Top 5 Crypto Lending Platforms

As we head into the second quarter of 2021, it's time to consider just what's coming next and how we can make sure this year continues to improve month over month. But there are a few more things we need to think about as we move forward. One of those is just how we're going to make the most of digitization and the latest and greatest advents in financial technologies. The cryptocurrency market is booming and growing at an unprecedented rate, and it's definitely time to look into just what we can (and should) be doing about it. One of those things is cryptocurrency lending.

1. Nebeus - Best Overall

At the top of the list of crypto lending platforms is Nebeus. Designed to bridge the gap between cryptocurrency and cash, this platform allows users to access crypto and financial services for everyday use. The platform strives to offer everything that a user could need in terms of services relating to both crypto and finance. But their main product is crypto collateralized lending, and they offer some of the most attractive rates in the industry.

Nebeus has the lowest interest rate in the industry, offering users the opportunity to borrow from as little as EUR 50 with 0% interest. Additionally, Nebeus has one of the highest LTV ratios, going as high as 80%. Each loan can be fully customized, and users can choose the term, LTV, and interest rate tailored to their specific needs. If needed, users can even opt for an early repayment option. The maximum loan term is 36 months, and the maximum loan size is EUR 250K.

Pros:

- The lowest interest rate in the industry (0%).

- One of the highest LTV ratios - up to 80%.

- A huge variety of options for withdrawing and depositing funds.

Cons:

- Only accepts Bitcoin and Ethereum as collateral.

- Does not offer SWIFT transfers.

2. YouHodler

YouHodler offers plenty of options for cryptocurrency-backed lending and accepts many different collateral types. The list of cryptocurrencies that they accept is extensive, and users can even earn interest by keeping crypto in their accounts. YouHodler even offers earnings on stablecoins. Overall, users can deposit 4 different fiat currencies, 6 different stablecoins, and 15 different cryptocurrencies.

YouHodler offers plenty of options for cryptocurrency-backed lending and accepts many different collateral types. The list of cryptocurrencies that they accept is extensive, and users can even earn interest by keeping crypto in their accounts. YouHodler even offers earnings on stablecoins. Overall, users can deposit 4 different fiat currencies, 6 different stablecoins, and 15 different cryptocurrencies.

On the cryptocurrency-backed lending side of things, YouHodler has one of the highest LTV's in the industry, climbing up to 90%. However, this LTV is only for a loan term of 30 days maximum. The overall maximum loan term is six months (180 days), which is a lot less than many other industry players, and might be an issue for many who have a long-term need.

Pros:

- Very High LTV (but only for short-term loans)

- Extensive list of cryptocurrencies accepted as collateral

Cons:

- Longer-term loans have low LTV

- Maximum loan term is six months (180 days)

