iCE3

Handelsavgift

Insättninsgmetoder

Kryptos (13)

UPDATE 16 March 2021: ICE3 is closing down, and the reason for doing so is that they "have been advised to initiate liquidation proceedings". The problems leading up to the liquidation was first announced through the following message:

Dear Trader,

It has come to our attention that there are discrepancies in the balances pertaining to Bitcoin and Litecoin we hold on the platform. After consultation and deliberation with our partner Merkeleon.com and their subsidiary Coinspaid.com, we have not been able to reach a satisfactory conclusion. On the advice of our legal & auditing team, we have suspended all Deposits & Trading. Furthermore, we have suspended BTC (bitcoin) and LTC (litecoin) withdrawals with immediate effect, pending the outcome of a full investigation and reconciliation. This is being done for the protection of all clients.

Currently, clients who hold any other currency (excluding Bitcoin & Litecoin) on the platform will be still able to withdraw their funds.

We urge you to do so as soon as possible.

Should the domain/email/service desk become unavailable as a result of 3rd party actions, we will engage via this page

We apologize for the inconvenience caused and will update you with progress throughout.

Yours Sincerely

GC Grobler

Director

Internet Currency Evolution Cubed (PTY) Ltd

Accordingly, we have marked this exchange as "dead" and moved it into our Exchange Graveyard.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

iCE3 Review

iCE3 (also known as iceCUBED exchange or iceCUBED bitcoin exchange, and formerly iCE3X) is a cryptocurrency exchange from South Africa. To our knowledge, iCE3 are US-investor friendly meaning that they do not prohibit US-investors from trading. US-investors should as always still do their own independent assessment of any problems arising from their residency or citizenship.

iCE3 also states that the platform is designed to fit the screens of all popular devices such as tablets, smart phones and regular computers. You can test it by resizing your browser window. This can of course be an advantage if you prefer to do your trading on anything other than desktop. Also, the exchange promises that it is carefully developed to look “sharp” with new generation HiDPI /Retina devices.

iCE3 Debit Card

The exchange has also launched its own debit card. At this point in time, however, it is only available to South African users and can only be spent in South Africa at merchants who accept MasterCard or Visa. If the launch goes well, the company has informed that they will most likely expand the offering to customers in Nigeria, Zimbabwe, Botswana and other countries as well.

To make a cash withdrawal from the card, you will need to pay ZAR 10-18 (depending on the ATM Bank Issuer). There is a monthly fee of ZAR 5, and a cashback function giving you ZAR 3-5 back from the shops you use the card at. A very neat function indeed!

iCE3 Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at iCE3 (trading mode):

iCE3 Fees

iCE3 Trading fees

The trading fees of this exchange are "completely dynamic" and "fine tuned to suit each market individually". In general though, when looking at the fees, the platform charges 0.50% flat fees (i.e. no different fees between takers and makers) for the most part. 0.50% is roughly twice the global industry average. The global industry average is arguably around 0.25%. Any prospective investor should consider whether this exchange has a strong offering to investors in other respects that outweighs the disadvantage of this somewhat higher trading fee.

Many exchanges also have volume based discounts on their trading fees, meaning that if you trade above a certain volume each month/year, you receive trading fee discounts. iCE3 has this as well. If your monthly trading volume exceeds 1 BTC, your trading fees will be 0.35% flat. If your monthly trading volume exceeds 100 BTC, you trading fees will be 0.25% flat.

iCE3 Withdrawal fees

iCE3 has a percentage based withdrawal fee. This means that they charge you a percentage of the withdrawn amount when you want to withdraw. Their percentage charged is between 0.25% and 0.50%. However, they have set certain maximum limits, thereby ensuring that you won't have to pay 5 BTC if withdrawing 1,000 BTC, which would be absolutely insane. The following table shows the minimum and maximum withdrawal fees for each cryptocurrency possible to trade at iCE3. We have listed the maximum withdrawal fee as the withdrawal fee in our database.

