Top Crypto Exchanges with Trading API Access (2025) – How to Use Them for Trading Bots, Analytics & Automation February, 2026

Crypto exchange APIs enable automated trading and real-time data access without manual interface limitations. These programmatic bridges to major exchanges provide the speed and automation necessary for modern crypto trading.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

PrimeXBT

Contract Trading Exchanges

|

34 | 0.01% | 0.02% | 0.0005 | 2018 |

GET 35% DEPOSIT BONUS

|

Visite | |||

Binance

Centralized Exchanges

|

433 | 0.10% | 0.10% | 0.0002 | 2017 |

CONSIGUE HASTA 100 USD DE BONO DE BIENVENIDA

|

Visite | |||

KuCoin

Centralized Exchanges

|

637 | 0.10% | 0.10% | 0.0005 | 2017 |

CONSIGUE HASTA 500 USDT EN BONO POR INSCRIPCIÓN

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||

Comparing the APIs of Crypto Exchanges in 2025

Crypto markets are open 24/7, they’re liquid and they're volatile - making them ideal for robotic and algorithmic trading. There’s ample opportunity for the right algorithm or robot to make quick large trades to take advantage of even the slightest movement or mispricing in the market.

If you’re thinking of setting up a robot, trading with an algorithm or even giving Claude a shot at making a few bucks, you’ll need a programmatic interface to do so, an API. Not all exchanges offer this and not all APIs are created equal. Of course, there are wrapper libraries, CCXT being the most popular.

But if you want 100% performance, control and access to all the features the exchanges APIs you need to go native. In this guide we’ll go through the APIs of best and the biggest, compare their features, developer friendliness and their respective use cases. Let’s get started!

