Greece vs Liberia

Crypto regulation comparison

Greece

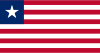

Liberia

Cryptocurrency is legal in Greece and regulated under the EU framework. A 2024 tax reform established a 15% tax on crypto capital gains, replacing the prior uncertain treatment. The Hellenic Capital Market Commission oversees crypto service provider registration.

The CBL has not issued crypto licenses and considers unauthorized crypto products illegal. No specific crypto legislation exists but the Financial Institutions Act requires licensing for all financial services.

Key Points

- 15% capital gains tax on crypto established under recent tax reforms

- HCMC registers and supervises crypto service providers

- Greece adopted EU AML directives for crypto businesses

- MiCA framework applicable from December 2024

- Crypto adoption grew during the 2015 financial crisis and capital controls

Key Points

- CBL has not approved any crypto licensing

- Unauthorized crypto products deemed illegal under Financial Institutions Act

- CBL shut down local crypto startup TACC in 2021

- No specific crypto tax framework

- Very low crypto adoption due to limited internet access