Using Fibonacci, VWAP, and EMA Confluence in Crypto Scalping January, 2026

Learn how to combine Fibonacci retracements, VWAP, and EMAs for high-probability crypto scalping setups. Discover step-by-step strategies, examples, and tips to trade with precision.

Written by Nikolas Sargeant

Written by Nikolas Sargeant

Crypto markets are famous for their volatility, and that volatility creates an environment where short-term traders thrive. Among these traders, scalpers stand out for their focus on capturing small but frequent price moves. Unlike swing traders who hold positions for days or weeks, scalpers often enter and exit trades within minutes, sometimes even seconds, relying heavily on technical indicators to guide their decisions.

In such a fast-paced environment, accuracy matters more than anything else. One of the best ways to improve accuracy is by relying on confluence, the alignment of multiple signals pointing to the same conclusion. Instead of depending on a single indicator, scalpers look for confirmation across tools. When different indicators all suggest a similar entry or exit, the odds of success improve significantly.

Three of the most effective indicators for scalpers are Fibonacci retracements, VWAP (Volume Weighted Average Price), and EMAs (Exponential Moving Averages). Each of these tools provides unique insights: Fibonacci levels highlight potential support and resistance zones, VWAP shows the average price weighted by trading volume, and EMAs help traders track momentum and dynamic price trends. When combined, they form a powerful confluence that cuts through market noise.

This guide will break down how each of these indicators works, why confluence is essential for scalping, and how to put them together into a practical trading strategy. By the end, you’ll understand not just how to set up Fibonacci, VWAP, and EMA on your charts, but also how to interpret them in real-time to make sharper, faster trading decisions.

Understanding Crypto Scalping

Scalping is one of the most aggressive and fast-paced trading styles in crypto. Instead of holding positions for hours, days, or weeks, scalpers aim to profit from tiny price movements that occur over very short timeframes, often one to fifteen minutes. A single trade might only yield a fraction of a percent in profit, but the idea is that by repeating this process dozens of times per day, those small wins can add up to meaningful gains.

Crypto markets are particularly well-suited for scalping. Unlike traditional stock exchanges, crypto trades 24/7 with high volatility and significant liquidity on major pairs like BTC/USDT and ETH/USDT. This constant movement provides scalpers with endless opportunities to catch quick swings in price. However, the same volatility that creates opportunity also makes scalping risky, markets can turn against you in seconds if you’re not disciplined.

A typical scalper uses leverage to maximize returns from small moves, but this also increases risk exposure. For example, a trader might use 5x or 10x leverage on a one-minute chart, aiming for a 0.2%–0.5% profit per trade. With proper execution, this can be highly profitable; without discipline, it can quickly lead to account blowouts.

The key skills in scalping include:

- Precision timing: entering and exiting trades at exact moments.

- Risk management: strict stop-losses to protect against sudden reversals.

- Chart awareness: understanding short-term momentum and liquidity levels.

Because crypto markets are noisy, relying on a single indicator is rarely effective. Scalpers need confirmation from multiple tools to avoid false signals and whipsaws. This is where Fibonacci retracements, VWAP, and EMAs come into play. When used together, they provide structure in otherwise chaotic intraday markets, helping scalpers identify high-probability setups and manage trades with confidence.

