BigoMex

Comisiones de intercambio

Métodos de depósito

Criptomonedas compatibles (18)

UPDATE 11 January 2023: When trying to access the website of Bigomex today, we were unsuccessful. There have been no preceding messages on system maintenance or new websites or anything similar.

Accordingly, we believe that this exchange has closed down and we have marked it as "dead" in our Exchange Graveyard. If the exchange's website would become accessible again and the error is just temporary, we will "revive" it and bring it back to our Exchange List.

To find a reliable exchange where you can start an account, just use our Exchange Filters and we'll help you find the right platform for you.

BigoMex Review

What is BigoMex?

BigoMex is a cryptocurrency exchange registered in Singapore. It opened up shop in 2020.

It is a so called derivatives exchange, meaning that they focus on derivatives trading. A derivative is an instrument priced based on the value of another asset (normally stocks, bonds, commodities etc). In the cryptocurrency world, derivatives accordingly derive its values from the prices of specific cryptocurrencies. You can engage in derivatives trading connected to 17 different cryptos here, which is quite many seeing as a lot of other derivatives exchanges only offer trading in BTC or BTC and ETH.

BigoMex Mobile Support

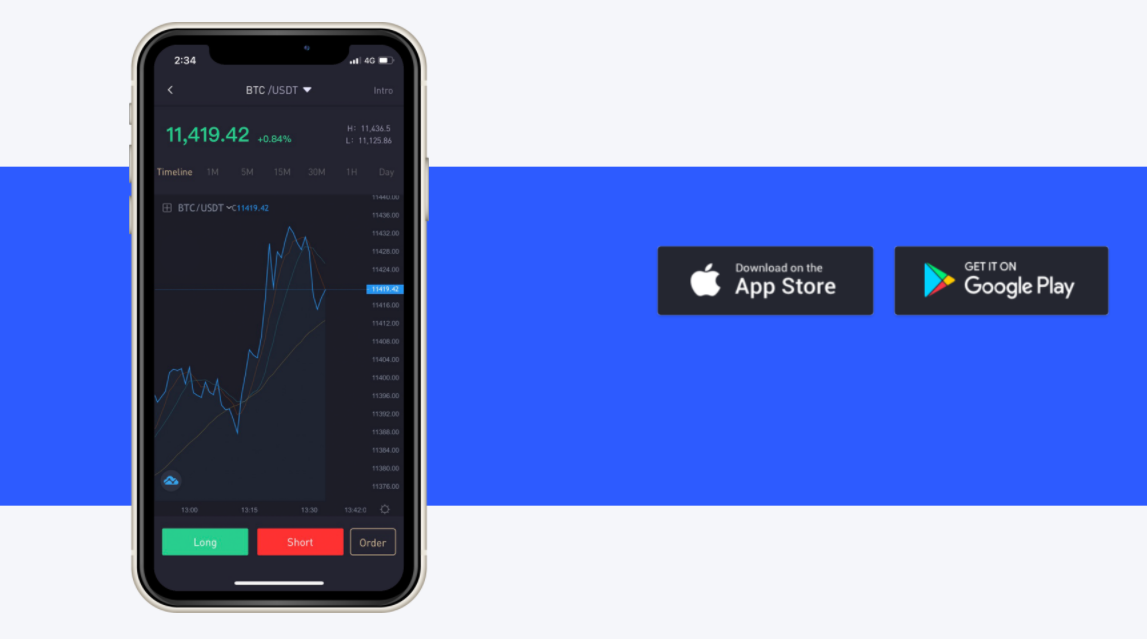

Most crypto traders feel that desktop give the best conditions for their trading. The computer has a bigger screen, and on bigger screens, more of the crucial information that most traders base their trading decisions on can be viewed at the same time. The trading chart will also be easier to display. However, not all crypto investors require desktops for their trading. Some prefer to do their crypto trading via their mobile phone. If you are one of those traders, you’ll be happy to learn that BigoMex’s trading platform is also mobile compatible. You can download it to/from both the AppStore and Google Play:

Leveraged Trading

BigoMex also offers leveraged trading to its users. The maximum leverage level is 100x (i.e. onehundred times the relevant amount). The platform does not offer futures with expiry dates at the moment, only perpetual futures. And users who wants to hold the position overnight will have to pay an overnight fee of 30% of the trading fees of the open position. The maximum leverage depends on the trading pair. You can open a Bitcoin position, for example, with as much as 100x leverage, whereas Tron positions are capped at 30x leverage.

