Restaking, EigenLayer, and the “Modular Crypto” Revolution October, 2025

Restaking allows Ethereum validators to secure multiple protocols at once, creating a shared market for blockchain security. This guide explores EigenLayer, AVSs, and how modular crypto is redefining DeFi’s next growth phase.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

The modular era of blockchain has arrived. Instead of a single chain handling execution, consensus, and data storage, networks are beginning to unbundle these layers. The result is a flexible ecosystem where different components specialize in specific functions and interconnect like digital infrastructure blocks.

At the center of this transition is EigenLayer, the protocol that introduced the concept of restaking. Restaking allows Ethereum validators to reuse their staked ETH to secure additional networks and services, effectively turning Ethereum’s existing trust layer into a shared resource. It is one of the most ambitious experiments in blockchain coordination to date, an open marketplace for security.

This approach is already reshaping how developers think about blockchain design. Instead of bootstrapping a new validator set or issuing new tokens, emerging networks can “borrow” Ethereum’s economic security through restaking. That creates a foundation for new services such as cross-chain bridges, oracle networks, and decentralized compute layers, all secured by the same ETH collateral that underpins the Ethereum network itself.

As restaking gains traction, it introduces both opportunity and risk. The ability to extend Ethereum’s security guarantees to other protocols could accelerate innovation, but it also concentrates systemic exposure in a single asset. This guide examines how EigenLayer works, the new primitives it enables, and the trade-offs involved in reusing trust across modular systems.