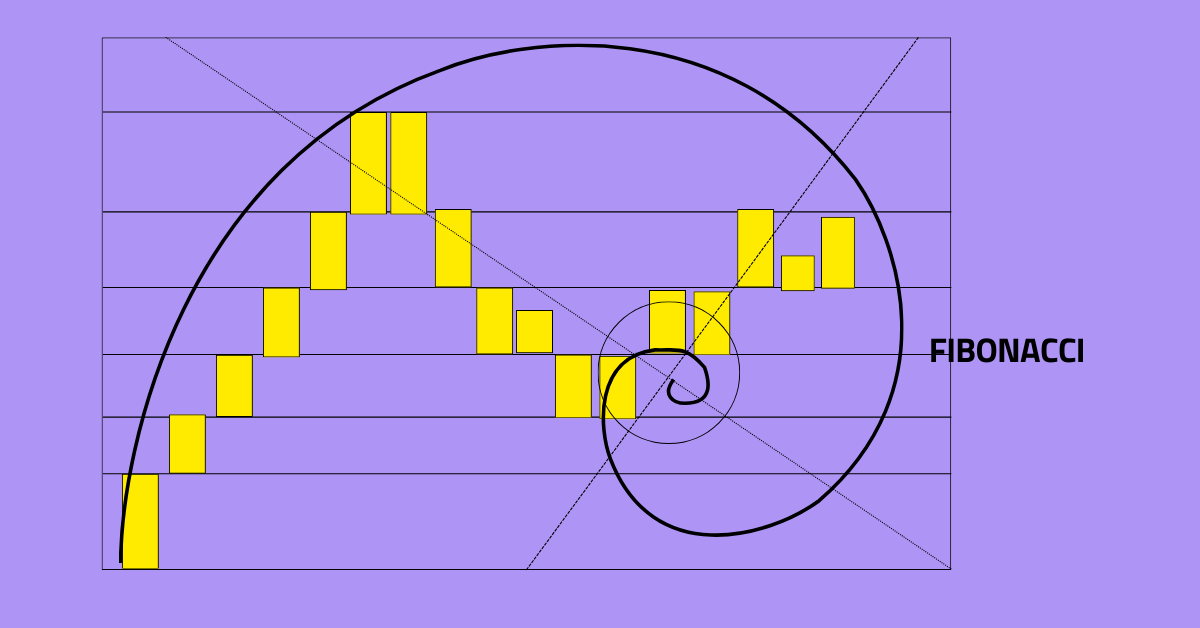

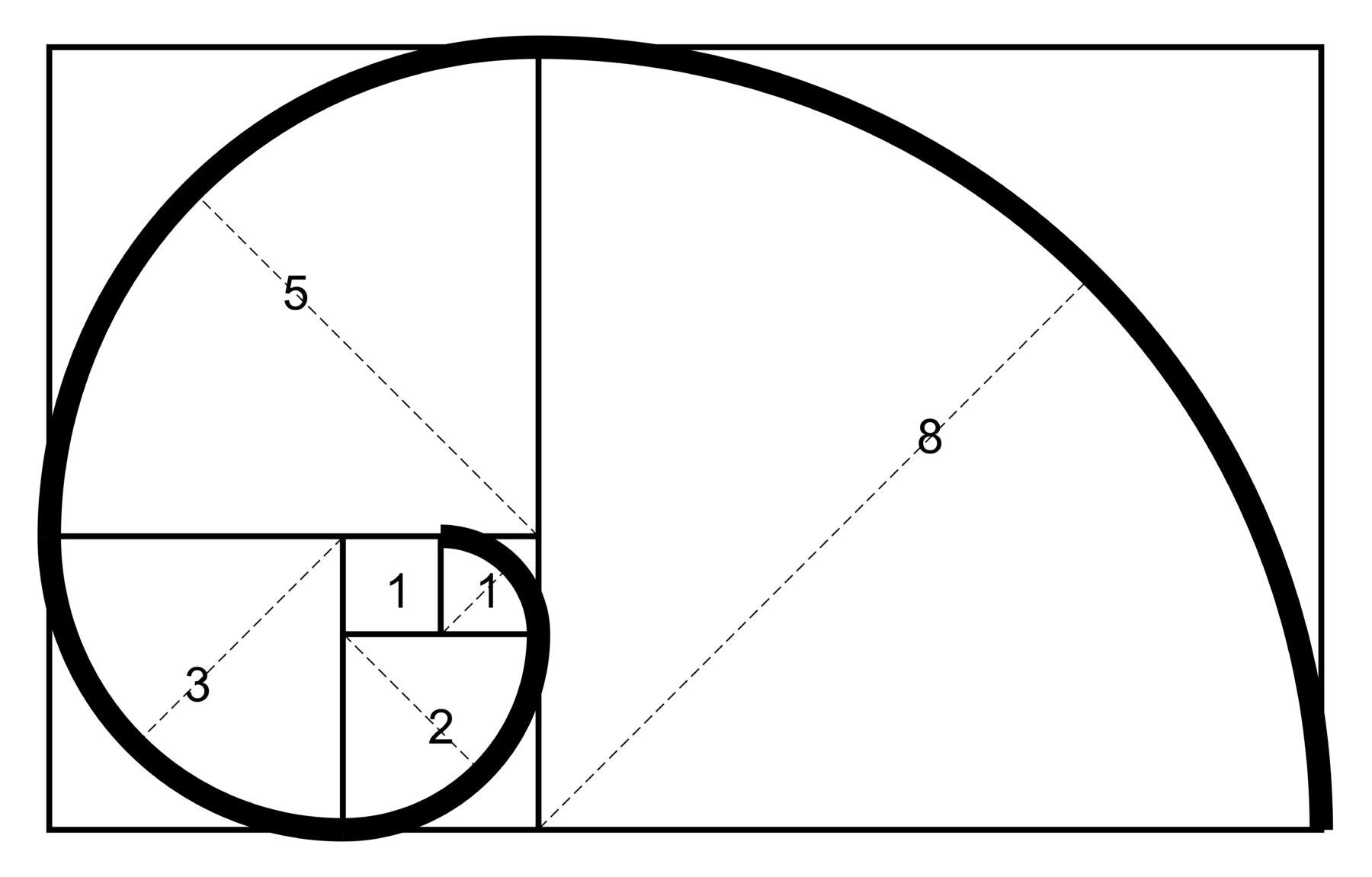

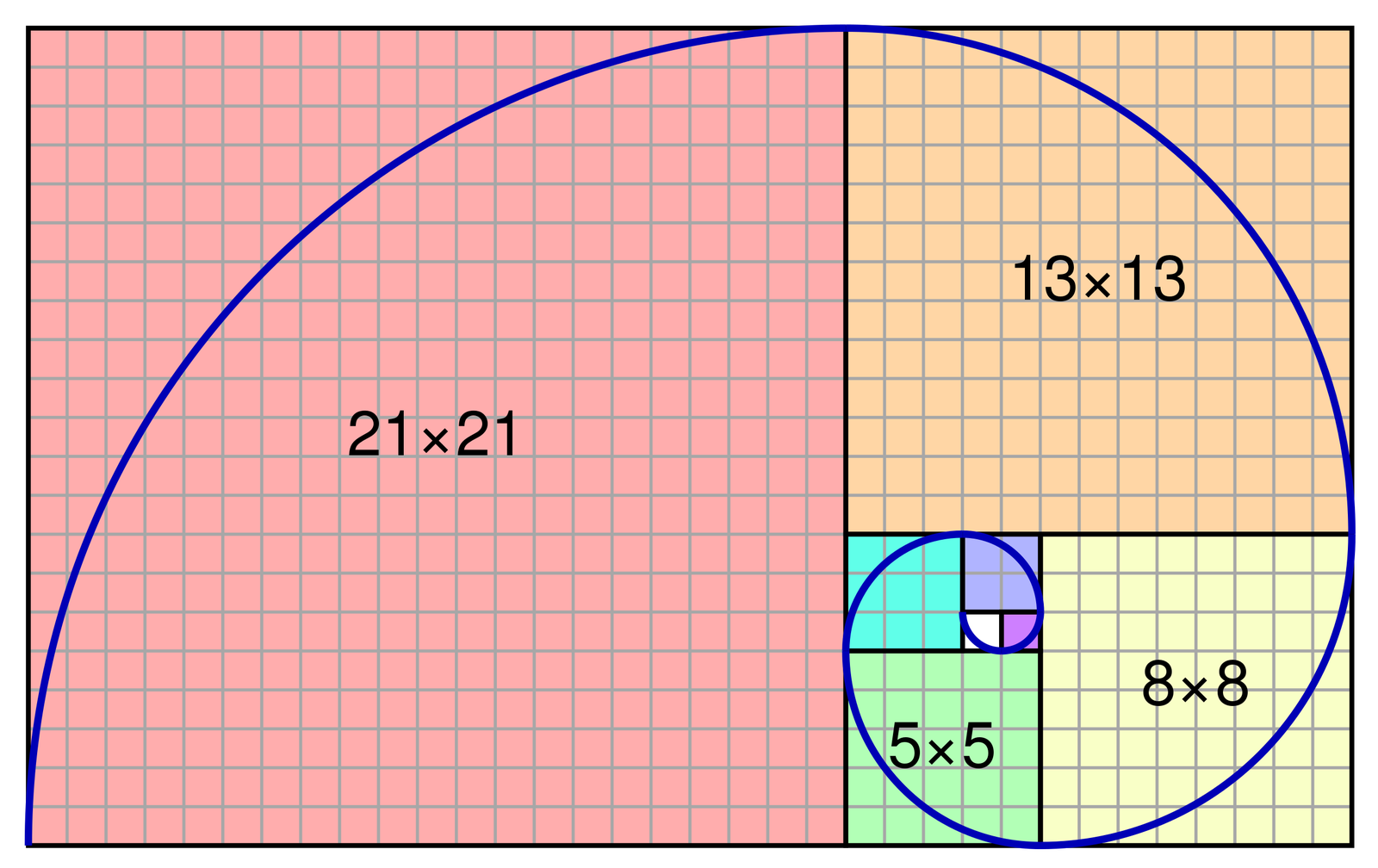

Fibonacci Retracements in Crypto

What is Fibonacci?

- Based on the famous Fibonacci sequence found in math and nature.

- In trading, it helps spot support and resistance zones during a trend.

- Works by dividing a price move (swing high to swing low) into key ratios.

Key Levels to Know

Traders mostly watch these levels:

- 0.382 (38.2%) – shallow pullback, signals strong trend continuation.

