IG Markets Crypto

Taxas da Bolsa

Métodos de Depósitos

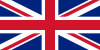

Criptos Suportadas (7)

IG Markets Review

What is IG Markets Crypto?

IG Markets is a very big player in the trading world. It is also the oldest platform we list on our site, seeing as it was originally launched in 1974. Obviously, there weren't any crypto trading available back then, but still.

The platform has its main offices in London, United Kingdom.

The platform is a so called derivatives platform, meaning that they focus on derivatives trading, or more specifically "CFDs". A derivative is an instrument priced based on the value of another asset (normally stocks, bonds, commodities etc). In the cryptocurrency world, derivatives accordingly derive its values from the prices of specific cryptocurrencies.

Supported CFD Contracts

IG Markets's crypto division offers trading in the following crypto related contracts: Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Stellar, NEO and EOS.

As is evident from the above picture, the platform only offers trading through CFD-contracts in the more well-known cryptos here.

US-investors

As far as we know, IG Markets does not allow US-investors to trade on the platform. So, if you’re from the US and would like to engage in crypto trading, you will have to look elsewhere. Luckily for you, if you go to the Exchange List and use our exchange filters, you can sort the exchanges based on whether or not they accept US-investors.

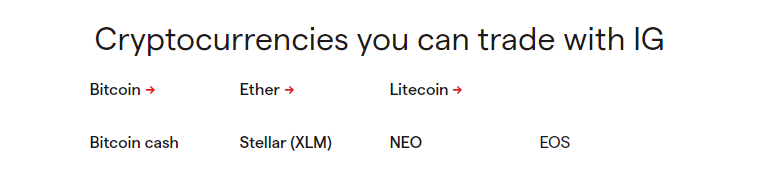

Mobile Support

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that IG Markets’s trading platform is also mobile compatible as apps for both iPhones and Android users.

According to information on IG Market's website, the platform has even won prizes for having the best mobile app out there, from a number of different publications.

IG Markets Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen CFD-contract and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can see that it feels right to you.

The following is the trading view at IG Markets (in Swedish, and one a demo-account, though):

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

Leveraged Trading

IG Markets also offers leveraged trading, up to 10x leverage on their cryptocurrency CFDs (and higher for certain other products).

Leveraged derivatives trading can lead to massive returns but – on the contrary – also to massive losses. For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD. As you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, there is potential for huge upside but also for huge downside…

IG Markets Crypto Fees

When you trade at a FX/Crypto Broker like IG Markets, you have to pay trading fees. However, the trading fees differ in their structure compared to the trading fees at a centralized crypto exchange for instance. At an FX/Crypto Broker, you need to consider the following fees in your trading: spreads, overnight fees and (possibly) inactivity fees.

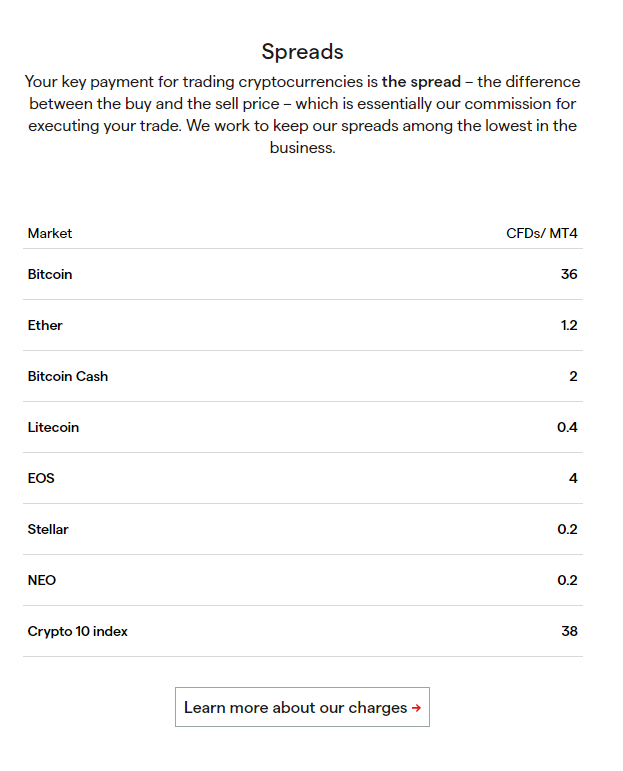

IG Markets Crypto Spread

Let’s start with explaining what a “spread” is. Spreads are the main fee of any CFD Trading Platform. In essence, it can be compared to trading fees at centralized crypto exchanges. It is the mark-up or mark-down charged by the platform when you purchase a certain crypto CFD. So if the price of the relevant CFD is USD 100, and the spread is 1%, the buyer can buy the crypto CFD on the trading platform for USD 101 (or sell it for USD 99). The difference between the sell price and the purchase price (USD 1 in this case), goes to the trading platform.

IG Markets have fixed unit amounts as their spreads and not a fixed percentage amount. When calculating the percentage of the fixed amount against the market price on the date of first writing this review (13 June 2021), we found that the spread was around 0.10%. We have therefore listed 0.10% as the trading fees in our database. Here's a picture showing the spreads of a few different markets at IG Markets (picture from 13 June 2021):

IG Markets Crypto CFD Overnight Fee

What is an overnight fee? An overnight is the fee charged by the platform when you hold a position (i.e. a Crypto CFD) overnight. It's as easy as that. Seeing as it is charged every night, it is small, and a trader will of course hope that his position will be successful enough that he won't even notice the overnight fee as the value of his position appreciates. IG Markets have different overnight fees depending upon which CFD you have traded. If you have traded Bitcoin, it is 0.0347% (12.5% per year), for the Crypto 10 Index (consisting of exposure towards a basket of different cryptos), overnight fee is 0.0417% and for any other specific crypto CFD the overnight fee is 0.0556% (20% per Annum).

IG Markets Crypto CFD Inactivity Fee

An inactivity fee is a fee that is charged if you have not logger in to your trading account for a certain period of time. At IG Markets, this period of time is 24 months after which the account will be closed if it's empty. If it's not empty, an inactivity fee will be charged of USD 15 per month. These time frames and fees are vastly more generous than the corresponding time frames and fees at Plus500. At Plus500, inactivity fees were charged after only 3 months (then USD 10 per month).

While the inactivity fee is clearly not one of the more important ones, we feel that is worth mentioning seeing as it is a bit consumer-unfriendly in our opinion. Most of the FX/Crypto Brokers seem to have it though. If it is of any comfort to you as a user, the inactivity fee is only collected when there are sufficient available funds in the user's account.

IG Markets Crypto Withdrawal fees

Seeing as you never really hold any cryptocurrency at this platform, but only contracts connected to such cryptocurrencies, there is no real point in stating a BTC-withdrawal fee here and then comparing that to the corresponding BTC-withdrawal fees at other platforms. The only thing you withdraw here is money.

For withdrawing USD via bank wire transfer, you will need to pay USD 15 per withdrawal. This seems to be quite on average with what FX/Crypto Brokers typically charge.

Deposit Methods

At IG Markets, you can deposit fiat currency in a lot of different ways, including (but not limited to) VISA, MasterCard, Klarna, PayPal, Skrill and many others. This is naturally very helpful for someone that needs an easy way to access his/her trading platform.

LEGAL RISK WARNING: 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!