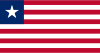

Liberia vs Seychelles

Crypto regulation comparison

Liberia

Seychelles

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

The VASP Act 2024 effective Sept 2024 establishes FSA as regulator for virtual asset service providers. Exchanges require licensing. Mining and mixer/tumbler services are prohibited in Seychelles.

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access

Key Points

- VASP Act 2024 enacted Aug 30, effective Sept 1, 2024

- FSA licenses and supervises all virtual asset service providers

- Mining facilities and mixer/tumbler services prohibited

- VASPs must maintain local office and resident director

- Licensed IBC VASPs taxed at 1.5% on assessable income