- 0.5 (50%) – not an official Fibonacci number, but widely used.

- 0.618 (61.8%) – the “golden ratio,” a major level for reversals.

Why It Matters in Crypto Scalping

- Crypto is fast and volatile, so scalpers need precise entry zones.

- Fibonacci gives clear levels to watch for bounces or rejections.

- Example: BTC rallies, then pulls back to the 0.618 Fib. If it holds and bounces, scalpers can enter with tight stop-losses.

Practical Scalping Tips with Fibonacci

- Identify the swing high and swing low on the 1m, 5m, or 15m chart.

- Plot Fibonacci retracement levels between them.

- Watch how price reacts around 0.382, 0.5, and 0.618.

- Look for confirmation from VWAP or EMA before entering.

Key Takeaway: Fibonacci retracements are not magic. They work best because many traders watch the same levels. In scalping, using Fib with VWAP and EMA turns potential noise into structured opportunities.

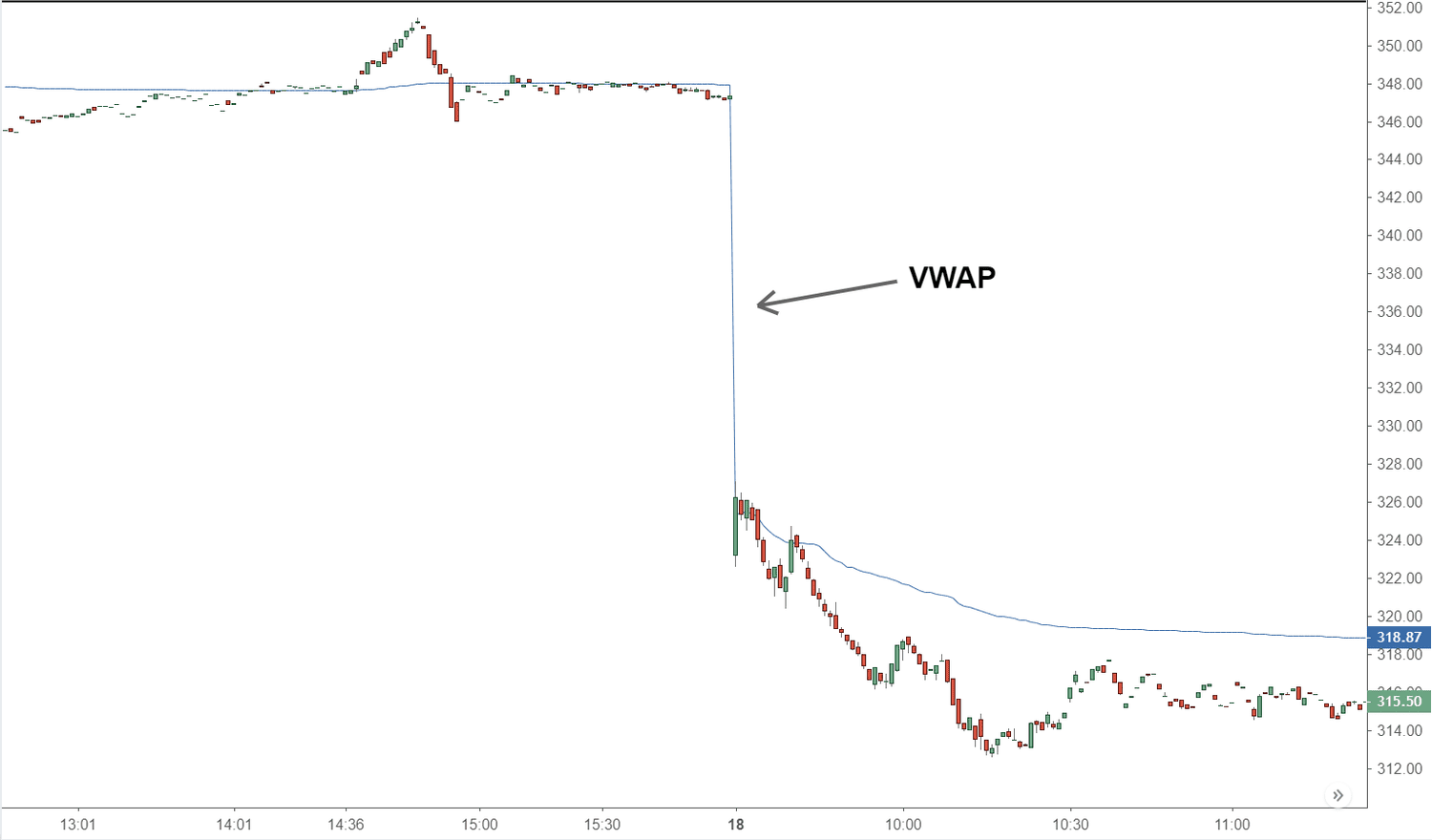

VWAP (Volume Weighted Average Price)

VWAP stands for Volume Weighted Average Price. It shows the average price of an asset, weighted by trading volume, over a specific period. Instead of just tracking price, it tells you the true average traders are paying.

