Tap Global Card

Комиссии карты

Методы пополнения

Поддерживаемые криптовалюты (5)

Tap Global Card Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a cryptocurrency debit card, you can. This is a review of Tap Global Card, one of the crypto debit cards out there.

General information

Tap Global Card is an interesting new card that we at Cryptowisser.com are very excited about. The card is formally regulated by the Gibraltar Financial Services Commission under the Distributed Ledger Technology (DLT) with license No. 25532.

Tap Global's mission is to

"make crypto as easy to use as fiat currencies, empowering users to get the most out of their money. We’re passionate about creating new opportunities to transform the way you trade, move & spend your money."

The Tap Global Card is intended to be used by both new crypto investors, familiar investors, crypto adopters and globetrotters. The card has attractive functionality for each and every one of these groups.

Mastercard

Tap Global Card is a Mastercard, meaning that you can use the card at any point of payment that accepts Mastercard. This is of course a great advantage, seeing that Mastercard is the most widely accepted card in the world (alongside VISA).

Supported Cryptos

The card has support for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Huobi Token (HT) and the card company's own native token the Tap Token (XTP).

Tap Free, Tap Black and Tap Titanium

There are three different types of Tap Global Cards: Tap Free, Tap Black and Tap Titanium. The main differences are lower fees and higher limits, if you have the Black version or - the best card of them all - the Titanium version.

Picture of Card

This is a picture of the card (the basic version of it):

Tap Global Card Cashback

What is a cashback feature? Well, it's actually quite simple, every time you use the card, a percentage of what you pay with the card gets transferred back to you, normally in the form of tokens.

To our knowledge, Tap Global Card does not currently have a cashback function.

Tap Global Card Fees

Tap Global Card’s fees are very competitive indeed.

There are no monthly fees. There are no issuance fees. There are no minimum deposit limits. As long as you have a balance on the card, you can use it.

The most important fee of them all is the commission on spending. Tap Global Card doesn't really have a commission on spending as far as we know. Loading is also free of charge so no fees that can be equalled to commission on spending either. The only spending commission like fee is for transactions you make outside of the card's currency, where the company charges a 1.50% Foreign Exchange Charge. This is very competitive indeed.

Here's the full list of fees (or full list of no fees) for the Tap Global Card:

Tap Global Card Limits

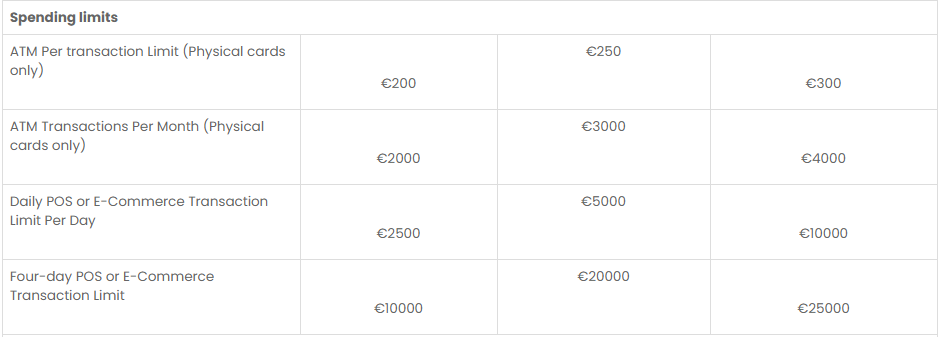

The following are the limits to using the card in EUR. From left to right, Standard Account, Black Account and Titanium Account:

Concluding remarks

We have a great feeling about the Tap Global Card. You can order one by downloading the app here.

If this is the cryptocurrency debit card for you, congratulations. But if not, check out one of the other cards in our crypto debit card list.

Good luck!

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!