Bancor Network

Taxas da Bolsa

Métodos de Depósitos

Criptos Suportadas (70)

Bancor Network Review

What is Bancor Network?

Bancor Protocol is a standard for a new generation of cryptocurrencies that are called Smart Tokens. Bancor Network is a decentralized exchange that allows you to hold any token and convert it to any other token in the network. This is done with no counter party, but at an automatically calculated price.

As stated on the exchange’s website:

“Bancor’s decentralized liquidity network redesigns the way people create and share value by ensuring continuous on-chain liquidity between blockchain-based assets.”

Bancor Network Advantages

Bancor Network lists credit card acceptance, 24/7 support and transparent pricing as three of their main advantages. We do indeed agree that these features are advantages.

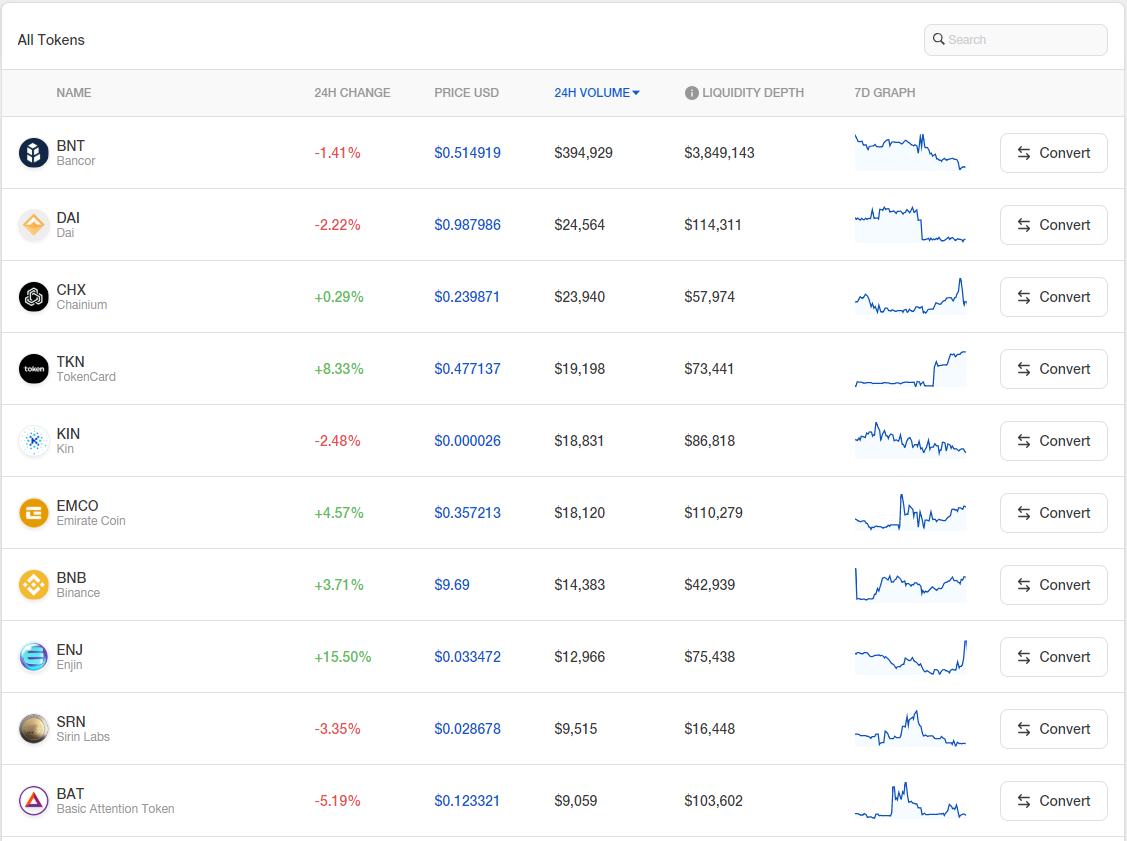

Supported Cryptos

The platform supports hundreds of different tokens, a few of which are listed below:

US-investors

Bancor Network does not explicitly prohibit US-investors from trading. In any event, all US-investors should still perform their own analysis of the legality of their trading. Worst case, US-investors may not trade at Bancor Network. If so, they must find another site that will be the best cryptocurrency exchange site for them.

Decentralized Exchanges

Decentralized exchanges are becoming increasingly more popular. They are definitely gaining market shares against their centralized counterparts.

Decentralized exchanges do not require a third party to store your funds. Instead, you always directly control your coins and you conduct transactions directly with whoever wants to buy or sell your coins. Decentralized exchanges normally do not require you to give out personal information either, which makes it possible to create an account and right away be able to start trading. The servers of decentralized exchanges spread out across the globe leading to a lower risk of server downtime. However, decentralized exchanges as opposed to regular top crypto exchanges normally have an order book with lower liquidity than the regular top crypto exchanges.

Bancor Network Roadmap

The following is a picture of the roadmap of the Bancor Network. As you can see, the remaining steps is for the exchange to launch a Dapp Browser, and then expand across blockchains.

Bancor Network Trading View

Different exchanges have different trading views. And there is no “this overview is the best”-view. You should yourself determine which trading view that suits you the best. What the views normally have in common is that they all show the order book or at least part of the order book, a price chart of the chosen cryptocurrency and order history. At this exchange, the exchange interface is very intuitive and easy to understand. It looks as follows:

Bancor Network Fees

Bancor Network Trading Fees

It is very important to consider the fees at any exchange. There are two main things that you can do at Bancor Network that are normally subject of fees: (i) list tokens, and (ii) convert tokens. At Bancor Network, no fees are charged for these things. This is a very competitive aspect of this exchange that we applaud.

Bancor Network Withdrawal Fees

As no assets are ever really deposited into Bancor Network, no withdrawals from Bancor Network is actually done either. This also means that withdrawal fees are irrelevant when speaking of this exchange.

Funding Methods

This exchange’s focus is on crypto-to-crypto trading. However, fiat currency funding is possible through the exchange’s partnership with Simplex.

Simplex is a payment service firm from Israel. The partnership with Simplex allows the Bancor Network-users to purchase e.g. Ethereum using a credit card. As Simplex is a third party, however, using Simplex to purchase crypto is – unlike the crypto-to-crypto trading at Bancor, not free-of-charge. Simplex charges 3.5% per trade. So if you want to buy Ethereum for USD 10,000, Simplex will take US 350 (plus a minium flat fee of USD 10) for enabling the purchase.

Bancor Network Security

The servers of decentralized exchanges are normally spread out. This is different from centralized exchanges that normally have their servers more concentrated. This spread-out of servers leads to a lower risk of server downtime and also means that decentralized exchanges are virtually immune to attacks. This is because if you take out one of the servers, it makes little to no difference for the network of servers in its entirety. However, if you manage to get into a server at a centralized exchange, you can do a lot more harm.

Also, if you make a trade at a decentralized exchange, the exchange itself never touches your assets. Accordingly, even if a hacker would somehow be able to hack the exchange (in spite of the above), the hacker can not access your assets. If you make a trade at a centralized exchange, however, you normally hold assets at that exchange until you withdraw them to your private wallet. A centralized exchange can therefore be hacked and your funds held at such exchange can be stolen. This is not possible in the same way when it comes to a DEX.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!