Deposit Methods

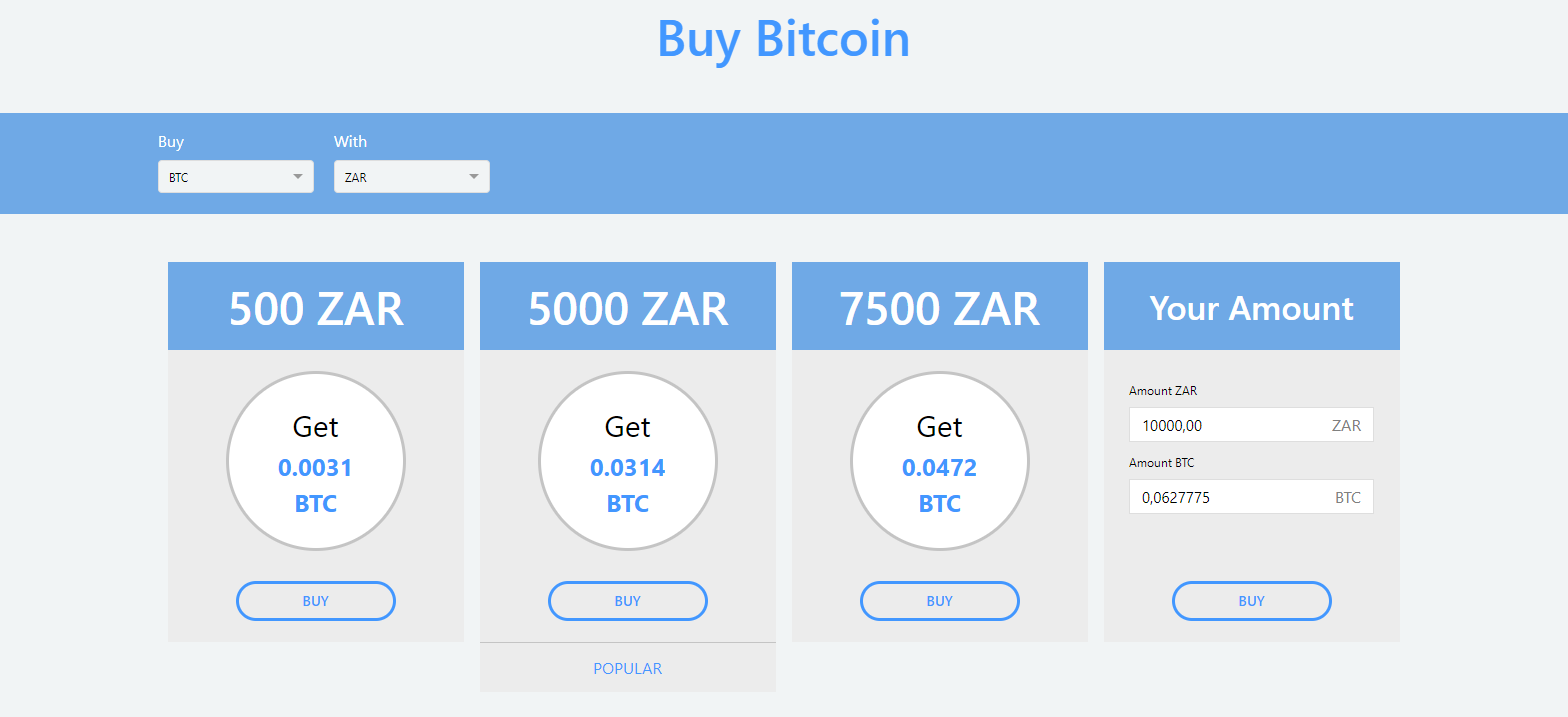

Here, you can deposit through both wire transfer and credit card, at least if you are from South Africa or Nigeria. This can be helpful particularly for newer crypto investors from those countries.

iCE3 Security

You can measure security at a cryptocurrency exchange in many different ways. For instance, this exchange takes pride in having:

- a fully implemented two-factor authentication system in place;

- checks and balances in place that flag suspicious transaction (internal staff when checks such suspicious transactions manually); and

- regular updates every few months which includes security upgrades.