Mastering Market Structure: Institutional Tactics for Crypto Traders January, 2026

Learn how institutional traders use market structure, liquidity sweeps, and smart entry tactics to dominate crypto markets. This guide breaks down real strategies across Bybit, KuCoin, and Coinbase.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

KuCoin

Centralized Exchanges

|

637 | 0.10% | 0.10% | 0.0005 | 2017 |

CONSIGUE HASTA 500 USDT EN BONO POR INSCRIPCIÓN

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||

In the fast-moving world of crypto, retail traders often get caught in the emotional churn, buying the top, selling the bottom, and chasing signals that flash too late. What separates professional traders from the pack isn't a secret algorithm or a hidden indicator, it's structure. More specifically, market structure.

Market structure is the roadmap institutions follow. It's how smart money navigates chaos, builds positions quietly, and exploits liquidity with surgical precision. And whether you're trading Bitcoin on Coinbase, altcoins on KuCoin, or perpetual futures on Bybit, understanding this structure will change how you see the market.

Instead of reacting to price, you’ll start anticipating it.

You’ll learn to spot where liquidity pools form, where retail stop losses are likely stacked, and how institutional players trigger moves that seem random, until you understand the mechanics behind them.

This guide is designed to walk you through the same market structure principles institutions use to manage risk and enter with precision. We’ll break down the core components of structure, walk through real examples on Bybit, Coinbase, and KuCoin, and show you how to adapt these concepts to the crypto space.

If you’re tired of relying on lagging indicators, this is your upgrade. Welcome to the side of the market that plays to win.

What is market structure (and why you should care?)

Market structure is the foundational language of price action. It’s how markets move, not randomly, but in a sequence of trends, consolidations, and reversals that institutions understand and often manipulate to their advantage.

At its core, market structure refers to the repeating phases that form in any market:

- Accumulation – where smart money builds positions quietly, often in a tight range

- Markup – the breakout phase where prices rise and momentum builds

- Distribution – where institutional players exit positions as retail jumps in

- Markdown – the sell-off phase, often sharp and emotional, back to fair value

These cycles play out across all timeframes, from the 5-minute chart to the weekly. And in crypto, where volatility is high and market depth is thinner than in legacy finance, these structures are even more visible.

But structure isn’t just about identifying trends. It’s about reading liquidity flow.

For example: a retail trader may see a breakout and FOMO in, but a trader focused on structure notices that the move happened after a stop hunt, a sweep of previous lows engineered to fuel the breakout. That’s not noise. That’s precision.

Why it matters:

- It helps you stop chasing price and start reading intention

- You’ll avoid retail traps like false breakouts or trendline bounces with no context

- It lets you plan entries based on logical structure shifts, not guesswork

- It simplifies risk: you know where your trade is invalidated (e.g. structure broken)

Whether you’re on Coinbase watching BTC/USDT break a daily high, or using Bybit for short-term leveraged plays, structure tells you who’s in control, buyers or sellers, and when that control shifts.

If you’re not trading based on structure, you're trading blind. Every indicator, every volume spike, every candle, flows from structure.

Master it, and you stop reacting. You start positioning like the institutions do.

Smart money concepts vs retail trading habits

Most retail traders operate on hope and habit. They chase green candles, draw trendlines with no context, and load up on indicators that flash after the move is done. Institutions, on the other hand, trade based on structure, liquidity, and intent. They know where the average trader is likely to enter, place stops, and panic. And they exploit it.

