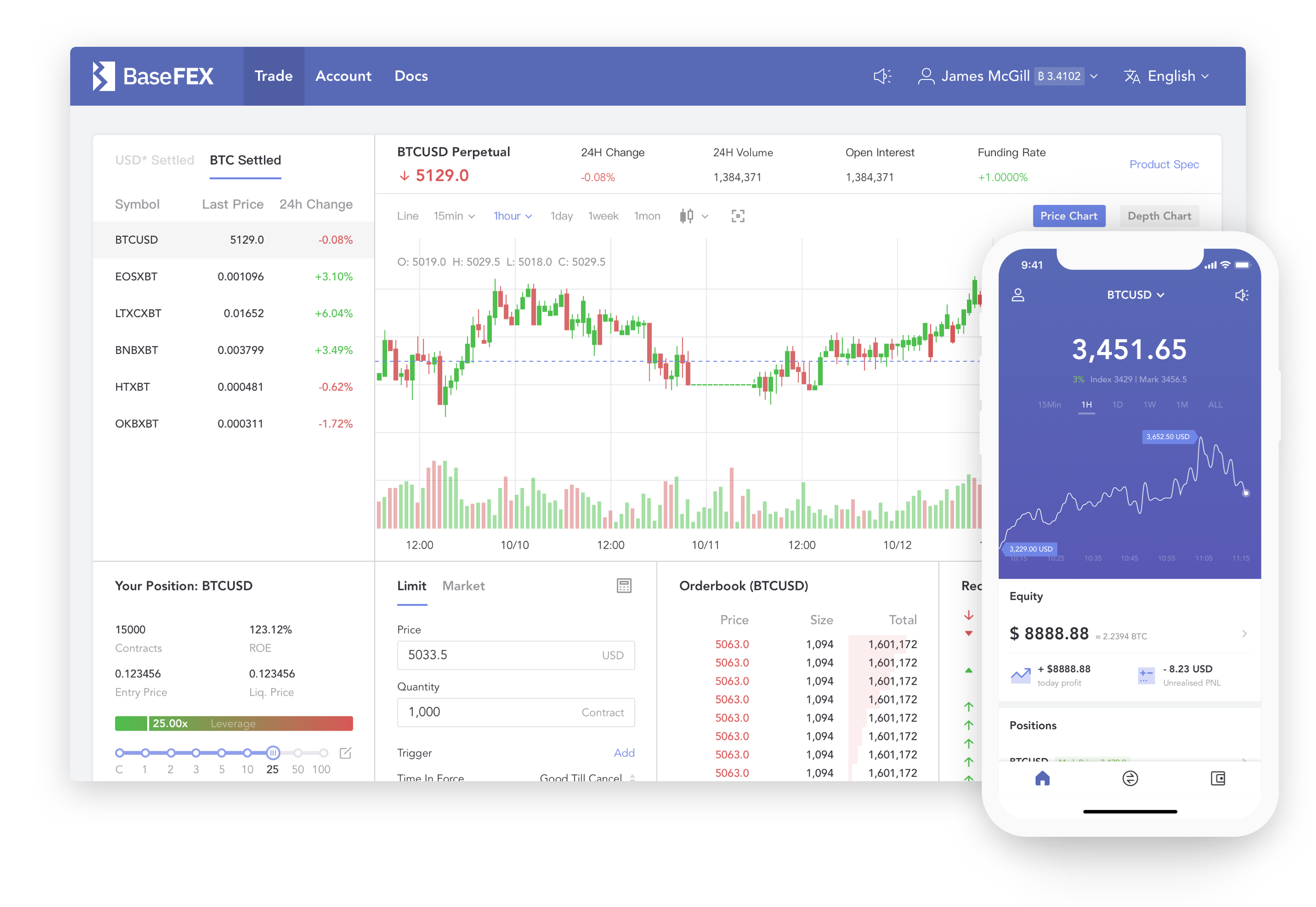

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the trading views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at BaseFEX (when not signed in):

Leveraged Trading

BaseFEX focuses on leveraged trading on its platform. This means that you can receive a higher exposure towards a certain crypto’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms means that you borrow from the exchange to bet more. You can get as much as 100x leverage on this platform.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., going up in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an extra 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC goes down in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

BaseFEX Fees

BaseFEX Trading fees

Many exchanges charge what we call taker fees, from the takers, and what we call maker fees, from the makers. Takers are the people removing liquidity from the order book by accepting already placed orders, and makers are the ones placing those orders. The main alternative to this is to simply charge “flat” fees. Flat fees mean that the exchange charges the taker and the maker the same fee.

As most exchanges that offer derivatives trading, this exchange offers a “maker discount”. They charge takers 0.06% and makers 0.02%.

0.06% for takers and 0.02% for makers is competitive and a consumer friendly fee model.

BaseFEX Withdrawal fees

Another fee to consider before choosing which exchange to trade at is the withdrawal fee. The withdrawal fee is usually fixed (regardless of the amount of cryptocurrency units withdrawn), and varies from cryptocurrency to cryptocurrency. The global industry average withdrawal fee is around 0.00053 BTC when you withdraw BTC, as per our Q3 2021 Empirical Fee Study report.

Here, at BaseFEX, you only have to pay the network fees, meaning the fees that miners receive to confirm transactions. Only charging network fees is very competitive.

Deposit Methods

BaseFEX does not accept any deposits of fiat currency. You can only deposit Bitcoin here. This means that the new crypto investors (i.e., the investors without any previous crypto holdings) can’t trade here. In order to purchase your first Bitcoins, you need a so called entry-level exchange, which is an exchange accepting deposits of fiat currency. Find one by using our Exchange Finder!