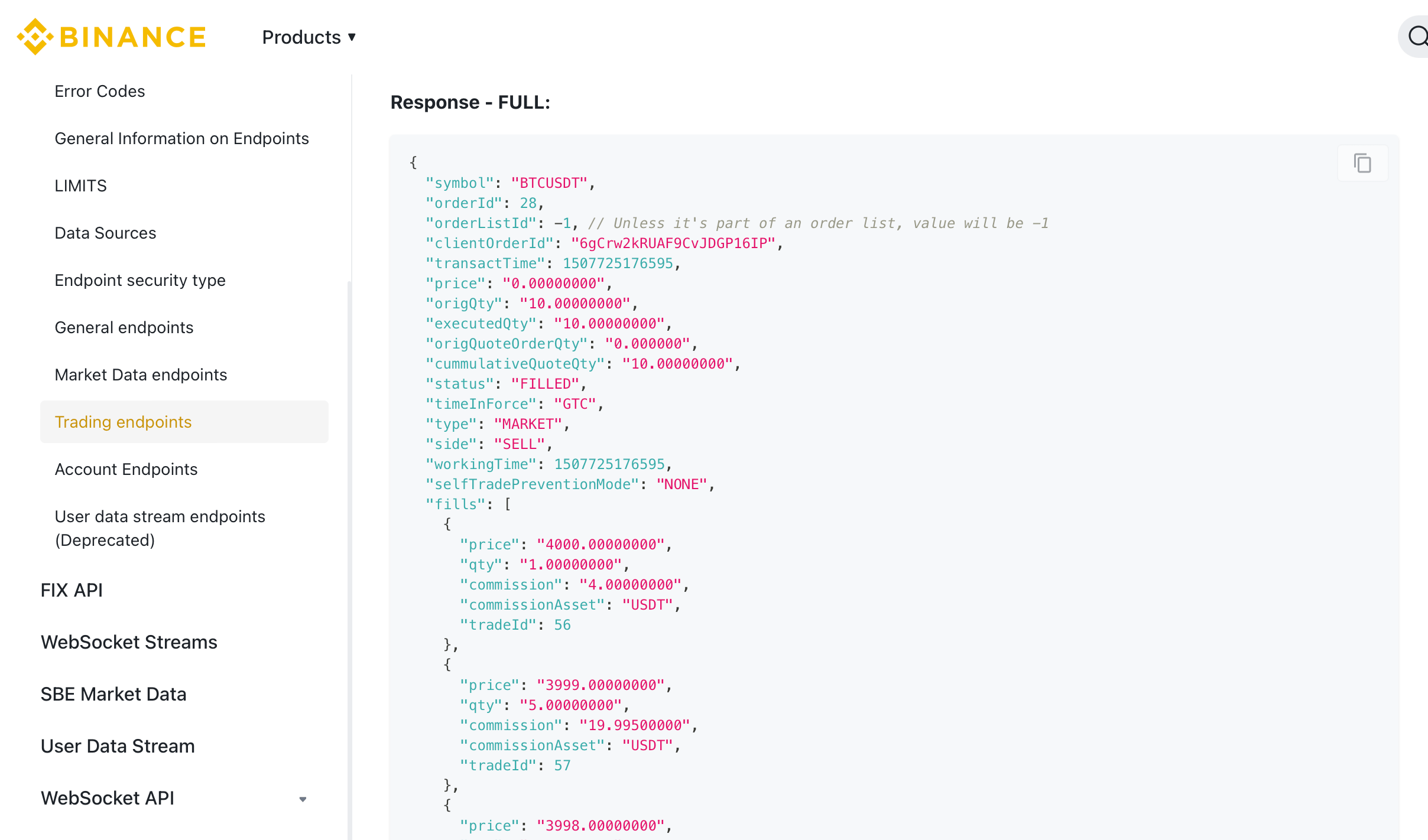

Binance

Binance offers different tiers of APIs based on four factors; 30 day trading volume, BNB holdings, institutional status and whether you’re a market maker. The API itself has a weight system, rather than a request system, meaning heavy operations consume more weight than an easy one. Users at a higher tier have more weight allotted to them and some features are available only for those with VIP status.

Protocols

The Binance REST API is the most comprehensive, which is great. The API has advanced order types built in, such as One Cancels the Other (OCO), One Triggers a One Cancels the Other (OTOCO), Iceberg and trailing stops. It also features self trade prevention, order amendment and all interactions have microsecond timestamps.

As for Websockets, Binance’s solution is state of the art. They offer 1024 streams per connection which is far and away the most of any exchange. It comes in handy with their “Combined Streams” feature, where one connection can contain multiple data feeds. With Binance, websockets aren’t limited to market data but can stream user data too. Lastly, the streams have a 60 second ping time out - once again far and away the most generous among the exchanges, double that of the second highest.

But, as with any comprehensive solution, a lot of complexity gets built in. The weight system for example. Any user has to be constantly aware of what they’ve spent. Then there are the different APIs for different use cases, for example there are separate APIs for spot, margin, future and, options, adding to complexity.

Performance

Performance-wise Binance is the leader. They offer low latency APIs run on AWS in Tokyo that have a latency of 12-15ms, available to VIP and institutional investors. Binance Websockets has a Simple Binary Encoding (SBE) protocol as an option when performance is of the greatest importance. VIP users have dedicated connections to avoid traffic jams during peak hours.

Developer Experience

While the documentation is very good, there are no code examples - just request and payload specs. There are no official SDKs for other languages. Of course, it’s Binance so there are community packages for most languages. The same goes for MCP - no official MCP but very good community ones. The documentation is translated into multiple languages and the comprehensive section on error handling sets it apart from other exchange APIs.

Binance is the easy choice when it comes to programmatic trading, especially if you’re an institution or need performance and are a VIP. They have the highest liquidity and their APIs have advanced order types built in. There’s some complexity in having multiple APIs, rather than a unified one and their usage of weights rather than requests for rating adds some complexity when implementing.