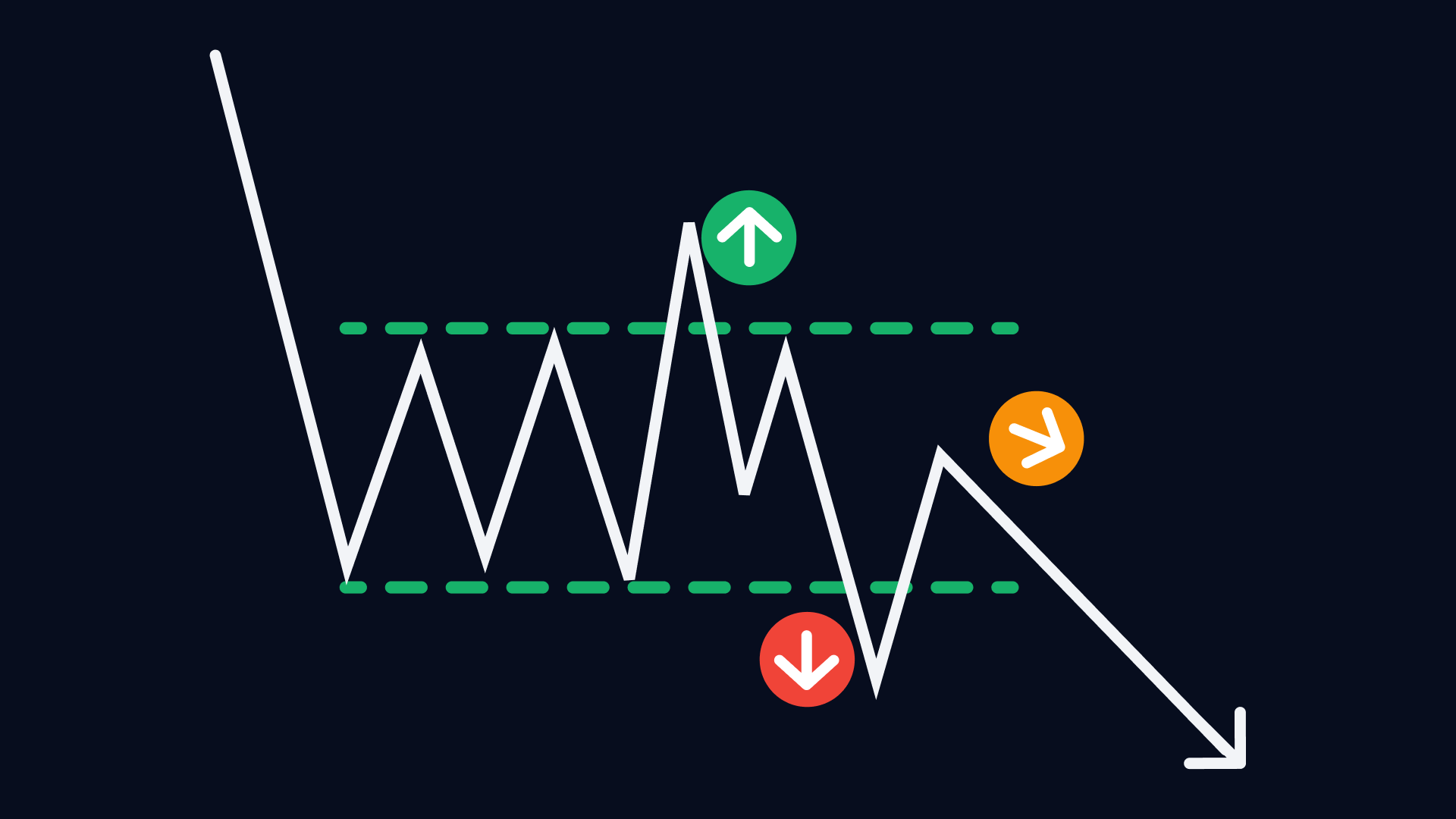

This is the core of Smart Money Concepts (SMC). It’s not about predicting every move. It’s about understanding where the market is engineered to take liquidity before the real move begins.

Core smart money tactics:

- Liquidity grabs – when price dips below a key low or spikes above a high to grab stop losses before reversing. These are intentional, not random.

- Stop hunts – used to trap retail traders in bad positions. For example, a spike below recent lows triggers panic selling, then price reverses and rallies.

- Order blocks – zones where large players initiated moves. These areas often act as magnets for future price re-entry or reversal.

- Change of character (CHoCH) – when the market shifts from lower lows to higher highs (or vice versa), signaling a change in control.

What retail traders often do:

- Enter on breakouts, just before price reverses.

- Use MACD or RSI without context, ignoring price structure.

- Place stops in obvious spots, like just below recent swing lows.

- Trade against strong institutional zones, often unknowingly.

Example: KuCoin BTC/USDT Stop Hunt

On June 22, 2025, BTC dipped just below $61,000 on KuCoin, sweeping a key daily low. Minutes later, it reversed sharply and climbed 4.8% in under two hours. To a smart money trader, this was a clear liquidity grab before a move higher. Retail traders who panicked got stopped out at the exact point institutions entered.

Understanding the difference between smart money tactics and retail habits is key to flipping your edge. It shifts your focus from reacting to the market to anticipating its traps and setups.

Price action and structure anatomy

Price action is how the market tells its story, candle by candle. But to read that story with clarity, you need to understand structure of anatomy. That means identifying the swing points, trends, and shifts that tell you when the market is preparing to move, and in which direction.

Forget the indicators for a moment. Real structure starts with:

Swing highs and swing lows

- A swing high is a local peak with two lower highs on each side.

- A swing low is a local bottom with two higher lows on each side.

These are the building blocks of structure. They show where buyers and sellers have failed or succeeded.

