Montenegro vs Samoa

Crypto regulation comparison

Montenegro

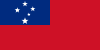

Samoa

Legal

No Regulation

Montenegro has no specific crypto law but crypto is not prohibited. Working toward EU candidacy and potential MiCA alignment. Capital gains taxed under general provisions.

Samoa has no specific cryptocurrency regulation. The central bank has cautioned about crypto risks.

Tax Type

Capital gains

Tax Type

Unclear

Tax Rate

9-15%

Tax Rate

N/A

Exchanges

Yes

Exchanges

Yes

Mining

Yes

Mining

Yes

Regulator

Central Bank of Montenegro, Capital Market Authority

Regulator

Central Bank of Samoa

Stablecoin Rules

No specific stablecoin regulation

Stablecoin Rules

No stablecoin regulation

Key Points

- No specific cryptocurrency legislation but crypto is legal

- Working toward EU candidacy and MiCA alignment

- Capital gains on crypto taxed at 9-15%

- Central Bank has acknowledged crypto without banning it

- Growing interest in crypto-friendly policies

Key Points

- No specific cryptocurrency legislation

- Central bank has cautioned about crypto risks

- Crypto not recognized as legal tender

- Limited crypto adoption

- No licensing framework for crypto services