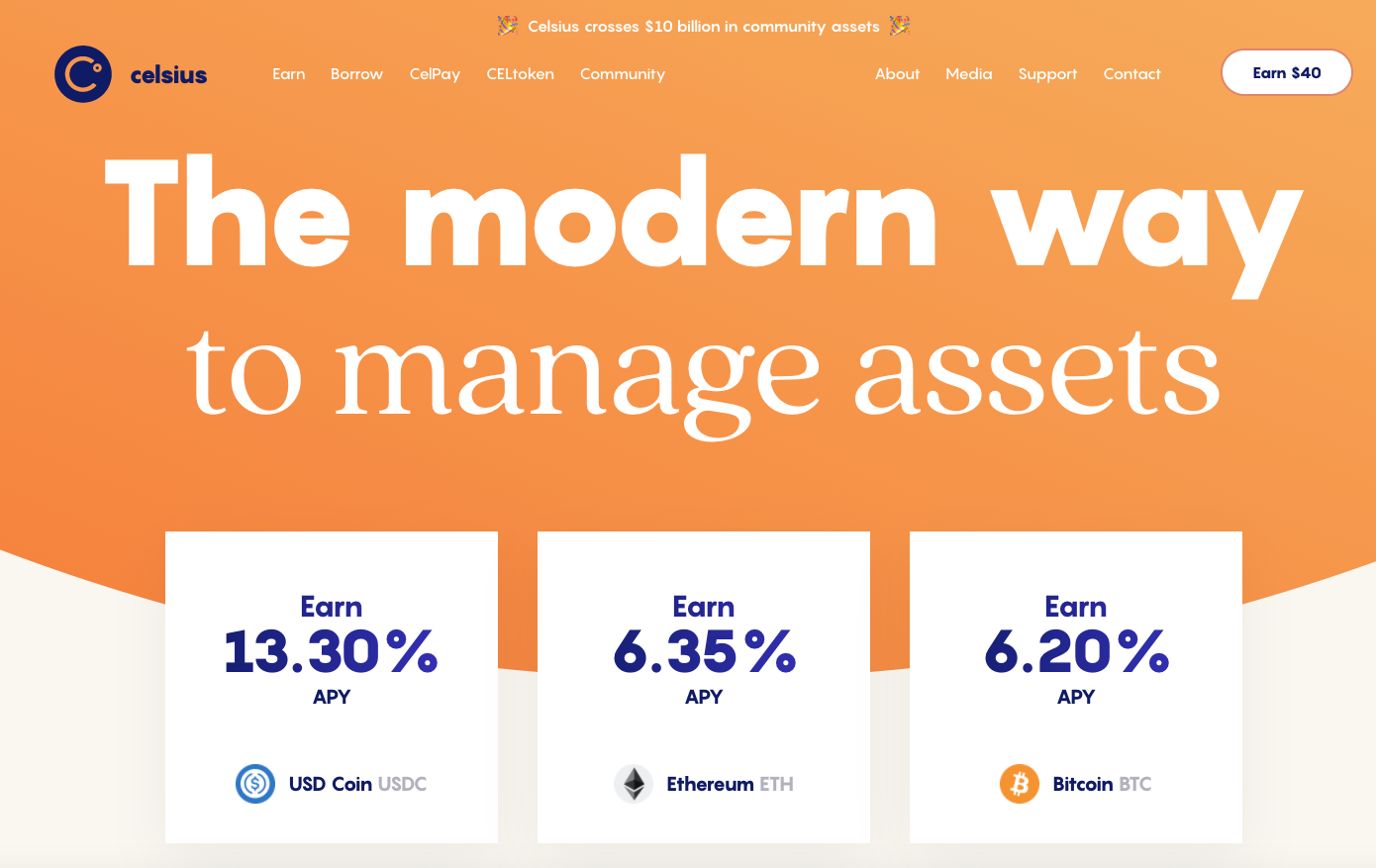

3. Celsius Network

Celsius Network, which launched only in 2017, has become an incredibly versatile platform for earning and borrowing on crypto. They work with 36 different cryptocurrencies and offer some handy services.

Celsius Network, which launched only in 2017, has become an incredibly versatile platform for earning and borrowing on crypto. They work with 36 different cryptocurrencies and offer some handy services.

Their crypto-backed loans product is easy to use but has limited options. Their LTV ratios are only between 25% and 50%, which is not great for those who want to get higher loan amounts. But on the other hand, their interest rates are attractive, starting at 1% and going up to 8.95%. If you choose to pay in their native CEL token, then the interest rate will be lower.

Pros:

- A variety of collateral options

- Low interest rates

- 36 months max loan term

Cons:

- It only works through an app - no desktop version.

- All the best benefits are only accessed using their native CEL token

- Limits placed on large withdrawals

4. BlockFi

BlockFi is based in the United States and is currently active in all but three US states. It also provides its services globally. You can use this platform to access a whole variety of services, but crypto-backed loans are its main service.

BlockFi is based in the United States and is currently active in all but three US states. It also provides its services globally. You can use this platform to access a whole variety of services, but crypto-backed loans are its main service.

BlockFi targets users with very specific needs, so their loans only start from USD 5,000, and their LTVs range from 25% to 50%. BlockFi's approach is to target users who are not looking to get loans for their daily needs but rather for more ambitious plans, such as buying a home or funding a business.

Pros:

- One free withdrawal per month

- Flexible loan terms built for long-term goals

Cons:

- The maximum LTV is 50%

- The minimum loan amount is USD 5,000

5. SpectroCoin

If you're looking for a service that can do a little of everything, you'll want to look at SpectroCoin. The platform offers an electronic wallet, a cryptocurrency exchange, and even a debit card allowing users to spend directly from their SpectroCoin account. And all of this alongside cryptocurrency collateralized loans, with some attractive rates. SpectroCoin interest rates vary between 5.5% and 16.95%, and you can opt for LTV of 25%, 50%, or 75%. Loan sizes vary between USD 25 and USD 1 million, but the loan term is maximum 12 months.

Pros:

- Loans are flexible with multiple options

- Loan repayment can be euros or in crypto

- Easy extension & early repayment options

Cons:

- You can only access the best rates when you pay in BNK tokens

- Interest rates are high

- The maximum term is 12 months

Conclusion

After going through a total rebranding and relaunch at the end of 2020, Nebeus has become one of the leading platforms for crypto-collateralized lending in 2021. In addition to their extremely flexible and attractive rates, the platform is highly robust and easy to use. Choosing Nebeus as your platform for crypto-backed loans is definitely a sound decision.

***

DISCLAIMER

The views, the opinions and the positions expressed in this article are those of the author alone and do not necessarily represent those of https://www.cryptowisser.com/ or any company or individual affiliated with https://www.cryptowisser.com/. We do not guarantee the accuracy, completeness or validity of any statements madewithin this article. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author. Any liability with regards to infringement of intellectual property rights also remains with them.

Comments

Log in to post a comment

No comments yet

Be the first to share your thoughts!