Pros:

-

Most comprehensive order types and features (OCO, OTOCO, trailing stops)

-

Highest liquidity and best performance metrics (12-15ms from Tokyo)

-

Advanced WebSocket with 1,024 streams and SBE protocol

Cons:

-

Complex multi-API system instead of unified approach

-

Confusing weight-based rate limits requiring constant calculation

-

No official SDKs, relying entirely on community packages

Links: Documentation • Sign up

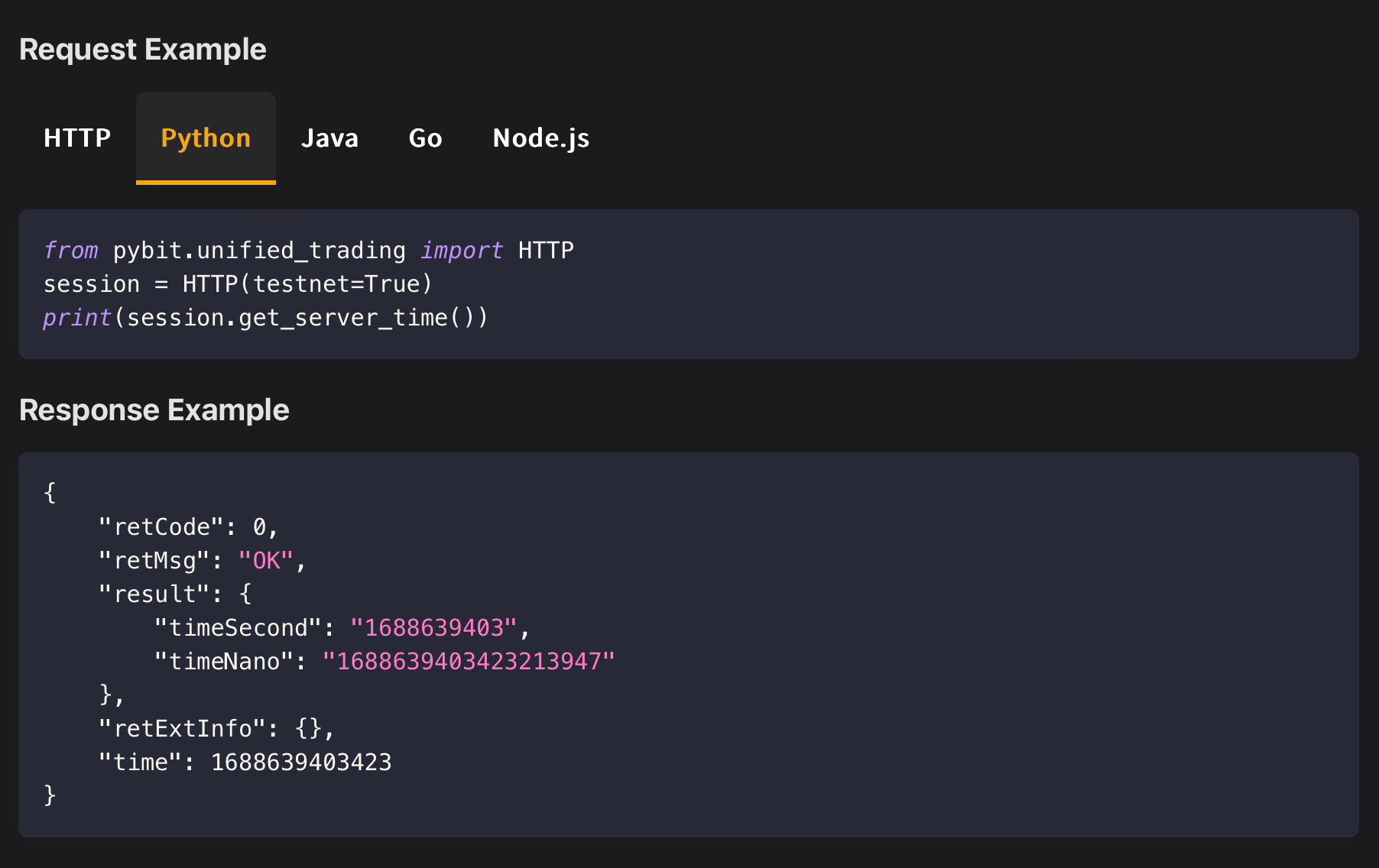

Bybit

Bybit chose a different strategy for their APIs. The fifth version of the Bybit API is completely unified. One interface gives you access to spot, options, derivatives and more. As with access to the Binance API, the Bybit one is tiered. There’s a Standard, PRO and VIP tier which determines stuff like rate limits (from 50 to 300 requests/s).

Protocols

However, if you’re on a lower tier and hitting rate limits REST API, you can make use of Bybit’s Batch Operations and send multiple orders with one request. The API also supports advanced order features like Binance and even has a Time-In-Force (TIF) option. The fifth version, unified API is ideal for someone who’s got a multi product strategy. The architecture is very clean and easy to understand.

Bybit’s Websocket solution offers both JSON and binary format for those who need performance and just as with the REST, it’s a very well organized API. The down side is the short heartbeat, only 20 seconds, the shortest of the reviewed APIs.

Performance

Performance is taken very seriously. For example - latency is measured and published publicly. If latency is of great importance, they’re hosted on AWS in Singapore and their infrastructure details are public, making co-location easy. A VIP-tier trader gets 300 requests per second.

Developer Experience

DX is where Bybit really shines. The unified API is very well documented, it has official Python, JavaScript, Go, C# and Java SDKs with code examples for each API operation. Additionally, the documentation offers interactive request builders that return live responses and there are Postman collections available. While there’s no official MCP there are multiple by the community.

