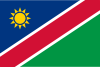

Namibia vs Uganda

Crypto regulation comparison

Namibia

Uganda

Namibia enacted the Virtual Assets Act (Act 10 of 2023) establishing a comprehensive licensing framework for VASPs. The Bank of Namibia is designated as regulator. Crypto is legal but not legal tender. No specific crypto tax framework yet.

Uganda restricts cryptocurrency. The Bank of Uganda issued a 2022 circular (NPSD 306) barring licensed payment service providers from facilitating crypto transactions. A 2023 High Court ruling upheld the circular, declaring cryptocurrencies illegal under the National Payment Systems Act 2020. No crypto exchanges are licensed to operate. Informal P2P crypto activity exists despite restrictions.

Key Points

- Virtual Assets Act (Act 10 of 2023) signed into law July 2023

- VASPs must obtain licenses from Bank of Namibia to operate

- Provisional licenses granted to first two exchanges in 2025

- Non-compliance penalties up to NAD 10 million and 10 years imprisonment

- Crypto is not legal tender but merchants may accept at their discretion

Key Points

- BOU Circular NPSD 306 (April 2022) bars licensed entities from facilitating crypto

- 2023 High Court ruled cryptocurrencies illegal under National Payment Systems Act 2020

- Growing crypto adoption, particularly for cross-border transactions

- No specific crypto taxation rules

- Financial Intelligence Authority requires VASPs to comply with AML laws