What Is Restaking and How EigenLayer Works

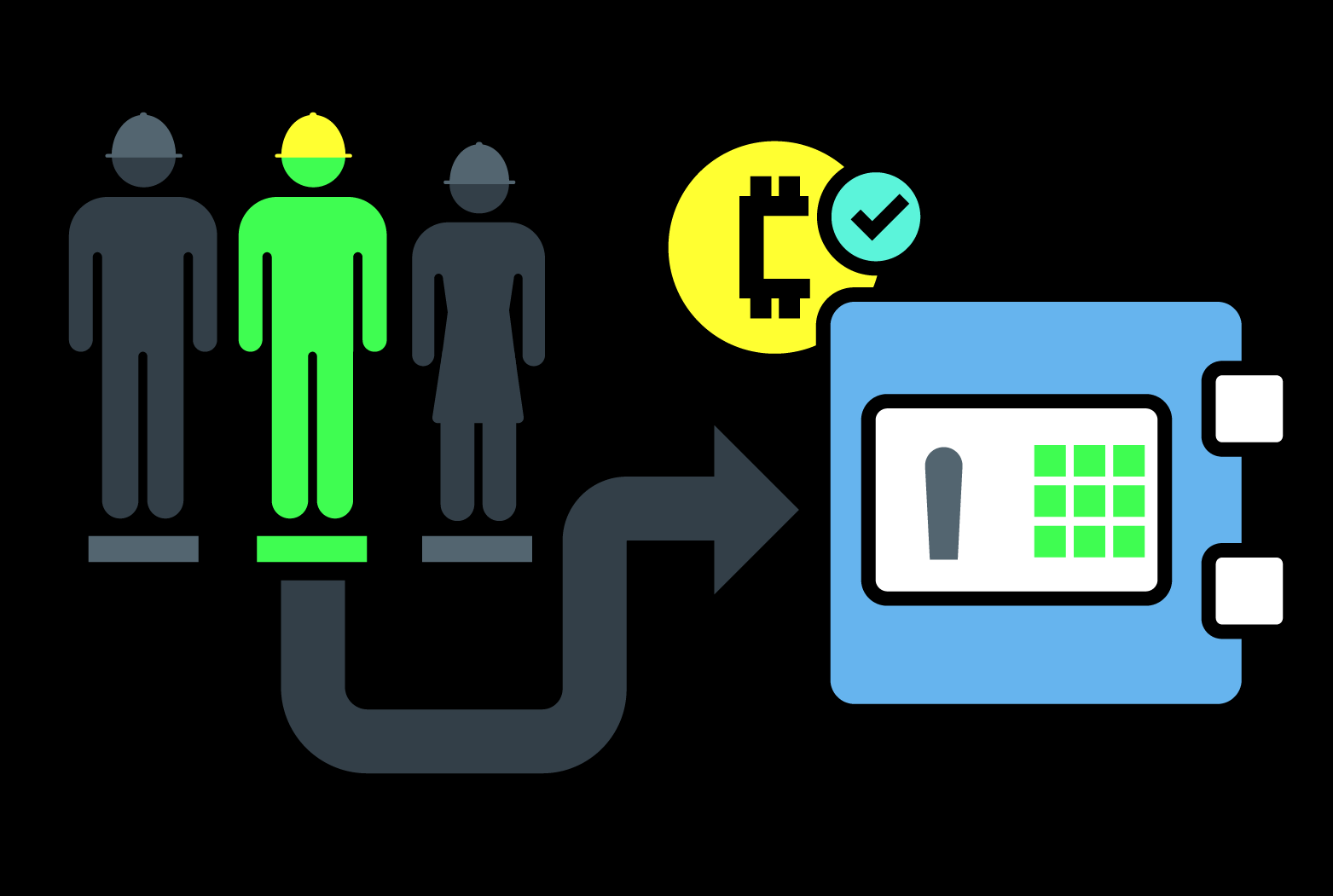

Restaking is a mechanism that lets Ethereum validators reuse their already-staked ETH to secure additional protocols. Instead of locking more capital into every new network, the validator “restakes” the same ETH to extend its economic security to multiple services at once.

The Basic Idea

- Ethereum Staking: Validators stake ETH on the Beacon Chain to secure Ethereum and earn rewards.

- Restaking Layer: EigenLayer introduces smart contracts that allow validators to opt in and restake their ETH (or liquid staking tokens such as stETH or cbETH).

- Active Validation Services (AVSs): These are external protocols—bridges, oracles, data networks—that borrow Ethereum’s validator base for additional security.

By restaking, a validator agrees that if they act dishonestly while serving an AVS, their original ETH can be slashed. This creates a shared-security model where the same collateral secures multiple systems simultaneously.

Why It Matters

Restaking solves one of the biggest problems in blockchain development: bootstrapping trust. New protocols no longer need to issue a token solely for security or build their own validator network. Instead, they can plug into Ethereum’s proven base layer.

For example:

- A new data-availability network can pay restakers for validating its data blocks.

- A cross-chain bridge can use restaked validators to monitor both ends of a transfer.

- A machine-learning inference network can leverage restaked nodes to verify computations.

Each of these systems inherits the credibility and economic weight of Ethereum’s stake pool without fragmenting security across multiple ecosystems.

Architecture Overview

EigenLayer works through three main components:

- Smart Contracts on Ethereum that manage deposits, restake commitments, and slashing rules.

- Operator Nodes that register to provide validation services for one or more AVSs.

- Service Managers who define validation logic, rewards, and penalties for their respective networks.

Together, these pieces create an open marketplace where validators choose which services to secure, and protocols compete to attract security by offering yield.

The New DeFi Primitives Built on Restaked ETH

Restaking does more than recycle security—it creates entirely new layers of economic activity in DeFi. By allowing Ethereum’s collateral base to be reused across multiple protocols, EigenLayer opens the door to financial instruments and coordination models that were previously impossible.

1. Yield Multiplication

Restaking transforms ETH from a passive staking asset into a productive, multi-yield instrument. A validator earns the standard Ethereum staking rewards, plus additional yield from each Active Validation Service (AVS) they support. The result is a form of stacked yield, where one collateral position produces several income streams.

However, this also increases complexity. Every new AVS adds exposure to slashing risk, so higher rewards come with higher systemic leverage. The emerging market for “restaking yield optimizers” already reflects this balance between opportunity and risk management.

2. Liquid Restaking Tokens (LRTs)

Just as liquid staking created tokens like stETH or rETH, restaking has led to liquid restaking tokens (LRTs) such as Ether.fi’s eETH, Renzo’s ezETH, and Puffer’s pufETH. These tokens represent ETH that is both staked and restaked, making them yield-bearing and composable across DeFi.

LRTs function as collateral, liquidity assets, and governance tools. Holders can deposit them into lending markets, farm additional rewards, or trade them like any other ERC-20 token. The presence of multiple LRT providers introduces competition around yield rates, validator selection, and security guarantees.

