Ternion

Comisiones de intercambio

Métodos de depósito

Criptomonedas compatibles (12)

UPDATE 14 December 2020: The exchange sent an email today to all of its users with the following contents:

Dear Ternion Exchange Client,

We inform you that Ternion Exchange activities will stop on 1.01.2021.

Please withdraw your funds via crypto withdrawal methods till this date.

Ternion Exchange Team

Ternion Review

Ternion is an exchange from Estonia with an exchange license from the Estonian authorities.

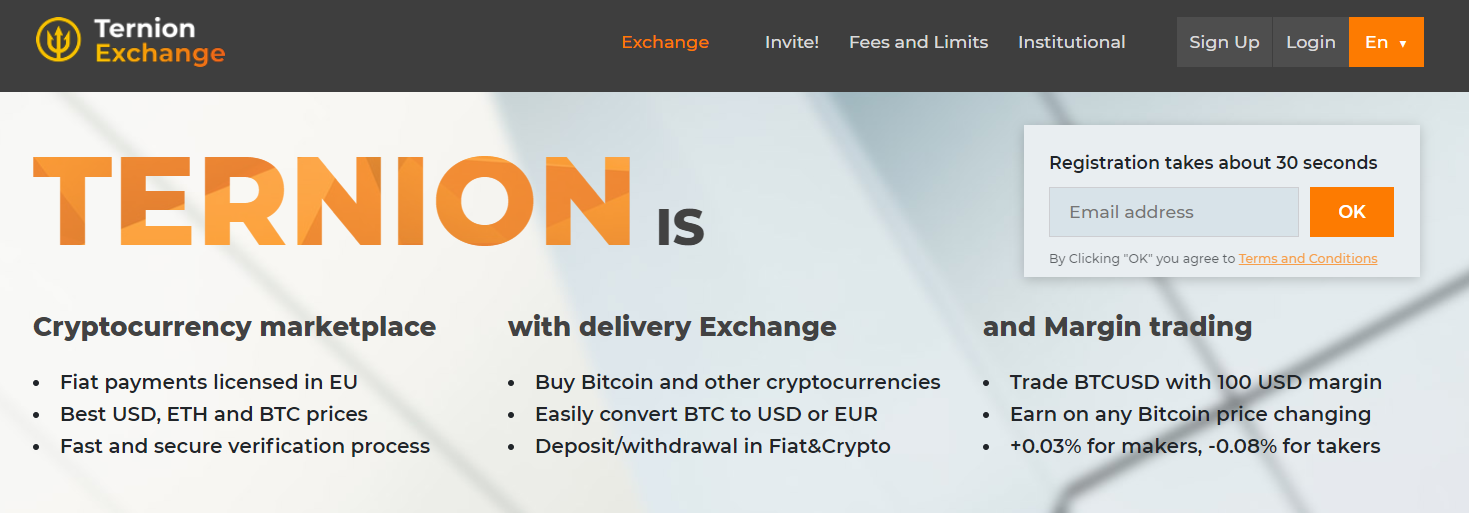

So what is Ternion? According to the below picture, Ternion is, among many other things, the licensed platform that has the best USD, ETH and BTC prices and a fast and secure verification process. These are some very strong statements indeed, and it remains to be seen whether they will show to be true or not.

US-investors

Ternion does not allow US-investors on its exchange. But if you’re from the US and you’re looking for an exchange that is just right for you, don’t worry. Use our Exchange Finder to find the right trading platform for you.

Margin Trading

Ternion offers leveraged trading on its trading platform. This means that you can receive a higher exposure towards a certain cryptocurrency’s price increase or decrease, without having the assets necessary. You do this by “leveraging” your trade, which in simple terms essentially means that you borrow from the exchange to bet more.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, the balance between risk and reward in leveraged deals is quite fine-tuned (there are no risk free profits).

Ternion Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen crypto and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. The below is a picture of the trading view at Ternion:

Ternion Fees

Ternion Trading fees

Every trade occurs between two parties: the maker, whose order exists on the order book prior to the trade, and the taker, who places the order that matches (or “takes”) the maker’s order. We call makers for “makers” as their orders make the liquidity in a market. Takers are the ones who “take” this liquidity by matching makers’ orders with their own.

At Ternion, takers pay only 0.08%. Makers on the other hand, get paid to trade (negative trading fees, -0.03%). Most often when platforms have negative trading fees, it is part of a campaign somehow and will later be replaced with regular trading fees. We’ll have to wait and see if this is the case also with Ternion. It is at least not marketed only as a campaign.

To clarify how this works, let’s say that you are the maker in an order where you purchase cryptocurrency for USD 1,000 at Ternion. This means that instead of paying USD 1,000, you will only have to pay USD 997. This is a very competitive trait indeed.

Ternion Withdrawal fees

Over to the withdrawal fees then. These are also very important to consider. When withdrawing BTC, the exchange charges you only 0.0004 BTC. This withdrawal fee is also far below the industry average (roughly half of the industry average).

All in all, the fees charged at this exchange is a competitive advantage against other exchanges out there today.

Deposit Methods

At this trading platform, you can deposit through both wire transfer and credit cards. This can be very helpful for newer crypto investors. The fact that fiat currency deposits are OK at all also makes this exchange an “entry-level exchange”, meaning an exchange where new crypto investors can take their first steps into the thrilling crypto world.