VDollar Exchange

Taxas da Bolsa

Métodos de Depósitos

Criptos Suportadas (23)

UPDATE 23 March 2023: When trying to access the website of VDollar Exchange today, we were unsuccessful. As far as we know, there have been no preceding messages on system maintenance or new websites or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

VDollar Exchange Review

What is VDollar Exchange?

VDollar Exchange was launched in July 2021 and is registered in Colorado, USA. Additionally, the exchange is also registered as an MSB (Money Services Business). In simple terms, it is a qualified entity for providing currency conversion and money transfer services. The platform supports exchange trading, margin trading, OTC trading, Swaps (includes coin-margined swaps and USDT-margined swaps), contract trading (with and without expiry dates) and functions as a P2P marketplace. Users can also make use of the platform’s stop loss and take profit features.

Trading Mining Mechanism

VDollar uses a trading mining mechanism on its platform. All transaction fees generated are parked in the URP or USDT Reserve Pool. All coin holders have a stake in this reserve pool along with a public on-chain address. VDollar’s native digital currency — VDollar, is pegged to this pool. The platform will follow through with an IPO in future, with an issuance upper limit fixed at 10 million, which corresponds to the URP at a 1:1 ratio. The first issuance phase will be for 4.5 million and each successive issue will be halved i.e. 2.25 million in the second phase and 1.125 million in the third. This also means that with each having, the value of the VDollar keeps increasing in terms of USDT. So if the VDollar is pegged at 1 USDT fee in Phase 1, it doubles to 2 USDT fees in the second phase.

Supported Cryptos

Currently, the VDollar Exchange supports 25 currencies which includes major cryptos like Bitcoin, Ethereum, Dogecoin, Ripple, Linkcoin, Bitcoin Cash, Ethereum Classic, Litecoin, Tron, EOS token, and others. Since it is an up and coming exchange, we are expecting this list could grow substantially over time.

Leveraged Trading

VDollar Exchange also offers leveraged trading to its users. They offer both futures with expiry dates as well as perpetuals (i.e., futures without expiry dates). However, the portal doesn’t support leverage trading on futures with expiry dates. A word of caution might be useful for someone contemplating leveraged trading. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value by 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk-free profits).

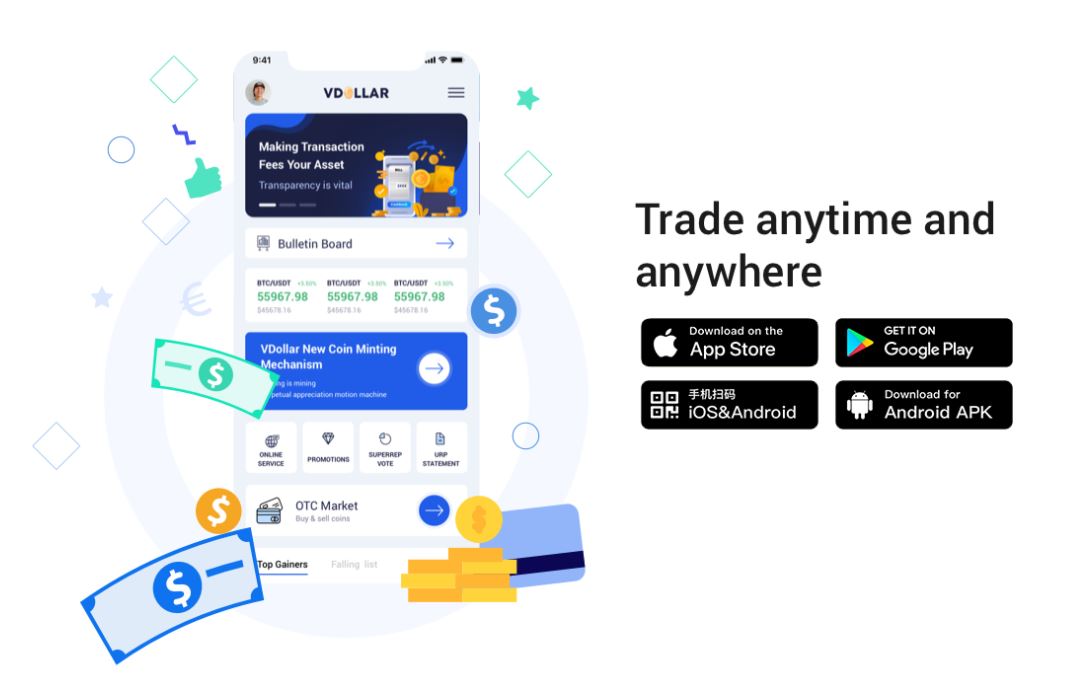

Mobile Support

Most crypto traders feel that desktops give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that VDollar Exchanges’ trading platform is also available as a dedicated mobile app for both iPhone and Android platforms.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is that the US does not allow foreign companies to solicit US investors unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

According to information we have received, US investors are indeed permitted to trade at VDollar Exchange. After all, VDollar is a registered American MSB. Any US investors should however also form their own opinion on this, as various state rules could also be an obstacle in their cryptocurrency trading.