A word of caution might be useful for someone contemplating leveraged trading. Leveraged trading can lead to massive returns but – on the contrary – also to equally massive losses.

For instance, let’s say that you have 10,000 USD on your trading account and bet 100 USD on BTC going long (i.e., increasing in value). You do so with 100x leverage. If BTC then increases in value with 10%, if you had only bet 100 USD, you would have earned 10 USD if you simply held Bitcoin. Now, as you bet 100 USD with 100x leverage, you have instead earned an additional 1,000 USD (990 USD more than if you had not leveraged your deal). On the other hand, if BTC decreases in value with 10%, you have lost 1,000 USD (990 USD more than if you had not leveraged your deal). So, as you might imagine, there is potential for huge upside but also for huge downside…

OTC-desk

Let’s say that you hold a very large amount of a certain cryptocurrency. You want to sell that amount. Should you do that on a regular trading platform like everyone else? Maybe not. One of many reasons for executing large trades outside of the normal market place is that large trades may affect the market price of the relevant crypto. Another reason, which is connected to the foregoing, is that the order book might be too thin to execute the relevant trade. A solution to these problems is what we call OTC-trading (Over The Counter). BigoMex offers OTC-trading, which might be helpful to all the “whales” out there (and maybe also to all the “dolphins”).

BigoMex Trading View

Every trading platform has a trading view. The trading view is the part of the exchange’s website where you can see the price chart of a certain cryptocurrency and what its current price is. There are normally also buy and sell boxes, where you can place orders with respect to the relevant crypto, and, at most platforms, you will also be able to see the order history (i.e., previous transactions involving the relevant crypto). Everything in the same view on your desktop. There are of course also variations to what we have now described. This is the trading view at BigoMex:

It is up to you – and only you – to decide if the above trading view is suitable to you. Finally, there are usually many different ways in which you can change the settings to tailor the trading view after your very own preferences.

US-investors

Why do so many exchanges not allow US citizens to open accounts with them? The answer has only three letters. S, E and C (the Securities Exchange Commission). The reason the SEC is so scary is because the US does not allow foreign companies to solicit US investors, unless those foreign companies are also registered in the US (with the SEC). If foreign companies solicit US investors anyway, the SEC can sue them. There are many examples of when the SEC has sued crypto exchanges, one of which being when they sued EtherDelta for operating an unregistered exchange. Another example was when they sued Bitfinex and claimed that the stablecoin Tether (USDT) was misleading investors. It is very likely that more cases will follow.

According to information from the exchange to us here at Cryptowisser.com, BigoMex does allow US-investors on its exchange.

BigoMex Fees

BigoMex Trading fees

Every time you execute an order, the exchange charges you a trading fee. The trading fee is normally a percentage of the value of the trade order. At this exchange, they don´'t really divide between takers and makers. Rather, they divide between opening a position and closing a position.

There are no fees involved with opening a position at this exchange.

For closing a position, BigoMex charges you 0.10%.

In our database, we have marked this as 0.10% as taker fee and 0.00% as maker fees, although we realize that this is not technically correct. We do feel however that it is the best way to present the fees at BigoMex from a comparison perspective.

BigoMex Withdrawal fees

The platform charges a withdrawal fee amounting to 0.0004 BTC when you withdraw BTC. This fee is also somewhat below the industry average, which - the last time we did an empirical study of all exchanges' withdrawal fees - was slightly above 0.0006 BTC per BTC-withdrawal.

Deposit Methods

In order to trade here, you must have cryptocurrency to begin with. The only asset class you can deposit to BigoMex is cryptocurrency. However, if you really like BigoMex but you don’t have any crypto yet, you can easily start an account with an exchange that has “fiat on-ramps” (an exchange where you can deposit regular cash), buy crypto there, and then transfer it from such exchange to this exchange. Use our Exchange Filters to easily see which platforms that allow wire transfer or credit card deposits.