3. Restaking Derivatives and Structured Products

The layered yield model has inspired the creation of new derivatives—synthetic assets and risk tranching instruments built on top of restaked ETH. Examples include:

- Leverage wrappers that magnify the yield from specific AVSs.

- Insurance vaults that pool funds to protect against slashing events.

- Yield-index tokens that bundle returns from several AVSs into a single diversified product.

These instruments mirror the structured finance of traditional markets but operate in real time on-chain, giving DeFi investors tools to customize their exposure across multiple protocols.

4. Shared Security as a Service

EigenLayer’s design makes security itself a tradable commodity. Projects can rent Ethereum’s validator base instead of building their own. In turn, restakers earn protocol-specific rewards for extending their security to others.

This “security-as-a-service” model is spawning an entire ecosystem of middleware providers, from decentralized oracle networks to data-availability layers and AI computation markets. Each relies on the same economic foundation, ETH collateral locked in the Ethereum mainnet but working across multiple ecosystems.

5. Composability and Interoperability

Because restaking is modular, it fits naturally into the DeFi stack. LRTs can be used as collateral in lending markets, yield tokens can be traded in secondary pools, and risk-management vaults can layer protection on top of them. The interoperability between these components is what makes modular crypto so powerful: liquidity, security, and utility flow freely between systems without creating new silos.

Restaking is therefore not just a technical feature—it’s a financial primitive. It links the security of Ethereum to an expanding network of applications and protocols, turning ETH into the backbone of a multi-layered, yield-generating economy.

AVS Use Cases: Cross-Chain Bridges, Data Availability Layers, and AI Compute Networks

Active Validation Services (AVSs) are the core innovation enabled by EigenLayer. They are the systems that restaked validators actually secure. Each AVS defines its own logic, reward structure, and responsibilities. Together, they showcase how restaking extends Ethereum’s security into new domains beyond simple transaction validation.

Cross-Chain Bridges

Cross-chain communication remains one of the most critical and fragile parts of crypto infrastructure. Many bridge exploits occur because the validator sets securing them are small or poorly incentivized. Restaking changes that model by letting bridges borrow Ethereum’s existing validator base.

A bridge built as an AVS can require restaked validators to observe multiple chains, verify transactions, and sign attestations. If a validator acts dishonestly, their staked ETH on Ethereum can be slashed. This turns bridge security into a shared public good rather than a fragile, isolated system.

Impact:

- Stronger trust guarantees for users moving assets across chains.

- Reduced need for wrapped tokens or centralized custodians.

- Easier standardization for inter-chain protocols.

Data Availability Layers

Data availability (DA) is another area benefiting from restaking. In modular blockchain design, DA layers handle the storage and retrieval of transaction data for rollups and sidechains.

By using restaked validators, DA layers can outsource security to Ethereum rather than operating their own token-based system. Restaked ETH acts as the economic guarantee that data posted to the DA layer will remain accessible and verifiable.

Impact:

- Higher security for rollups without inflating new tokens.

- Lower operational costs for new chains that rely on external DA.

- Easier cross-rollup communication thanks to shared security standards.

AI Compute Networks

As decentralized AI infrastructure grows, restaked security provides a foundation for trustless compute verification. AI networks that run training or inference tasks can use restaked validators to verify that computations were executed correctly.

Validators in this case act as verifiers, checking cryptographic proofs or verifying model outputs. If a validator reports incorrect results, their restaked ETH can be slashed. This makes AI networks both decentralized and economically secure without needing their own consensus layer.

Impact:

- Verifiable, decentralized machine-learning pipelines.

- New economic models for AI compute marketplaces.

- Cross-domain coordination between DeFi, AI, and data services.

The Broader Role of AVSs

Beyond these examples, AVSs can include oracles, indexing services, privacy layers, and zero-knowledge verification networks. Each uses restaking to rent Ethereum’s trust layer while offering specialized functionality to other protocols.

In this sense, EigenLayer acts as a security clearinghouse, a platform where new systems can buy verified trust and where stakers can sell it. It is this dynamic marketplace of validation services that defines the “modular crypto” revolution and sets the stage for a more interconnected blockchain economy.