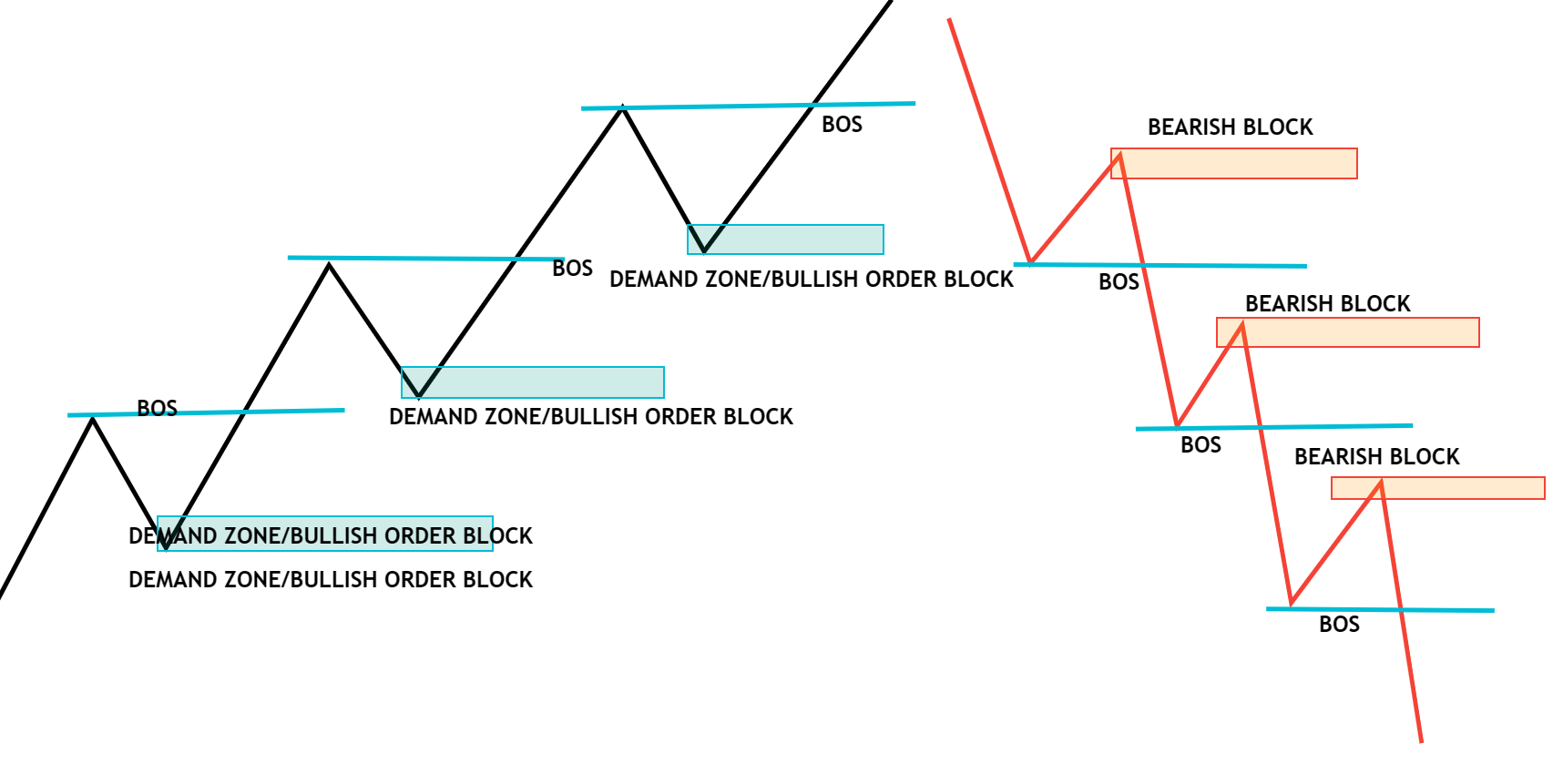

Break of Structure (BOS) vs Change of Character (CHoCH)

- BOS happens when price breaks a recent swing high or low in the direction of the current trend. It confirms continuation.

- CHoCH is more powerful. It signals a possible trend reversal. If price had been making lower lows, then suddenly breaks a previous high and forms a higher low, that’s a shift in character. Smart money notices this.

Internal vs external structure

- External structure refers to the main trend. Think higher highs and higher lows in a bullish market.

- Internal structure tracks what happens inside those swings. This is where entry setups form.

You need both perspectives. External tells you the big picture. Internal gives you precision entries.

Trend identification using structure

- In an uptrend: look for BOS on highs and higher lows holding.

