Crypto Payments in the Real World: What Actually Works in 2026 January, 2026

Crypto payments promise speed, freedom, and lower fees, but only a few models actually work at scale in 2026. This guide breaks down where crypto payments succeed in the real world, where they fail, and what users and merchants realistically rely on today.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

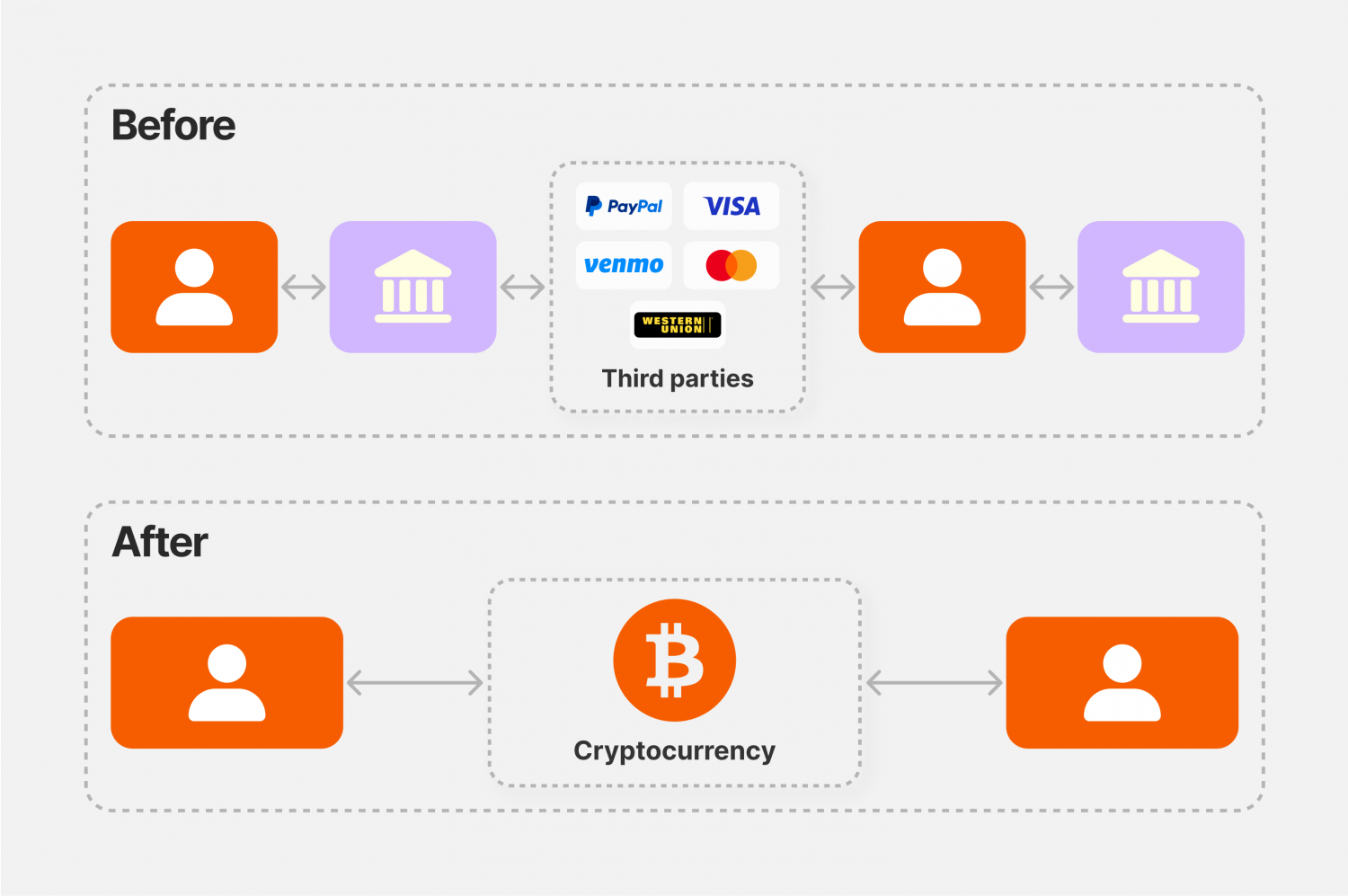

Crypto payments have been “five years away” for more than a decade. In 2026, the reality is clearer than ever: crypto has not replaced cards, mobile wallets, or bank transfers, and it was never going to. What it has done is quietly establish itself as a payment rail in situations where traditional finance is slow, expensive, or unavailable. Today, people pay freelancers in stablecoins, businesses settle cross-border invoices without banks, and online services accept crypto with instant settlement and no chargebacks. At the same time, crypto payments still fail badly at everyday retail, refunds, and consumer protection. This guide focuses on what actually works in the real world in 2026, which payment models survive real usage, and why most “mass adoption” narratives continue to miss the point.

