Blockcard

Avgifter och gränser

Insättningsmetoder

Kryptos (12)

Blockcard Review

A common argument for regular money (also known as fiat currency) as opposed to cryptocurrency is that you can’t use cryptocurrency to buy groceries and other everyday items. Well, through the use of a cryptocurrency debit card, you can. This is a review of Blockcard, one of the crypto debit cards out there.

General information

Blockcard is card from US-people, for US-people. It is available to everyone in the US, not only a few selected people in the US but for card holders from all states in the US. This is very unusual and out of all the cards in our Crypto Debit Card List, roughly 1 out of 3 accept US-investors at all.

Within short however, the company expects that Blockcard will be available also to card holders from 31 European countries. It does not clearly state which ones (and there are 44 countries in Europe), but we will most likely find out shortly.

Crypto Cashback

Different from many other cryptocurrency debit cards, Blockcard also has a crypto cash back-program. The crypto cash back-program can reward you with as much as 6.00%. The spending required to reach different cash back-levels are set out in the below picture (starting at 0.00% for spending worth less than 30,000 TERN):

But that's not all. Blockcard not only has a high crypto cash back-percentage, it is unlimited. Many cards with crypto cash back-programs cap the cash-backs to a certain spending limit. Not Blockcard. This could be hugely advantageous for an avid spender. In the company's own words:

"It’s a major driver for many users and negates many of the other fees are bank partners mandate us to have."

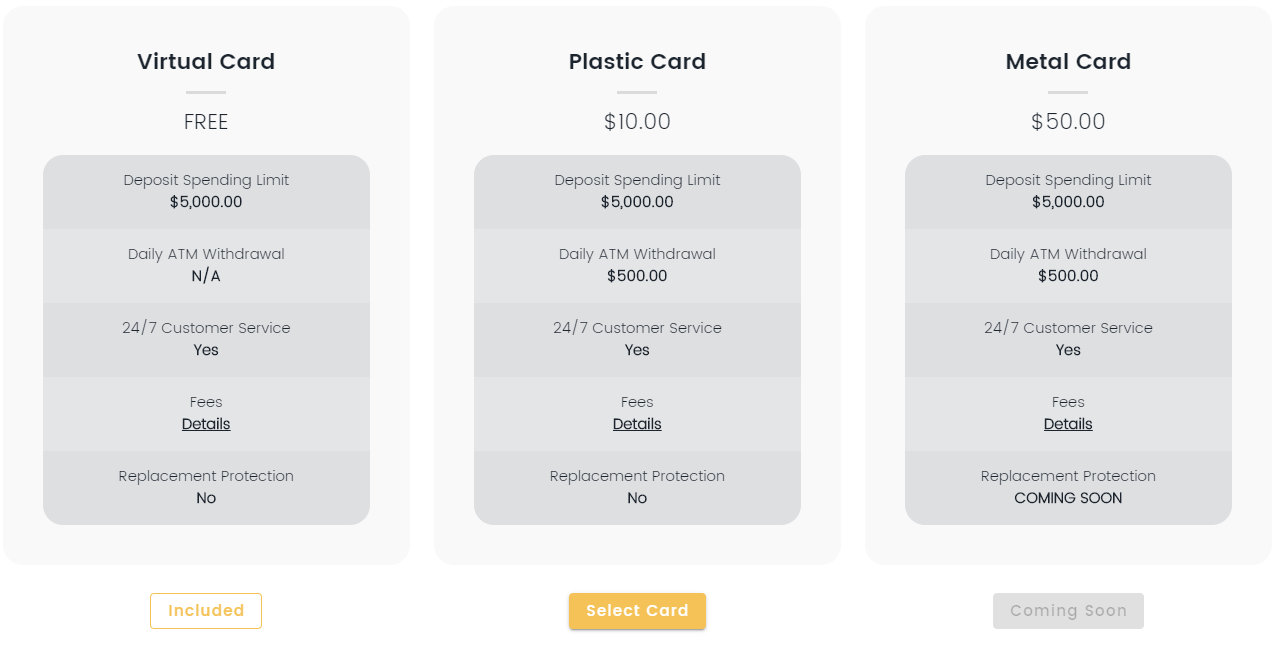

Three Types of Cards

There is/will be three different versions of Blockcard. The differences between them are neatly outlined in the below picture (obtained from Blockcard's website):

Referral Program

Blockcard also offers an attractive referral program. The terms are quite simple. If you invite a friend to sign up for the card, both you and your friend receives USD 10.00. However, you can't withdraw any funds you have made from the referral program if you are not from the United States. So European users, beware.

VISA-card

Blockcard is a VISA-card, meaning that you can use the card at any point of payment that accepts VISA. This is of course a great advantage, seeing that VISA is the most widely accepted card in the world (alongside MasterCard). The card that will be launched in Europe, however, will be a MasterCard.

Apple Pay Support etc.

Another unique feature of this card is that it is possible to use anywhere where you can use ApplePay, Google Pay or Samsung Pay. To our knowledge, this is not possible with any other crypto debit card. Great work pushing the boundaries here, Blockcard!

Blockcard Fees

Blockcard’s fees are very competitive. There are of course fees involved in using it, but these are not deterrent to using it at all.

The monthly fee depends on whether you spend more than USD 750 a month or not. If you do, there's no monthly fee at all. If you don't, the monthly fee is USD 5.00.

There is an issuance fee set to USD 10.00. This is slightly below the global industry average crypto debit card issuance fee which is arguably around USD 15.00.

ATM-usage results in a fixed fee of USD 3.00 on the withdrawn amount, provided that you make your withdrawal in the US. If you withdraw outside the US, the ATM-usage is a fixed fee of USD 3.50. Maximum withdrawal is USD 500 per day. Fixed fees like this may become disadvantageous in countries where the normal ATM-machines only allow smaller amounts of withdrawals (USD 20 for instance). In such scenarios, in order to withdraw a larger amount you need to withdraw several times, thus triggering the fixed fee each time. You can usually avoid this by just going to a local bank at the relevant place. Local banks normally permit higher withdrawals.

Furthermore, the most important fee of them all, is the commission on spending. Blockcard doesn't have a spending commission at all. This is a very competitive feature for this card which is actually quite unusual.

There is no maximum or minimum deposit, as far as we understand it. There is however a maximum spending level. Maximum spending is USD 10,000 per day. We would assume that most card holders will be on the right side of this daily spending limit with a great margin...

Picture of Card

Concluding remarks

If this is the cryptocurrency debit card for you, congratulations. But if not, check out one of the other cards in our crypto debit card list. Good luck!

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!