- In a downtrend: expect BOS on lows and lower highs forming after pullbacks.

In consolidation: expect fakeouts and liquidity sweeps. That’s when structure becomes even more important.

Example: Price action on Coinbase ETH/USD

On July 12, 2025, ETH/USD on Coinbase broke a clear internal structure high at $3,070 after printing higher lows all week. This CHoCH marked a major shift from distribution into markup. Traders who recognized the shift entered on the retest of the order block around $3,040 and rode the move up to $3,230 within 48 hours. No RSI, no indicators, just pure structure.

Learning to read these movements is like learning a language. Once you see it, you can’t unsee it. And it works across Bybit, KuCoin, Coinbase, and any asset that moves with supply and demand.

Key institutional tools and concepts

Once you understand structure and liquidity, the next step is learning how institutional traders actually enter the market. They don’t rely on retail tools like Bollinger Bands or stochastic oscillators. Instead, they use price-based concepts rooted in logic and volume.

Let’s break down the most important institutional tools used across Bybit, KuCoin, and Coinbase.

1. Order blocks (OBs)

An order block is the last bullish or bearish candle before a strong market move. It’s where institutions likely placed large orders. These zones often act as areas of interest for re-entry or reversal.

- Bullish OB: Last down candle before an impulsive move up

- Bearish OB: Last up candle before a strong drop

Order blocks are not support/resistance. They represent areas of imbalance that big money may revisit to fill unfilled orders.

2. Fair value gaps (FVGs)

Fair value gaps are areas on the chart where there was no real trading activity. Price moved too fast, creating an imbalance between buyers and sellers.

These gaps often get filled later, meaning price will return to that area before continuing in the original direction.

-

Spot them between three candles: if the middle candle breaks away sharply and leaves a “gap” between candle 1 and 3, you have a fair value gap.

3. Imbalance zones

Similar to FVGs, these are regions where buying or selling pressure was so dominant that it left thin liquidity. Institutions often target these zones for entries or exits.

4. Premium and discount levels

Using Fibonacci or a simple swing high/low range, you can divide price into:

- Premium: Above equilibrium. Favorable for selling.

- Discount: Below equilibrium. Favorable for buying.

Institutions typically accumulate below equilibrium and offload above it.

Example: OB + FVG confluence on SOL/USDT

On July 15, 2025, SOL/USDT on KuCoin formed a bullish order block at $142 and left a fair value gap between $143.20 and $144.10. Price swept a local low, tapped the OB, filled the FVG, and then exploded past $150 within 36 hours. No indicator needed. Just structure, liquidity, and imbalance.

When you combine these tools with your knowledge of structure and liquidity, you stop entering trades randomly. You start building setups with context.

How to trade like institutions on Bybit, KuCoin, and Coinbase

Institutional tactics aren't tied to one specific platform, they rely on tools, timing, and liquidity. But depending on where you trade, your edge may shift. Some platforms are better for precision scalps, others for clean structure reading, and some for volatile altcoin plays.

Let’s break it down.

Bybit

Bybit is ideal for active traders using smart money concepts on lower timeframes. Why? Because it offers deep liquidity, fast execution, and built-in volume tools across perpetual futures.

How to trade it like a pro:

- Use 5m–15m structure for scalps after a CHoCH or BOS

- Monitor volume and open interest to confirm liquidity sweeps

- Use OB + FVG setups with defined invalidation based on recent swing lows

Bybit excels for traders using leverage with discipline. It’s where smart money setups like liquidity sweeps and OB re-tests shine.

Coinbase

Coinbase is better for spot trading with a clean structure. The price action is less manipulated, making it easier to see CHoCHs, BOS, and internal structure shifts.

How to trade it like a pro:

- Use daily or 4H timeframes for swing setups

- Identify discount zones using premium/discount models

- Place orders inside OBs or FVGs after internal structure confirms

Coinbase’s interface and cleaner price action make it ideal for planning high-conviction, lower-frequency trades.

KuCoin

KuCoin is a goldmine for volatile altcoins and engineered liquidity plays. Smaller caps often show dramatic sweeps and “stop hunt” patterns.

How to trade it like a pro:

- Look for engineered liquidity around equal highs or lows on trending coins

- Use OBs on the 1H or 2H chart for sniper entries

- Avoid breakout chasing — wait for liquidity grabs then structure confirmation

KuCoin gives you explosive upside, but only if you’re aware of how quickly structure can shift.

