Cuba vs Liberia

Crypto regulation comparison

Cuba

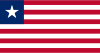

Liberia

Cuba's Central Bank issued Resolution 215/2021 recognizing virtual assets and establishing a licensing framework for virtual asset service providers (VASPs). The BCC evaluates and grants one-year licenses to VASPs. US sanctions limit access to international platforms but domestic crypto use is formally regulated.

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Key Points

- Resolution 215 (2021) allows central bank to license virtual asset service providers

- Central Bank licenses virtual asset service providers under Resolution 215

- VASPs must comply with AML/KYC requirements and report to the central bank

- US sanctions significantly limit access to international crypto platforms

- Government agencies may not use virtual assets without BCC authorization

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access