When people talk about crypto payments in 2026, they are rarely talking about paying directly with volatile coins at a checkout terminal. In practice, crypto payments now fall into a few clearly defined models, each used for very specific reasons.

Stablecoin Payments (The Default Choice)

The most widely used crypto payment method today is stablecoin settlement. Payments are typically made using USDC or USDT on low-fee networks.

Real-world examples:

- Freelancers getting paid in USDC on Solana instead of waiting days for international bank wires

- Agencies settling monthly invoices in USDT on Tron to avoid SWIFT fees

- Online services pricing subscriptions directly in stablecoins

Stablecoins work because they behave like digital dollars. Prices stay stable, settlement is fast, and accounting is far simpler than using volatile assets.

Bitcoin Payments via the Lightning Network

Bitcoin is rarely used directly on-chain for payments due to confirmation delays and unpredictable fees. Where it does work is through the Lightning Network.

Where Lightning is actually used:

- Instant payments for digital services and content

- Small-value transactions where speed matters more than final settlement

- Regional usage in areas with limited banking access

Lightning works best when amounts are small, the user experience is abstracted, and merchants either rebalance or convert immediately.

Low-Fee Chains and Layer 2 Networks

Some blockchains are used primarily because they offer fast finality and predictable transaction costs.

Common use cases:

- USDC transfers on Solana for payouts and internal treasury movement

- Stablecoin subscriptions processed on Polygon

- Recurring payments where low fees matter more than decentralization purity

These networks are rarely marketed as payment solutions, but they quietly power a large share of real crypto commerce.

Custodial and Invisible Crypto Payments

Many so-called crypto payments are crypto only under the hood. Users pay with crypto, but merchants receive fiat.

How this usually works:

- The customer selects crypto at checkout

- Payment is converted instantly

- The merchant settles in local currency

In this model, crypto functions as a backend payment rail rather than a consumer-facing currency.

Key takeaway: Crypto payments succeed or fail based on the rail being used and how much complexity is hidden from the user.

Crypto payments only work when they solve a concrete operational problem. In 2026, those use cases are narrow but well established, and they are driven by specific companies and platforms rather than abstract adoption narratives.

Online Services and Digital-First Businesses

Digital-first companies were early adopters of crypto payments because they do not deal with physical delivery, in-person refunds, or point-of-sale hardware.

Real-world examples:

- Namecheap accepts Bitcoin and stablecoins for domain registrations and hosting services.

- Proton allows users to pay for Proton Mail and VPN subscriptions using Bitcoin.

- Shopify merchants can accept USDC through crypto-enabled checkout integrations.

These businesses benefit from instant settlement, global customer reach, and the absence of card chargebacks, which is particularly valuable for subscription-based services.

Cross-Border Payments and Contractor Payroll

Stablecoins are now widely used for international payments, especially by companies with distributed teams and overseas contractors.

Real-world examples:

- Remote supports crypto-based payouts for international contractors.

- Deel enables contractors to receive payments in stablecoins instead of local bank transfers.

- Crypto-native startups pay developers directly in USDC to avoid SWIFT delays and banking fees.

In these cases, crypto payments reduce settlement time from days to minutes and remove dependency on correspondent banks.

Stablecoin-Native Commerce

Some platforms operate almost entirely on stablecoins, treating them as both the payment rail and the unit of account.

Examples:

- Circle promotes USDC as a settlement layer for businesses and institutions.

- Stripe supports stablecoin payments for selected merchants and cross-border use cases.

- Some marketplaces denominate contracts and payouts directly in USDC.

Stablecoins succeed here because they remove volatility, simplify pricing, and integrate cleanly with accounting systems.

Restricted or High-Risk Industries

Crypto payments are also common in industries that face friction or outright restrictions from traditional payment processors.

Real-world examples:

- OnlyFans creators have historically relied on crypto after card processor disruptions.

- Patreon creators use crypto alternatives when payments are blocked.

- International digital services operating in regions with unstable banking infrastructure also rely on crypto payments.

In these scenarios, crypto is not used for convenience. It functions as censorship-resistant payment infrastructure that allows businesses and individuals to continue operating.

Bottom line: Crypto payments work where traditional systems fail, not where they already excel.