Risks of Rehypothecation and Over-Leveraged Security

Restaking brings efficiency, but it also concentrates risk. The same ETH that secures Ethereum now secures multiple external systems. This creates a layered dependency network where one event can cascade across several protocols. Understanding these risks is essential before calling restaking the new standard for blockchain security.

1. Rehypothecation of Trust

Rehypothecation is the reuse of collateral across multiple positions. In traditional finance, it can amplify returns but also magnify losses. The same principle applies to restaking. A single validator’s ETH might secure Ethereum, a bridge, a data network, and a compute layer all at once.

If any of those services experiences a fault or attack that triggers slashing, the validator’s collateral is reduced for every service simultaneously. What was once diversified risk becomes a single point of failure spread across the ecosystem.

The danger is not only technical, it’s systemic. If a major AVS suffers a coordinated exploit and large amounts of ETH are slashed, the impact would extend beyond that protocol, shaking confidence in the entire restaking model.

2. Over-Leverage and Yield Chasing

The high returns from stacking multiple AVS rewards can lead validators to take on more exposure than they can manage. This incentive structure mirrors the leverage cycles seen in DeFi yield farming. As validators compete for higher yields, they may participate in too many services without fully understanding each one’s risk parameters.

When rewards are high and slashing penalties are rare, risk builds quietly until an event exposes the fragility of the system. The combination of shared collateral and interdependent protocols could produce liquidation-like cascades similar to those that have destabilized other DeFi sectors in the past.

3. Complexity and Opaque Dependencies

Restaking makes security composable, but that composability introduces hidden complexity. Each AVS has its own rules, slashing logic, and failure conditions. When dozens of these systems interact, mapping the dependency graph becomes difficult even for experts.

If an AVS depends on data from another AVS that later fails, the secondary service may also become compromised. The result is a layered risk structure that is hard to model and nearly impossible to monitor in real time.

4. Governance and Accountability

With multiple protocols sharing the same validators, governance becomes complicated. Who decides whether a slashing event is valid? Who is responsible if a validator is penalized because of a software bug in an AVS they support?

Without clear standards for arbitration and appeals, disputes could arise that undermine trust in the whole system. Governance frameworks will need to evolve to handle cross-protocol accountability, perhaps through shared insurance pools or independent oversight bodies.

5. Regulatory and Perception Risk

If restaking becomes large enough to underpin hundreds of protocols, regulators may view it as a form of pooled financial service. Questions about liability, custodianship, and systemic risk could emerge, especially if restaked assets are offered to retail investors through liquid restaking tokens.

The line between decentralized infrastructure and unregistered collective investment will blur, forcing developers and validators to anticipate new compliance expectations.

Managing the Risk

To make restaking sustainable, several safeguards are emerging:

- Clear disclosure of AVS participation and risk exposure for each validator.

- Independent audits and simulation frameworks that test slashing scenarios.

- Insurance protocols and loss-sharing pools that absorb shocks.

- Governance standards that separate operational faults from malicious intent.

The ultimate goal is proportional risk. Restaking should distribute Ethereum’s security efficiently, not concentrate it dangerously. Achieving that balance will determine whether modular crypto matures into a resilient ecosystem or repeats the leverage-driven collapses of earlier DeFi cycles.

Conclusion and Outlook for Modular Crypto (2025–2026)

Restaking turns blockchain security into an open market. Instead of every network building its own validator set, protocols can rent Ethereum’s trust layer through EigenLayer. This approach saves capital, speeds up development, and links ecosystems that were once isolated.

What Comes Next

- Expansion beyond validation. Restaking will secure new layers for data, compute, and cross-chain coordination.

- Financial innovation. Liquid restaking tokens and structured yield products will evolve into a core part of DeFi portfolios.

- Risk management. Insurance, circuit breakers, and transparent auditing will become mandatory as shared security scales.

The Bigger Picture

Modular crypto changes how blockchains grow. Developers can focus on performance and utility instead of bootstrapping security. Ethereum becomes a shared foundation rather than a single ecosystem.

The opportunity is clear: a faster, more connected blockchain economy built on reusable trust. The challenge is keeping that efficiency from turning into fragility. The systems that balance both will define the next stage of decentralized finance.