Trade8

Comisiones de intercambio

Métodos de depósito

Criptomonedas compatibles (12)

Trade8 Review

What is Trade8?

Trade8 is an exchange from Singapore that launched in 2016.

Trade8 is a so called derivatives exchange, meaning that they focus on derivatives trading. A derivative is an instrument priced based on the value of another asset (normally stocks, bonds, commodities etc). In the cryptocurrency world, derivatives accordingly derive its values from the prices of specific cryptocurrencies. You can engage in derivatives trading connected to the following cryptos here: BTC, ETH, BCH, LTC, NEO, TRX, XRP, NANO, EOS, DASH, XLM, ADA and ETC.

Forex Also Possible

To can also trade non-crypto markets here (Forex, etc.), but then you must be a "professional status investor" and justify this upon account opening.

Trade8 Advantages

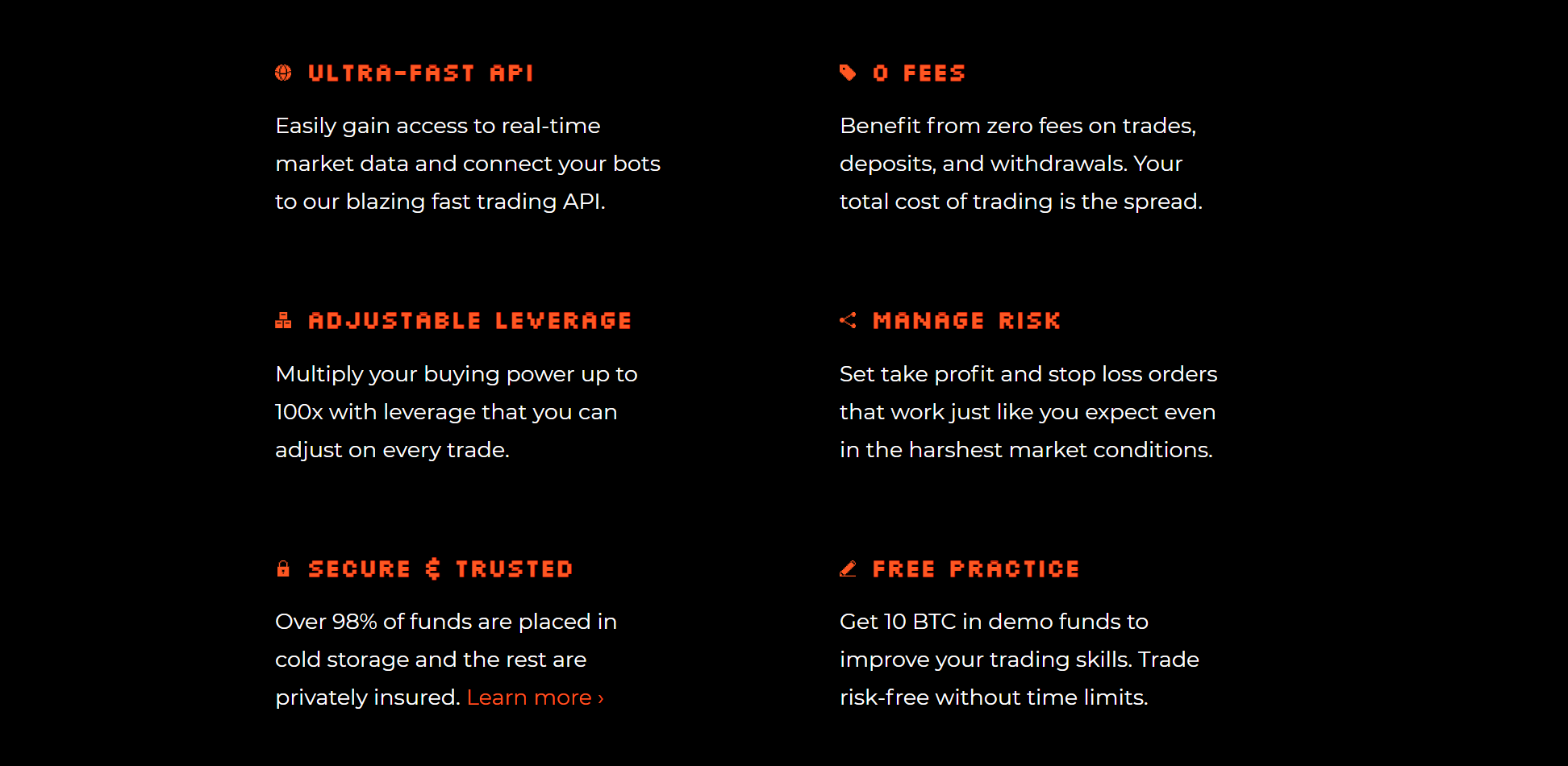

Trade8 explicitly mentions six advantages with their platform on their website. Among other things, they state that they have an ultra-fast API, adjustable leverage, that you can use take profit and stop loss-orders. They also highlight that you can use a demo version of the platform to practice, and that 98% of their funds is palced in cold storage. We think that these factors are all "nice to haves" at a crypto trading platform, but it's ultimately up to you to decide how important they are to your own trading.

Leveraged Trading

At Trade 8, you can also use leverage on your trades. Maximum leverage on crypto contracts is 20x and on non-crypto contracts 300x. There are however risks involved with leveraged trading.

For instance, let’s say that you have 100 USD in your trading account and you bet this amount on BTC going long (i.e., going up in value). If BTC then increases in value with 10%, you would have earned 10 USD. If you had used 100x leverage, your initial 100 USD position becomes a 10,000 USD position so you instead earn an extra 1,000 USD (990 USD more than if you had not leveraged your deal). However, the more leverage you use, the smaller the distance to your liquidation price becomes. This means that if the price of BTC moves in the opposite direction (goes down for this example), then it only needs to go down a very small percentage for you to lose the entire 100 USD you started with. Again, the more leverage you use, the smaller the opposite price movement needs to be for you to lose your investment. So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

Trade8 Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at Trade8:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Trade8 Fees

Trade8 Trading fees

Every time you place an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. Many exchanges divide between takers and makers. Takers are the ones who “take” an existing order from the order book. Makers are the ones who add orders to the order book, thereby making liquidity at the platform.

In a recent announcement, Trade8 announced that it will no longer charge trading fees for opening or closing a position. However, open positions on the exchange might attract decay.

Trade8 Withdrawal fees

Trade8 charges a withdrawal fee of 0.001 BTC per BTC-withdrawal. This fee is a bit above the global industry average. The current global industry average is around 0.00053 BTC per BTC-withdrawal.

Deposit Methods and US-investors

Deposit Methods

In order to trade here, you must have cryptocurrency to begin with. The only asset class you can deposit to Trade8 is cryptocurrency. However, if you really like Trade8 but you don’t have any crypto yet, you can easily start an account with an exchange that has “fiat on-ramps” (an exchange where you can deposit regular cash), buy crypto there, and then transfer it from such exchange to this exchange. Use our Exchange Filters to easily see which platforms that allow wire transfer or credit card deposits.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

Trade8 does not allow US-investors on its exchange. Investors from Australia, Burma, Canada, Congo, Crimea, Cuba, Hong Kong, Ivory Coast, Liberia, North Korea, Sevastopol, Singapore, Sudan, Switzerland, Syria or Zimbabwe are'nt welcome either. So if you’re from any of those countries and would like to engage in crypto trading, you will have to look elsewhere.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!