On most charting platforms, VWAP appears as a single line that resets each day or session. Since crypto trades 24/7, many traders customize it to daily or weekly sessions depending on their strategy.

Why VWAP Matters for Scalpers

- Trend Bias: If price is above VWAP → bullish momentum. Below VWAP → bearish pressure.

- Fair Value: Helps you see whether price is “expensive” or “cheap” relative to traded volume.

- Dynamic Support/Resistance: VWAP often acts as a magnet where price consolidates or reverses.

Example in Action

Imagine ETH on the 5-minute chart:

- Price rallies up to VWAP, stalls, and starts pulling back.

→ A scalper might short with stop-loss just above VWAP. - Price dips to VWAP during an uptrend, bounces, and pushes higher.

→ A scalper might go long, targeting the next resistance level.

VWAP vs. Moving Averages

-

Similarities: Both show the average price over time.you

-

Difference: Moving averages use only price data, while VWAP factors in volume, making it more responsive to heavy buying or selling activity.

Quick Scalping Tips

- Use VWAP on short timeframes (1m, 5m) to guide trend direction.

- Treat it as a “line in the sand”: above VWAP = long bias, below = short bias.

- Don’t use VWAP alone. Combine with Fibonacci or EMA to confirm entries.

Key Takeaway: VWAP helps scalpers align trades with institutional flows and fair value. It’s most powerful when paired with other indicators instead of being used on its own.

Exponential Moving Averages (EMA)

Exponential Moving Averages, or EMAs, are one of the most popular tools in short-term trading. Unlike a Simple Moving Average (SMA), which gives equal weight to all prices in the calculation, the EMA puts more emphasis on recent data. This makes it faster and more responsive to sudden market moves, which is exactly what scalpers need.

How EMAs Work for Scalpers

- Momentum Tracking: A rising EMA shows bullish momentum, while a falling EMA signals bearish pressure.

- Dynamic Support/Resistance: Price often “respects” EMAs by bouncing off them during trends.

- Crossovers: A faster EMA (like the 9) crossing above a slower EMA (like the 21) can signal trend shifts.

Common EMA Settings

- 9 EMA: Extremely responsive, used for pinpointing quick scalps.

- 21 EMA: Balances reactivity and reliability, good for confirming trend direction.

- 50/200 EMA: More for higher timeframes, but still useful to understand the bigger picture.

Example: If BTC is above the 200 EMA on the 1-hour chart, a scalper on the 1-minute chart may prefer long setups to trade in line with the macro trend.

Practical Scalping Example

- ETH is in a strong uptrend on the 5-minute chart.

- Price dips back toward the 9 EMA and quickly bounces.

- Scalpers enter long at the bounce, with stop-loss just below the EMA.

This creates a simple, repeatable setup without guessing.

Quick Tips for EMA Scalping

- Use a fast EMA (9) for entries and a slower EMA (21 or 50) for confirmation.

- Watch for EMA bounces during trending markets.

- Avoid relying only on EMA crossovers in sideways or choppy conditions.

- Combine EMAs with VWAP or Fibonacci to confirm signals before entering.

Key Takeaway: EMAs help scalpers stay aligned with short-term momentum. Their real power comes from combining them with VWAP and Fibonacci, where multiple signals overlap.

Why Confluence Matters in Scalping

Scalping crypto is fast, intense, and often chaotic. On short timeframes, the market produces a lot of false signals. If you trade based on just one indicator, you risk getting caught in whipsaws and fakeouts. This is where confluence comes in.

Confluence simply means using multiple indicators or signals that align in the same direction. The more tools pointing to the same decision, the higher the probability of success.

Why Confluence Works

- Filters Noise: Reduces the number of false entries common on 1m and 5m charts.

- Boosts Confidence: Knowing multiple tools agree makes it easier to pull the trigger.

- Market Psychology: Many traders spot the same overlapping levels, so their actions reinforce the move.

