Barbados vs Lesotho

Crypto regulation comparison

Barbados

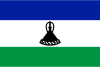

Lesotho

Barbados has a favorable environment for cryptocurrency. With no income or capital gains tax, crypto activities are not specifically taxed. The Financial Services Commission oversees financial markets. Barbados has been exploring blockchain for government services.

Lesotho has no specific cryptocurrency regulation. The central bank has not issued formal guidance on crypto.

Key Points

- No income tax or capital gains tax applies to crypto

- Financial Services Commission provides general oversight of financial markets

- Government has explored blockchain for land registry and identity services

- Crypto businesses operate under general financial services regulations

- Growing fintech sector with interest in digital asset innovation

Key Points

- No specific cryptocurrency legislation

- Central bank has not issued formal crypto guidance

- Part of the Common Monetary Area with South Africa

- Limited crypto adoption

- No licensing framework for crypto services