Cuba vs Maldives

Crypto regulation comparison

Cuba

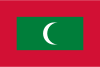

Maldives

Cuba's Central Bank issued Resolution 215/2021 recognizing virtual assets and establishing a licensing framework for virtual asset service providers (VASPs). The BCC evaluates and grants one-year licenses to VASPs. US sanctions limit access to international platforms but domestic crypto use is formally regulated.

The Maldives Monetary Authority has warned against cryptocurrency and does not recognize it as legal tender. No specific legislation exists but the MMA discourages crypto activities.

Key Points

- Resolution 215 (2021) allows central bank to license virtual asset service providers

- Central Bank licenses virtual asset service providers under Resolution 215

- VASPs must comply with AML/KYC requirements and report to the central bank

- US sanctions significantly limit access to international crypto platforms

- Government agencies may not use virtual assets without BCC authorization

Key Points

- MMA has warned against cryptocurrency use

- Crypto not recognized as legal tender

- No specific cryptocurrency legislation

- Financial institutions discouraged from dealing in crypto

- Limited crypto adoption