Coinhouse

Комиссии биржи

Методы внесения депозита

Поддерживаемые криптовалюты (6)

Coinhouse Review

What is Coinhouse?

Coinhouse is a French cryptocurrency exchange. To be perfectly correct though, it is not an exchange but a “broker/dealer”. Nevertheless, for the purposes of consistency between reviews, Coinhouse will hereinafter be referred to as an “exchange” anyways.

KYC & Verification

Coinhouse complies to KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. In order to complete a registration, the user must upload a scan of his/her ID as well as a selfie of him/her holding the ID.

Upon initial verification, the user will be limited to EUR 200 to EUR 5,000 per day depending on the type and quality of the documents provided.

Coinhouse is also the first French platform to be registered with the AMF, guaranteeing the security of the funds of Coinhouse customers. Furthermore, they offer French customer service available by email, phone and online form.

EUR-L

On 17 March 2021, Coinhouse launched EUR-L for trading on their platform. EUR-L is a Euro stablecoin, i.e. it is a crypto backed by the Euro: 1 EUR-L = 1 Euro.

Coinhouse Advantages

As two of their main advantages, Coinhouse presents on its website that their transactions are instant, and that they have secure storage of the users’ cryptoassets. These are two important features indeed.

US-investors

Coinhouse does not permit US-investors on the exchange. So, if you are a US-investor and want to trade at Coinhouse, you’ll have to reconsider your choice of trading venue and choose one of the other top crypto exchanges.

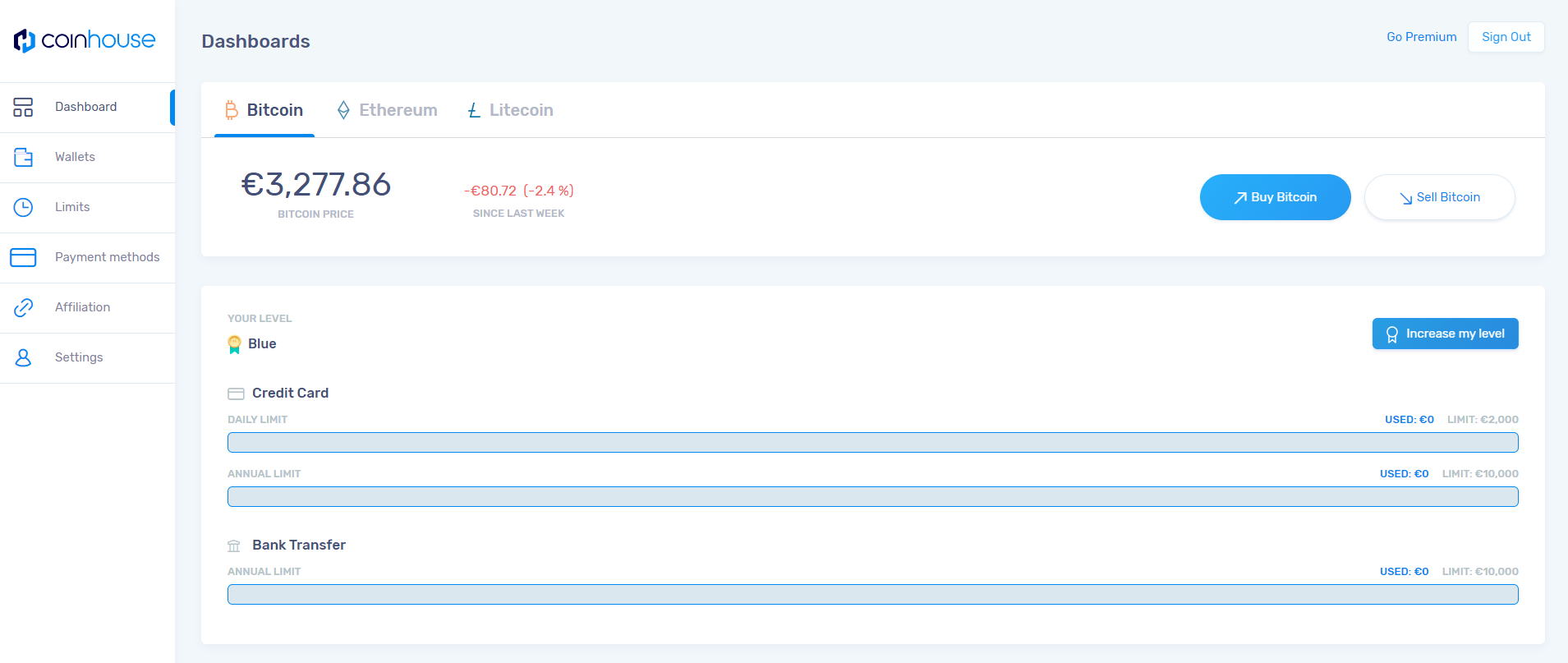

Coinhouse Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. They normally also have buy and sell-boxes. Before you choose an exchange, try to have a look at the trading view so that you can ascertain that it feels right to you. At this exchange, there is no real trading view, merely order boxes. This makes it easily understandable for new crypto investors, while it might lack some features that more experienced traders look for. The below is a picture of the purchase interface at Coinhouse:

Coinhouse Fees

Coinhouse Trading fees

This trading platform charges a commission on performed orders amounting to 4.90% for buyers and 3.90% for sellers. These fees are naturally much higher than the 0.25%-averages that most centralized exchanges charge. However, seeing as Coinhouse is a broker/dealer (and not a centralized exchange), it might be wrong to compare Coinhouse’s fees with industry averages for centralized exchanges.

Coinhouse Withdrawal fees

Considering how this exchange operates, withdrawal fees are irrelevant.

Deposit Methods

At this exchange, you can deposit through both wire transfer and credit cards. This can be helpful especially for newer crypto investors.

One should generally look out for the different deposit fees charged by exchanges for deposit of fiat currencies via wire transfer or credit cards, and whereas it might be indifferent to you whether you should deposit via wire transfer or credit card, it might be very different fees. Some exchanges charge a deposit fee of up to a staggering 11% for credit card deposits.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!