Despite real progress in specific niches, crypto payments still fail badly in everyday consumer environments. These failures are structural, not temporary, and they show up clearly when crypto is compared directly with existing payment systems.

Everyday Retail and Point of Sale

Crypto payments have not gained traction in physical retail because they are slower, more complex, and less familiar than existing options.

Real-world comparison:

- Apple Pay completes a transaction in seconds with biometric confirmation

- Visa and Mastercard offer instant authorization and consumer protections

- Crypto payments require wallet setup, address confirmation, and manual approval

Major retailers like Walmart, Target, and Carrefour do not accept crypto directly because it adds friction at checkout without offering clear advantages over cards or mobile wallets.

Refunds, Chargebacks, and Consumer Protection

One of the biggest barriers to crypto payments is the lack of native refund and chargeback mechanisms.

Where this breaks down:

- Card payments allow disputes through banks and networks

- Crypto transactions are final once confirmed

- Disputes must be handled manually by the merchant

Platforms like Amazon and Booking.com rely heavily on refunds and dispute resolution. Crypto payments do not fit these models because final settlement removes consumer protections that customers expect.

Tax Complexity for Small Purchases

In many jurisdictions, crypto payments create taxable events, even for everyday spending.

Practical impact:

- Paying with Bitcoin can trigger capital gains calculations

- Users must track cost basis for each transaction

- Small purchases create disproportionate reporting overhead

This makes crypto impractical for frequent low-value transactions compared to traditional currencies, which do not carry reporting requirements for normal spending.

User Experience and Error Risk

Crypto payments still place too much responsibility on the user.

Common failure points:

- Sending funds to the wrong address

- Choosing the wrong network

- Misjudging transaction fees or confirmation times

Payment apps like PayPal and Revolut succeed because they remove these risks. Until crypto payments reach a similar level of abstraction, mainstream retail adoption will remain limited.

Conclusion: Crypto payments fail where consumers expect speed, reversibility, and simplicity. These expectations are already met by existing payment systems.

Not all crypto payment rails are equal. In 2026, a small number of networks and layers handle the majority of real payment volume, each optimized for a different trade-off between speed, cost, and reliability.

How the Main Crypto Payment Rails Compare

| Payment Rail | Speed | Typical Fees | Volatility Risk | Where It Is Actually Used |

|---|---|---|---|---|

| Bitcoin (On-Chain) | 10 to 60 minutes | Variable, often high | High | Large settlements, long-term transfers |

| Bitcoin Lightning Network | Instant | Very low | High | Small digital payments, tips, content |

| USDC on Solana | Seconds | Less than $0.01 | Low | Payroll, SaaS billing, merchant payouts |

| USDT on Tron | Seconds | Low and predictable | Low | Cross-border B2B payments, remittances |

| USDC on Polygon | Seconds | Low | Low | Subscriptions, recurring payments |

The pattern is consistent. Stablecoins on fast, low-fee networks dominate real payment usage. Bitcoin payments survive primarily through Lightning and only for small amounts where speed matters more than final settlement guarantees.

Why Stablecoin Rails Win in Practice

Businesses choose payment rails based on predictability, not ideology.

What stablecoin rails offer:

- Prices denominated in familiar units

- Near-instant settlement

- Fees that remain stable regardless of network congestion

- Easy integration with accounting and treasury systems

This is why platforms like Stripe and Circle focus their crypto payment tooling almost entirely around stablecoins rather than volatile assets.

Where Bitcoin Still Fits

Bitcoin remains relevant as a payment method only when second-layer infrastructure is used and expectations are realistic.

Bitcoin payment use cases that still work:

- Lightning payments for digital content

- Peer-to-peer transfers where banking access is limited

- Situations where censorship resistance matters more than convenience

Outside of these scenarios, Bitcoin functions better as a settlement asset than a consumer payment tool.

Key takeaway: Crypto payments work when the rail matches the job. Stablecoins handle commerce. Lightning handles speed. On-chain Bitcoin handles settlement, not shopping.

User experience is still the main reason crypto payments do not scale beyond niche use cases. In 2026, some things are noticeably better, but the gap between crypto wallets and mainstream payment apps remains wide.

What Still Feels Broken

Even experienced users encounter friction when paying with crypto. For newcomers, the failure points are often enough to stop adoption entirely.

Common UX problems users still face:

- Choosing the wrong network when sending funds

- Sending to an incorrect or incompatible address

- Unclear fee estimates and confirmation times

- No native undo or dispute mechanism

By contrast, apps like Apple Pay and PayPal reduce payments to a biometric tap and instant confirmation. Users are never exposed to routing, settlement, or fee logic.