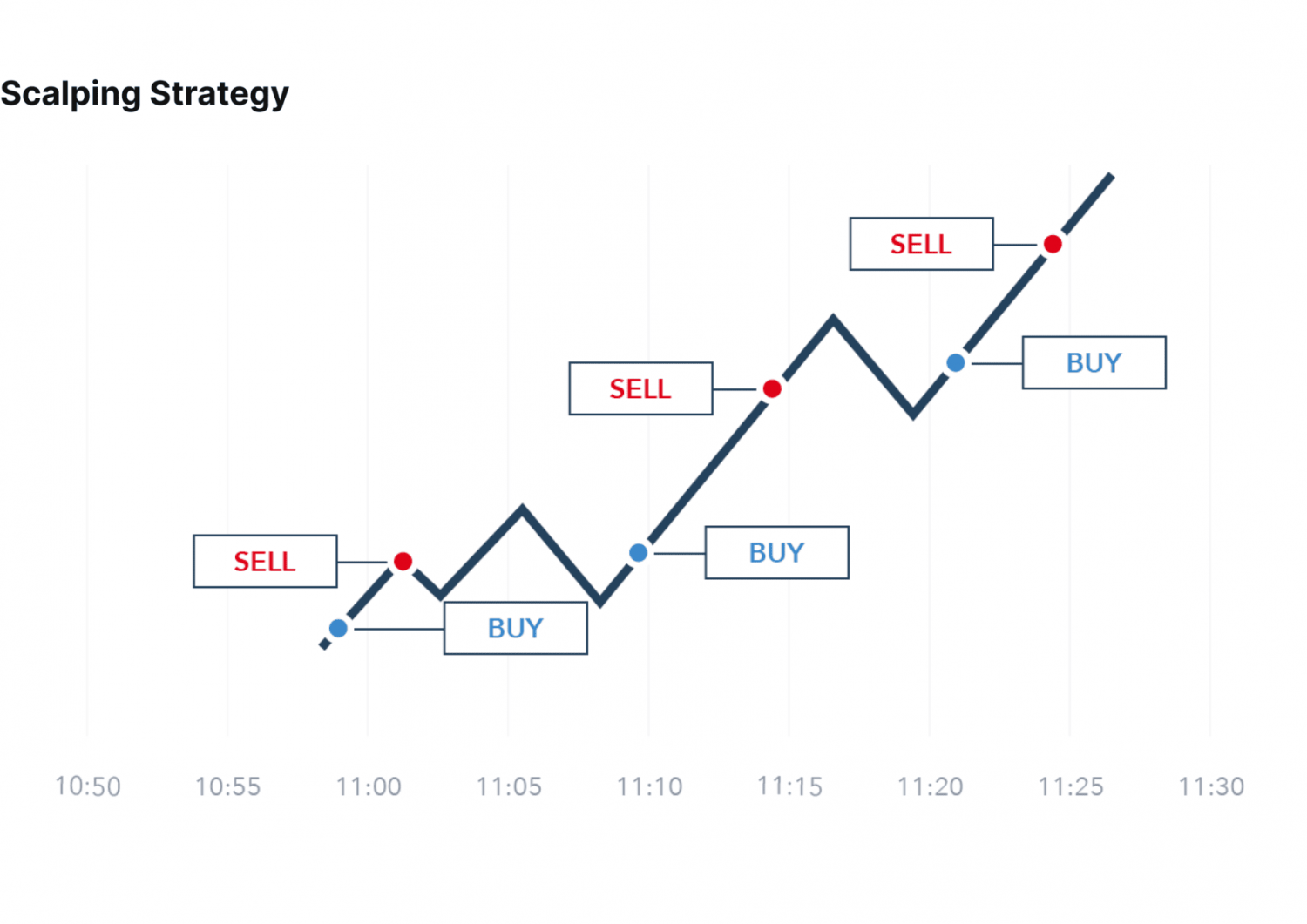

Example of Confluence in Action

Imagine BTC on the 5-minute chart:

- Price retraces to the 0.618 Fibonacci level.

- At the same time, VWAP is sitting in the same zone.

- The 21 EMA is rising right into that level as well.

Now you don’t just have a Fib level. You have three signals stacked together. This dramatically increases the chance of a bounce and makes for a high-probability scalp entry.

Confluence vs. Single Indicator Trading

- Single Indicator: Entering a trade just because price touched the 9 EMA. Often unreliable, especially in sideways markets.

- Confluence Setup: Waiting until price touches the 9 EMA and aligns with a Fibonacci level and confirms at VWAP.

The difference is quality over quantity. Scalpers who use confluence take fewer trades but win more often.

Quick Guidelines for Scalpers

- Always wait for at least two signals to align.

- Focus on overlaps of Fib + VWAP + EMA rather than just one tool.

- Be patient. In scalping, discipline beats speed when it comes to consistent profitability.

Key Takeaway: Confluence doesn’t guarantee wins, but it stacks the odds in your favor. In a high-speed environment like crypto scalping, that edge can mean the difference between steady profits and constant losses.