Bybit is the go-to for anyone with a multi product strategy or wants an outstanding DX. Additionally, the API is powerful enough even for institutional investors and algorithmic trading.

Pros:

-

Unified V5 API dramatically simplifies multi-product integration

-

Excellent official SDKs across 5 languages with great documentation

-

Published infrastructure details enable co-location strategies

Cons:

-

Shortest WebSocket timeout at only 20 seconds

-

More restrictive than Binance in total features

-

Lower stream limits for public data (10 subscriptions)

Links: Documentation • Sign up

Phemex

Phemex’s API is more focused on derivatives. Through the API, the exchange offers up to 100x in leverage.

Protocols

The REST API offers some extra functionality that comes in handy for someone trading with leverage. There’s a risk limits API, Hedged Perpetuals support and position management tools. There are also advanced order types built in that are helpful to derivatives traders, such as Close-on-Trigger. Their WebSockets API is a little more limited than most others and only offers the essentials: order updates, position changes and market data.

Performance

As for performance, Phemex offers up to 100 requests per minute, which is quite significantly lower than Bybit who offers 50 requests per second. At the VIP, Institutional or Market Makers tiers there are higher request limits. There’s no published information about their infrastructure, their latency metrics. Safe to say the performance isn’t the biggest selling point for Phemex.

Developer Experience

They provide clear documentation and have an official Java SDK. The documentation provides request and response examples and there’s a separate documentation for the Java SDK with code examples. For Python users there’s a few code examples, albeit limited. We couldn’t find an MCP implementation for Phemex.

Phemex is for derivatives traders, plain and simple. There’s a bunch of features baked into the API that will make your trading experience better if that’s your product of choice. The feature depth when it comes to spot trading is more limited.