Platform comparison

|

Platform |

Strengths |

Ideal For |

Execution Type |

|

Bybit |

Volume depth, futures, fast fills |

Leverage + short-term setups |

Perpetual contracts |

|

Coinbase |

Clean price action, trusted spot |

High-conviction swing trades |

Spot trading |

|

KuCoin |

Volatility, altcoin opportunities |

Liquidity sweep setups + alts |

Spot + margin trading |

Learning to adapt institutional setups across platforms gives you flexibility. It’s not just what you trade, it’s where and how you execute the setup.

Risk management and psychological discipline

You can master market structure, liquidity, and institutional tools, but if you ignore risk management, it will all fall apart. Professional traders don’t survive by being right all the time, they survive by controlling risk when they’re wrong.

The key mindset shift? Trade like you’re managing capital for someone else.

1. Risk per trade = structure invalidation

Don’t set your stop loss based on how much you “can afford to lose.” Instead, use structure:

- If you’re trading a bullish order block, your stop should be just below the OB low.

- If you’re trading after a BOS, your stop should sit beyond the last higher low.

This approach means you’re only wrong if the structure fails — not if the market pulls back randomly.

2. Position sizing = protection, not aggression

Smart money doesn't over-leverage. Use a fixed percentage model, like 1% risk per trade. On Bybit or KuCoin, use stop losses paired with position calculators. Let the math do the work — not your emotions.

3. Discipline > predictions

Even the best setups fail. If you journal 20 trades and win 12 with 2R returns, you’re ahead. But that only works if you:

- Stick to setups backed by structure and liquidity

- Take losses mechanically, without revenge trading

- Focus on process, not outcome

Bonus tip: Journal every trade

Use tools like Notion or Edgewonk to log:

- Why you entered

- What structure supported the entry

- Where your risk was

- How you felt

Over time, this helps eliminate emotional bias and identify what’s actually working.

Example setup breakdown: From BOS to exit

Let’s walk through a real trade using smart money structure, liquidity, and institutional entry logic. This example uses Bybit BTC/USDT perpetual on the 1-hour chart.

Step 1: Identify market context

BTC was in a short-term downtrend with consistent lower highs and lower lows. Price tapped into a higher-timeframe discount zone near $58,600 and formed a strong bullish reaction. This hinted at possible accumulation.

Step 2: Watch for CHoCH

After a weak low formed, BTC printed a sharp move breaking the previous lower high at $59,800. This was our change of character (CHoCH), signaling a potential trend reversal.

Step 3: Find confluence

We marked:

- A bullish order block just before the breakout (at $59,000–59,300)

- A small fair value gap overlapping the OB

- Resting liquidity below recent equal lows around $58,900

- This created a high-probability entry zone.

Step 4: Entry and invalidation

- Entry: Limit buy order at $59,200 inside the OB

- Stop loss: Below $58,750, under the liquidity sweep

- Target: $61,400, just below the next external swing high

This trade offered a clean 3.8R risk-to-reward ratio.

Step 5: Execution and exit

Price pulled back into the OB and filled the FVG. It swept liquidity at $58,900, reversed sharply, and ran to target in less than 36 hours.

No indicators, no guessing. Just structure, liquidity, and logic.

These setups repeat across Coinbase, KuCoin, and Bybit. When you understand what institutions are targeting, your trades become more mechanical, less emotional, and significantly more profitable.

Final shift: Thinking like the pros

Most traders chase signals. Smart traders chase structure. Once you start viewing price through the lens of market phases, liquidity zones, and institutional intent, everything slows down. You stop reacting to candles and start preparing for setups days in advance.

Whether you're trading BTC on Bybit, ETH on Coinbase, or altcoins on KuCoin, the patterns are there. Institutions leave footprints. Your edge is learning to spot them.

Forget perfection. Focus on probability. Keep your trades simple, your risk defined, and your execution consistent. That’s the real edge.

The market isn’t random. It’s structured, if you know where to look.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!

| Comisiones de intercambio | Métodos de depósito | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Nombre | Criptomonedas compatibles | Comisión del tomador | Comisión del creador | Comisiones de extracción | Transferencia electrónica | Tarjeta de crédito | Trading API | Activo desde | Offer | |

Bybit

Contract Trading Exchanges

|

188 | 0.06% | 0.01% | 0.0005 | 2018 |

CONSIGUE HASTA $600 EN RECOMPENSAS

|

Visite | |||

KuCoin

Centralized Exchanges

|

637 | 0.10% | 0.10% | 0.0005 | 2017 |

CONSIGUE HASTA 500 USDT EN BONO POR INSCRIPCIÓN

|

Visite | |||

Coinbase

Centralized Exchanges

|

136 | 2.00% | 2.00% | 0.000079 | 2012 |

GET USD 5 SIGN-UP BONUS!

|

Visite | |||