Building a Scalping Strategy with Fibonacci, VWAP, and EMA

Now that we’ve covered the tools and why confluence matters, let’s put it all together. Below is a step-by-step process to build a scalping strategy that uses Fibonacci retracements, VWAP, and EMAs in harmony.

Setting Up the Chart

Before you can trade, you need the right environment.

Recommended platforms:

- TradingView: Excellent for charting, custom indicators, and Fib drawing tools.

- Exchange charts (Binance, Bybit, OKX): Faster execution, but less flexibility for analysis.

Best timeframes for scalping:

- 1-minute (1m): Ultra-fast moves, requires high focus.

- 5-minute (5m): Most common for scalpers, balances speed and clarity.

- 15-minute (15m): Used to confirm broader intraday trend.

Setup tips:

- Add VWAP to your chart. Reset it daily for consistency.

- Add two EMAs, typically the 9 and 21.

- Keep the Fibonacci retracement tool ready to plot swings.

- Keep your chart clean. Avoid stacking unnecessary indicators.

Goal: Your chart should give you a quick “at-a-glance” sense of where the market is relative to VWAP, EMAs, and key Fib levels.

Entry Signals

Scalpers succeed by entering only at high-probability zones. This is where confluence shines.

Steps to find an entry:

- Identify the short-term trend. Is price generally trending up or down?

- Use the Fib tool to measure a swing high to swing low (in a downtrend) or swing low to swing high (in an uptrend).

- Wait for price to retrace into a Fib level (0.382, 0.5, or 0.618).

- Check where VWAP is. If it lines up with that Fib level, confidence increases.

- Confirm momentum with EMAs.

-

-

In an uptrend, price should hold above the 9/21 EMAs.

-

In a downtrend, price should respect EMAs as resistance.

-

Example:

- BTC is trending up on the 5m chart.

- Price pulls back to the 0.618 Fib.

- VWAP is sitting right at that same level.

- The 21 EMA is rising into that zone.

Result: This is a strong long entry. Stop-loss goes just below the Fib level or EMA support.

Exit Strategy & Risk Management

Good scalpers focus as much on exits as entries.

Profit Targets:

- Use the next Fibonacci level as your first target.

- Alternatively, look at recent highs/lows or key intraday levels.

- Some scalpers trail profits using VWAP or EMA.

Stop-Loss Placement:

- Place it just below EMA support in longs or just above EMA resistance in shorts.

- Never risk more than 1–2% of your capital per trade.

Risk-to-Reward (R:R):

-

Aim for at least 1:1.5 or 1:2. Even if you only win 50% of trades, you’ll still be profitable.

Scalping isn’t about hitting home runs. It’s about stacking small, consistent wins while protecting your downside.

Backtesting & Refinement

No strategy should be traded live without testing. Backtesting helps you see if the method works over many trades.

Steps to backtest:

- Open historical charts on TradingView.

- Pick a period (last 1–3 months) and apply your Fib + VWAP + EMA setup.

- “Replay” the chart bar by bar and mark where confluence occurs.

- Record win/loss ratio, average profit, and risk-to-reward.

Tips for refinement:

- Adjust EMA lengths (some prefer 8/20 instead of 9/21).

- Test different VWAP resets (daily vs. session-based).

- Try Fib extensions as profit targets in strong trends.

Practice Mode:

- Use demo accounts or small position sizes before scaling up.

- Real money introduces emotion, so start small until you’re consistent.

Backtesting + practice ensures you’re trading a proven edge instead of guessing.

Section Summary

- Chart setup: Clean and simple with Fib, VWAP, and EMAs.

- Entries: Wait for confluence at key retracement levels.

- Exits: Use Fib levels, VWAP, or EMA as guides.

- Risk Management: Stick to small, consistent wins.

- Backtesting: Prove your edge before risking capital.

Practical Examples & Case Studies

Theory is great, but nothing beats seeing confluence in action. Below are two practical case studies showing how Fibonacci, VWAP, and EMA can work together in real crypto scalping scenarios.

Case Study 1: BTC Long Setup on the 5-Minute Chart

Market Context:

- Bitcoin was trending upward during a high-volume session.

- Overall bias was bullish, supported by higher timeframe momentum.

Step-by-Step:

- BTC rallied from $28,500 to $29,200 on the 5m chart.

- A retracement began, and the 0.618 Fibonacci level lined up at $28,850.

- VWAP for the day was also sitting at $28,850.

- The 21 EMA was rising right into that same level.

Trade Execution:

- Entry: Long at $28,850 confluence zone.

- Stop-loss: $28,780 (just below Fib and EMA).

- Target: $29,150 (prior high and Fib extension level).