Wallet UX Still Lags Behind Fintech Apps

Popular self-custody wallets have improved, but they still assume a level of technical understanding that mainstream payment users do not have.

Real examples:

- MetaMask requires users to manage networks, gas fees, and transaction approvals.

- Phantom simplifies Solana payments but still exposes addresses and confirmations.

- Coinbase Wallet offers a smoother experience but introduces custodial trade-offs.

Compared to apps like Revolut, which hide all payment complexity, crypto wallets still ask users to think about too many things at once.

Where UX Has Actually Improved

Despite these issues, some areas have clearly moved forward.

Meaningful improvements in 2026:

- Stablecoin payments reduce price uncertainty at checkout

- Lower fees on networks like Solana and Polygon remove cost anxiety

- Better wallet warnings for incorrect networks and addresses

- Faster confirmations reduce payment uncertainty

For repeat users and businesses operating in crypto-native environments, these improvements are enough to make payments reliable and predictable.

Why UX Still Blocks Retail Adoption

Mainstream users expect payments to be fast, reversible, and forgiving. Crypto payments still place too much responsibility on the sender, and mistakes are often irreversible.

Until crypto payments offer the same level of abstraction and protection as modern fintech apps, they will remain a parallel system used intentionally rather than a default choice.

Key takeaway: Crypto payment UX has improved, but it is still designed for motivated users, not casual consumers.

Merchants approach crypto payments very differently from consumers. For businesses, ideology does not matter. What matters is settlement speed, accounting clarity, and risk management.

Settlement and Volatility Management

Most merchants that accept crypto do not want exposure to price swings. They want fast settlement in a predictable unit of account.

How real businesses handle this:

- Stripe allows selected merchants to accept stablecoin payments while settling in fiat.

- Circle positions USDC as a settlement layer for businesses, not a speculative asset.

- Many merchants set automatic conversion rules so crypto exposure lasts seconds, not hours.

This approach removes volatility risk entirely. From the merchant’s perspective, crypto behaves like a faster bank transfer.

Accounting and Reporting Reality

Accounting is one of the least discussed but most important barriers to crypto payments.

What merchants actually need:

- Clear transaction records in a single currency

- Consistent settlement timestamps

- Easy reconciliation with invoices and tax filings

Stablecoin-based payments integrate more cleanly with accounting software than volatile assets. This is one reason why Bitcoin payments are rarely used for day-to-day business operations.

Why Auto-Conversion Is Non-Negotiable

Merchants that succeed with crypto payments almost always use automatic conversion.

Common setup:

- The customer pays in crypto

- The payment is converted instantly

- The merchant settles in local currency or stablecoins

This model mirrors traditional card payments and allows businesses to benefit from crypto rails without taking on new financial risk.

Merchant takeaway: Crypto payments only scale when they look boring from the accounting side.

Looking forward, crypto payments are improving, but not in the way early narratives predicted. Progress is happening quietly in infrastructure, not in consumer behavior.

What Is Likely to Improve

Areas seeing real progress:

- More stablecoin regulatory clarity in major jurisdictions

- Better wallet safeguards against user error

- Deeper integration between crypto rails and fintech apps

These improvements benefit businesses and repeat users first. Casual retail adoption remains a secondary outcome.

What Is Unlikely to Change

Structural limits:

- Crypto will not replace card networks for everyday spending

- Refund and chargeback expectations will not disappear

- Mainstream users will not manage private keys willingly

Crypto payments will continue to function as a parallel system rather than a universal replacement.

Final verdict: Crypto payments work when they are invisible, predictable, and purpose-built. Stablecoins dominate real usage, Lightning serves niche speed use cases, and traditional retail remains better served by existing payment networks.

In 2026, crypto payments are no longer about mass adoption. They are about solving specific financial problems better than the alternatives.

Quick Take: What Actually Works in 2026

- Stablecoins dominate real payments. USDC and USDT handle most real-world crypto commerce because they remove volatility and simplify accounting.

- Bitcoin payments only scale through Lightning. On-chain Bitcoin is settlement infrastructure, not a checkout tool.

- Retail adoption is structurally limited. Cards and mobile wallets already solve speed, refunds, and UX better.

- Crypto works best as a parallel system. It succeeds where banks are slow, expensive, or unavailable.

Crypto payments in 2026 are not about replacing Visa or Apple Pay. They are about offering an alternative rail where traditional finance breaks down.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!