Pros:

-

Specialized derivatives tools like Close-on-Trigger orders

-

100x leverage with sophisticated risk management

-

Well-maintained GitHub documentation with CCXT integration

Cons:

-

Extremely low rate limit at 100 requests per minute

-

Only Java SDK available officially

-

No published performance metrics or infrastructure details

Links: Documentation • Sign up

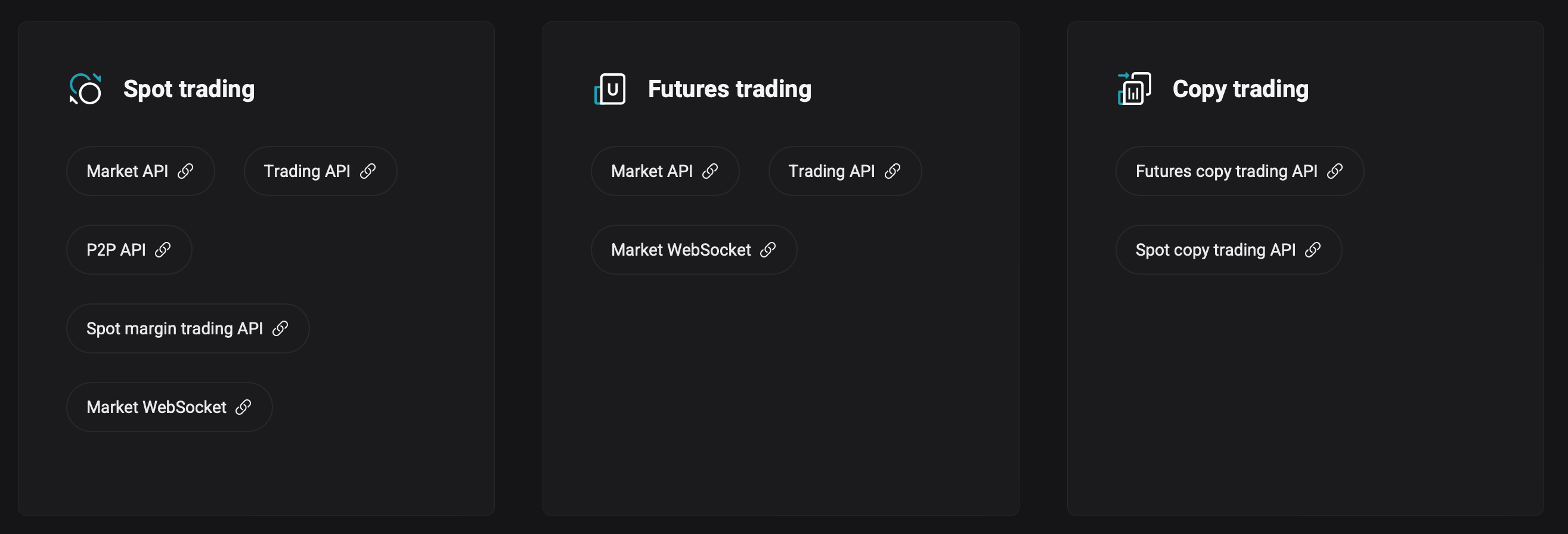

MEXC

If you make a lot of trades, even a 0.1% fee stacks up pretty quickly. If this is becoming an issue - MEXC is for you. The exchange offers 0% fees on spot trading. MEXC is also set up for brokers to bring their own clients and they do have some performance optimizations.

Protocols

Through the REST API, users can access a few features with MEXC that set them apart. First of all, there’s the Protocol Buffer option for data transfer. If you’re not familiar, Protocol Buffer is a Google developed mechanism for serializing structured data into binary and allows for quicker and smaller requests as well as testable code. Additionally, MEXC offers ETF trading as well as saving products within the API. The API is a bit lacking, however, both when it comes to advanced order types (they offer none) and the rate limits. While they’re not as limiting as Phemex, at 5 orders per second, they’re way behind both Binance and Bybit.

Their WebSockets implementation also offers a Protocol Buffer format (in addition to standard JSON) and has a trade aggregation feature. There’s also a batch subscription support which makes their pretty average 30 subscriptions per connection a lot more powerful.