Result:

- Trade hit target within 20 minutes.

- Risk-to-reward: 1:2.

- A textbook example of how confluence sharpens precision.

Case Study 2: ETH Short Setup on the 1-Minute Chart

Market Context:

- Ethereum showed choppy action with a downward bias.

- Scalpers looked for short entries rather than longs.

Step-by-Step:

- ETH bounced to $1,720, right into the 0.5 Fibonacci retracement.

- VWAP was sloping down and positioned exactly at $1,720.

- The 9 EMA crossed below the 21 EMA moments before price touched VWAP.

Trade Execution:

- Entry: Short at $1,720.

- Stop-loss: $1,728 (above VWAP and Fib).

- Target: $1,700 (psychological round number and recent low).

Result:

- Price dropped quickly to $1,702, nearly hitting target.

- Partial profits taken at $1,705, stop moved to breakeven.

- Final exit: $1,700 level for a full scalp win.

Lessons from These Examples

- Patience pays: Both setups required waiting for all three signals to align.

- Tight stops are critical: With scalping, a few dollars can be the difference between profit and loss.

- Confluence builds conviction: Instead of guessing, you’re stacking probabilities in your favor.

Key Takeaway: Real market examples show that Fibonacci, VWAP, and EMA are powerful on their own, but combined, they create precise trade zones that scalpers can trust.

Common Mistakes and How to Avoid Them

Even with a strong strategy, scalpers often fall into traps that cost them money. Here are the most common mistakes and how to avoid them.

1. Overloading the Chart

- Mistake: Adding too many indicators and signals.

- Why it hurts: Creates analysis paralysis and conflicting signals.

- Fix: Stick to the core trio (Fibonacci, VWAP, EMA). Keep the chart clean.

2. Ignoring Market Context

- Mistake: Trading signals without considering news, liquidity, or overall market conditions.

- Example: Entering a scalp long right before a major Fed announcement.

- Fix: Always check the news calendar and higher timeframe trend before scalping.

3. Overtrading

- Mistake: Taking every setup you see, even low-quality ones.

- Why it hurts: Fees add up quickly in scalping, eating profits.

- Fix: Wait for true confluence. Fewer, higher-probability trades beat random entries.

4. Poor Risk Management

- Mistake: Trading with wide stops or risking too much per position.

- Result: One bad trade can wipe out a day’s worth of small wins.

- Fix: Use tight stop-losses and risk only 1–2% per trade.

Key Takeaway: Most scalpers fail not because of bad strategies, but because of bad habits. Focus on clean charts, patience, and strict risk control to avoid these pitfalls.

Advanced Tips for Scalpers

Once you master the basics of Fibonacci, VWAP, and EMAs, you can take your scalping to the next level with a few advanced tweaks.

1. Pair Confluence with Order Flow

- Watch order book data and trade volume alongside your indicators.

- If a Fib + VWAP level aligns with large buy orders, that zone becomes even stronger.

2. Use Volume Profile

- Volume Profile highlights where most trading activity occurred within a price range.

- If high-volume nodes line up with Fib or EMA levels, expect strong reactions.

3. Multi-Timeframe Confirmation

- Don’t just scalp off the 1m or 5m.

- Check the 15m or 1h chart first to confirm trend direction.

- Example: Only scalp long on 1m charts if the 1h chart is above the 200 EMA.

4. Know When to Stand Aside

- Not every moment is ideal for scalping.

- Avoid trading during extremely low volatility or right before major announcements.

- Sometimes the best trade is no trade.

Key Takeaway: Advanced scalpers don’t just rely on indicators. They combine confluence with order flow, volume insights, and higher timeframe awareness to refine entries and avoid unnecessary risks.

Putting It All Together

Scalping crypto is one of the fastest ways to trade, but also one of the toughest. The difference between success and frustration often comes down to having structure. That’s exactly what the combination of Fibonacci retracements, VWAP, and EMAs provides.

Each tool has its own strengths:

- Fibonacci highlights where price may pause or reverse.

- VWAP shows fair value and institutional flow.

- EMAs reveal momentum and dynamic support or resistance.

On their own, these indicators can produce false signals. But when they align, they create powerful confluence zones where probabilities shift in your favor. Add risk management, patience, and practice, and you have the foundations of a scalping system that can thrive in volatile crypto markets.

The key is discipline. Don’t chase every move. Wait for the right setups where multiple signals overlap, trade small, and build consistency first. Over time, those small, repeated wins will do far more for your account than random guesses.

Crypto scalping isn’t about speed alone, it’s about precision. And with Fibonacci, VWAP, and EMA working together, you’ll have the tools to trade with confidence instead of luck.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!