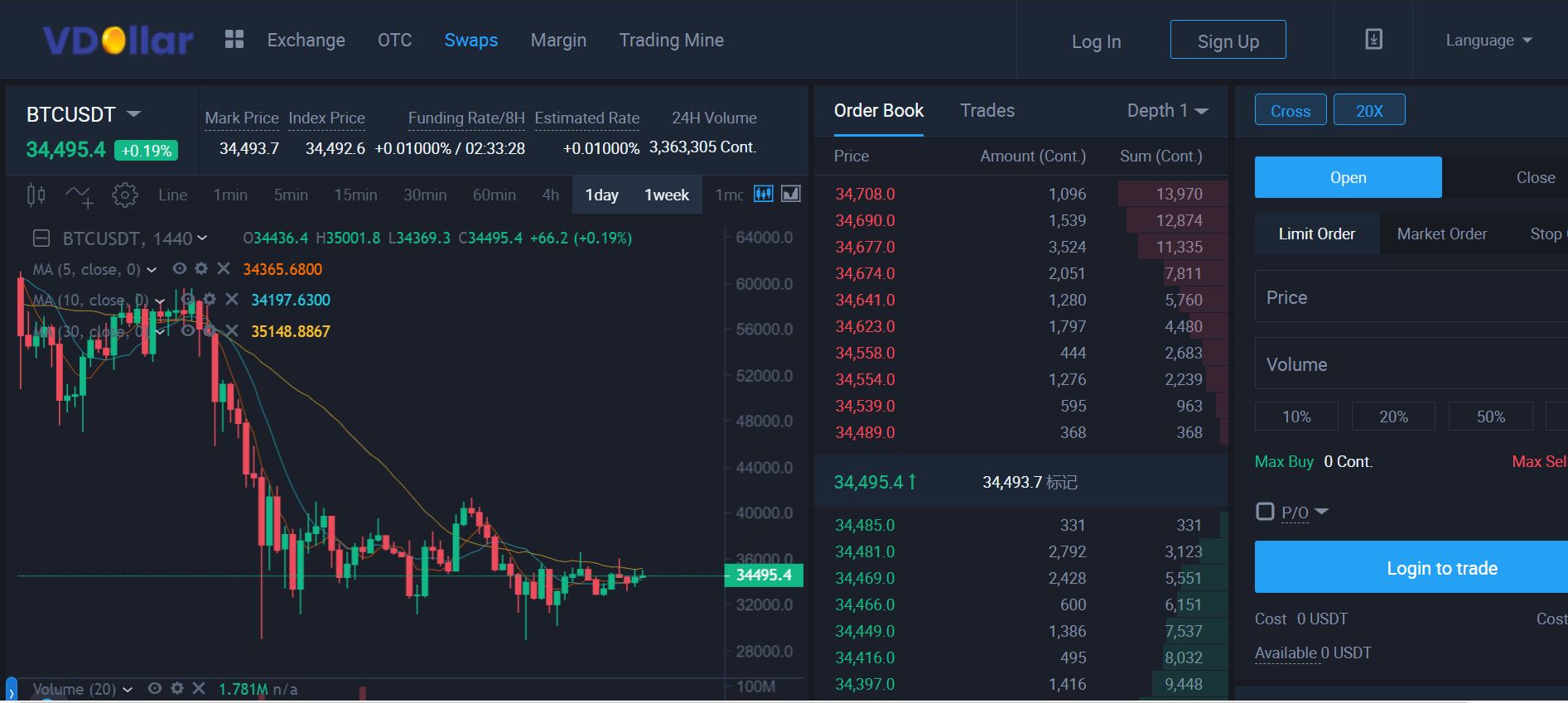

VDollar Exchange Trading Interface

Every trading platform has a trading interface. This interface is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in one holistic interface on your desktop. There are of course also variations to what we have now described. This is a screengrab from VDollar’s exchange interface, OTC interface and Swap interface:

VDollar Exchange Trading Interface

VDollar OTC Trading Interface

VDollar Swap Trading Interface

It is up to you – and only you – to decide if the above trading interface is suitable for you. Finally, there are usually many different ways in which you can change the settings to tailor the trading interface after your very own preferences.

VDollar Exchange Fees

VDollar Exchange Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the ones who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

VDollar Exchange charges what we call flat fees on exchange or margin transactions, meaning that both the takers and the makers pay the same fee i.e. 0.20%. However, this fee rate does not account for volume-based discounts. This fee rate is pretty much in line with the global industry averages for centralized exchanges.

As far as swap transactions go, VDollar levies 0.06% fee for Makers and 0.04% for Takers, whereas OTC transactions are temporarily free.

VDollar Exchange Withdrawal fees

Withdrawal fees are usually fixed and vary from one crypto to another. If you withdraw BTC, you pay a small amount of BTC for the withdrawal. If you withdraw ETH, you pay ETH. When we conducted our quarterly empirical study for Q3 2021 which includes the BTC-withdrawal fees in the crypto exchange market, we found that the average BTC-withdrawal fee was 0.00053 BTC per BTC-withdrawal.

VDollar Exchange charges a withdrawal fee as per industry practice and earmarks them to be used for handling miner’s expenses. Any withdrawal fees collected has no role to play in transaction mining.

Deposit Methods

VDollar offers wire transfer as a deposit method, but you can’t deposit via credit card. This of course negative news to you if you would prefer to use your credit card for any reason. Just like many other exchanges, VDollar does not charge you any fees for deposits.