Liechtenstein vs Liberia

Crypto regulation comparison

Liechtenstein

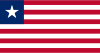

Liberia

Liechtenstein's Blockchain Act (TVTG) effective since 2020 is among the world's most comprehensive crypto frameworks. The FMA supervises registered TT service providers. Adapted for EU MiCAR in 2025.

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Key Points

- Blockchain Act (TVTG) adopted unanimously in 2019, effective Jan 2020

- Token Container Model enables tokenization of any asset or right

- FMA registers and supervises all TT service providers

- EEA MiCAR Implementation Act entered into force Feb 2025

- First country with comprehensive blockchain-specific legislation

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access