Performance

The only thing MEXC really has going for them with regards to performance is their Protocol Buffer option for data. Other than that, there’s not a lot to say, there are no infrastructure specs, no co-location possibilities and no published latency benchmarks. It’s just not their strongest suit.

Developer Experience

Developers can enjoy a 24/7 Telegram support line, which is unique and a huge plus for DX. Their documentation features basic request/response examples and there are no official SDKs for any programming language nor is there an MCP. The documentation is available in multiple languages though.

If you trade spot and want to save on fees - MEXC is for you. The zero fee trading really sets the exchange apart. You’ll be hard pressed to use it for high frequency trading though, as they only offer 5 orders/second and don’t have any published infrastructure specs.

Pros:

-

Zero spot trading fees create unique arbitrage opportunities

-

Protocol Buffers implementation for better performance

-

24/7 Telegram support unique among exchanges

Cons:

-

Restrictive 5 orders/second limit kills high-frequency strategies

-

No advanced order types whatsoever

-

80% pair coverage with major exclusions like BTC/USDT

Links: Documentation • Sign up

Bitget

Lastly, there’s Bitget. The exchange is interesting because they’ve chosen to niche down on a specific feature - copy trading.

Protocols

Of course, like any other API, Bitget offer the standard spot and futures endpoints. However, there’s not much more to it than that. No advanced order types, no ETFs, no-frills. What they have really emphasized is copy trading. There are tons of features such as strategy replication, position sharing and following, automatic copying and more. These features are definitely more suited to building a social application on top of, more than for you to build some kind of algo.

Their WebSockets are also a standout feature. Bitget allows 100 connections per IP with 1000 channels per connection - a whopping 100.000 possible channels. It’s a no frills kinda interface though with market data and order updates, so no binary options or anything like that.

Developer Experience

As for the DX - there’s a well maintained but unofficial Node.js SDK with good documentation and plenty of examples. Bitget themselves provide a very good sandbox environment with virtual funds that includes the entire API suite. Their own docs are good, nothing amazing, nothing wrong either.

Are you developing a social trading application? Look no further. Bitget has most of the features you could hope for.

Pros:

-

Only exchange with copy trading APIs for social trading platforms

-

Highest WebSocket connection density (100,000 total channels)

-

Generous demo environment with virtual funds

Cons:

-

No published latency metrics or infrastructure details

-

Lacks advanced order types found on other exchanges

-

No official SDKs in any programming language

Links: Documentation • Sign up

| Exchange | Rate Limits | WebSockets | Spot Fees | Best Use Case |

|---|---|---|---|---|

| Binance |

6,000 weight/min (standard) |

1,024 streams/connection 60s timeout |

0.1% |

Institutional trading, complex strategies, highest liquidity needs |

| Bybit |

50-300 req/s (tiered) |

10-2,000 subs 20s timeout |

0.1% |

Multi-product strategies, excellent developer experience |

| Phemex |

100 req/min (standard) |

20 subs/connection 30s timeout |

0.1% |

Professional derivatives trading with high leverage (100x) |

| MEXC |

5 orders/s(spot) |

30 subs/connection 30s timeout |

0% |

High-volume spot trading where fees matter most |

| Bitget |

Standard limits (not specified) |

100 connections × 1,000 channels 30s timeout |

0.1% |

Building copy trading and social trading platforms |

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

PrimeXBT

Contract Trading Exchanges

|

34 | 0.01% | 0.02% | 0.0005 | 2018 |

GET 35% DEPOSIT BONUS

|

Visite | |||

Binance

Centralized Exchanges

|

433 | 0.10% | 0.10% | 0.0002 | 2017 |

CONSIGUE HASTA 100 USD DE BONO DE BIENVENIDA

|

Visite | |||

KuCoin

Centralized Exchanges

|

637 | 0.10% | 0.10% | 0.0005 | 2017 |

CONSIGUE HASTA 500 USDT EN BONO POR INSCRIPCIÓN

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||