The Automation Revolution: From Holy Water Dispensers to Crypto Vending Machines

The financial industry has been slow to adopt automation, but with the advent of public and open-source blockchains, the potential for fully automating finance is now a reality. Public and open-source blockchains, such as Bitcoin and Ethereum, have made it possible to standardize and automate financial transactions in a way that was previously not possible. In contrast to the current financial system, which is a patchwork of various corporations and currencies working under an intricate web of trust, public and open-source blockchains provide a level of decentralization, security, transparency, accessibility, and automation that traditional financial systems cannot match.

Holy Transactions

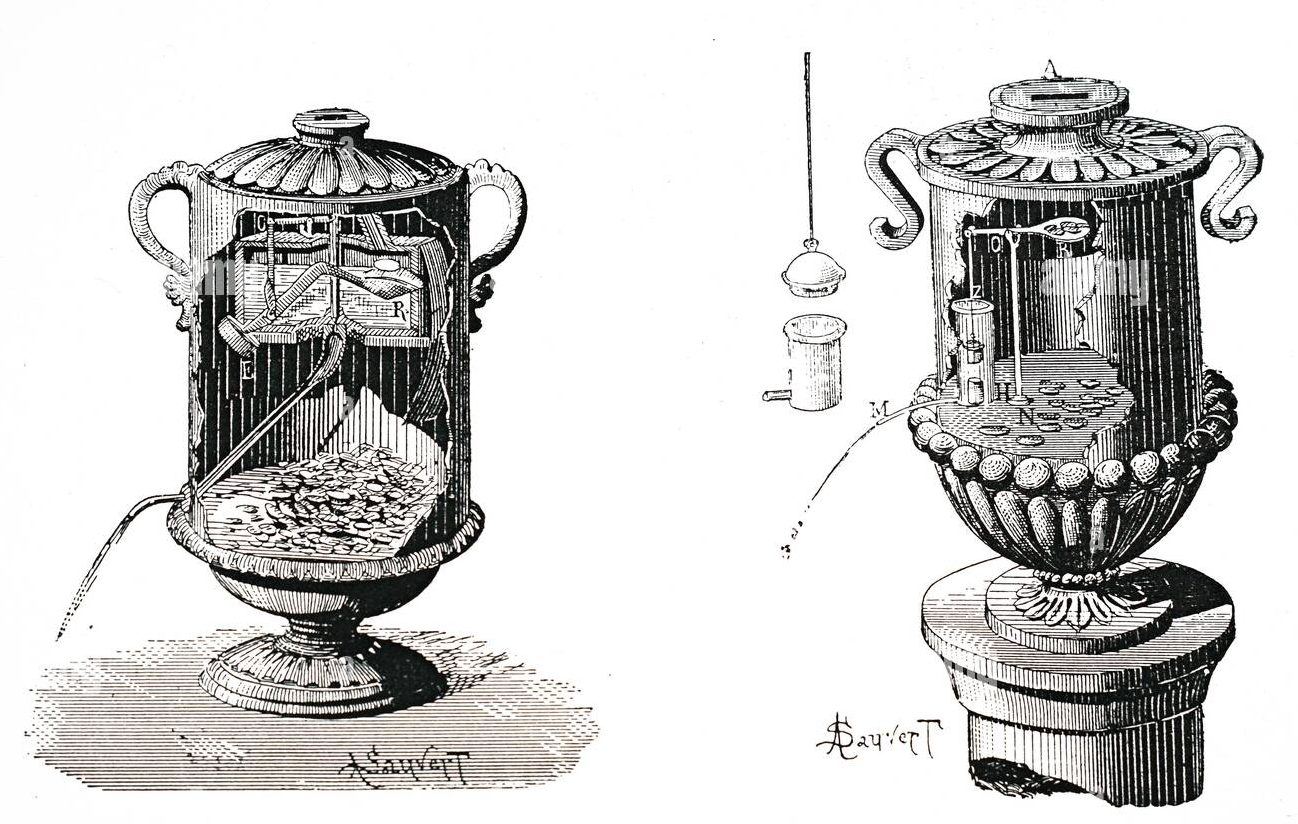

Let's take the humble vending machine; they are arguably the first automated machines humans have ever invented, and interestingly the first vending machines were also coin-operated, which makes them useful as an analogy for understanding the potential of automation in finance. The first vending machine in history was invented over 2000 years ago by a guy named Heron who wanted to charge for holy water at temples in Egypt. The reason for inventing the first coin-operated dispenser was that people in the temples kept taking more holy water than they paid for. Instead of relying on the virtue of people, Heron made a machine to dispense water when a coin was deposited. The deposited coin’s weight then presses down on a scale opening up the water valve. The coin will then gradually slip off the scale closing the valve and cutting the stream of holy water automatically.

The invention of the coin-operated vending machine was not only a holy transaction, but one that enriched the Egyptian priests and marked a significant milestone in the history of automated profit-generating machines.

Fast forwarding to the present day, we have ATMs, crypto exchanges all dispensing money all over the world, but what's even more interesting is the vast array of vending machines found in Japan. In Japan there are over 5.52 million machines, this translates into 1 vending machine for every 23 people, and they even sell everything from live crabs, puppies, and baby cats. You may have infamously heard of the myth about 'used underwear' being vended. These highly accessible machines are a staple in virtually any setting. Even prayer cards can be purchased within old Japanese shrines.

It's no doubt that technological advancements and integration of IoT, and now blockchains, which are in effect automated financial systems, are largely responsible for the explosive growth of even more automated machines. Today, with the integration of blockchain and IoT, these vending machines can remotely check stock levels, control temperature, activate and deactivate cashless payments, monitor maintenance issues, and more. These advancements not only increase performance and reduce operational costs, but they also increase visibility into transactions and payment metrics.

So how is this affecting finance? The sector is already seeing significant changes due to automation, and key pieces of evidence of this are in the realm of crypto exchanges. Platforms like Binance, Coinbase, HollaEx Pro and Crypto.com are using open-source blockchains like Bitcoin and Ethereum to provide fast, secure transactions and reduce the need for intermediaries. Many of these crypto exchanges are functioning with very small teams, and even some exchanges are now fully without an owner or operator; they are purely automatic financial platforms – the ultimate vending machine.

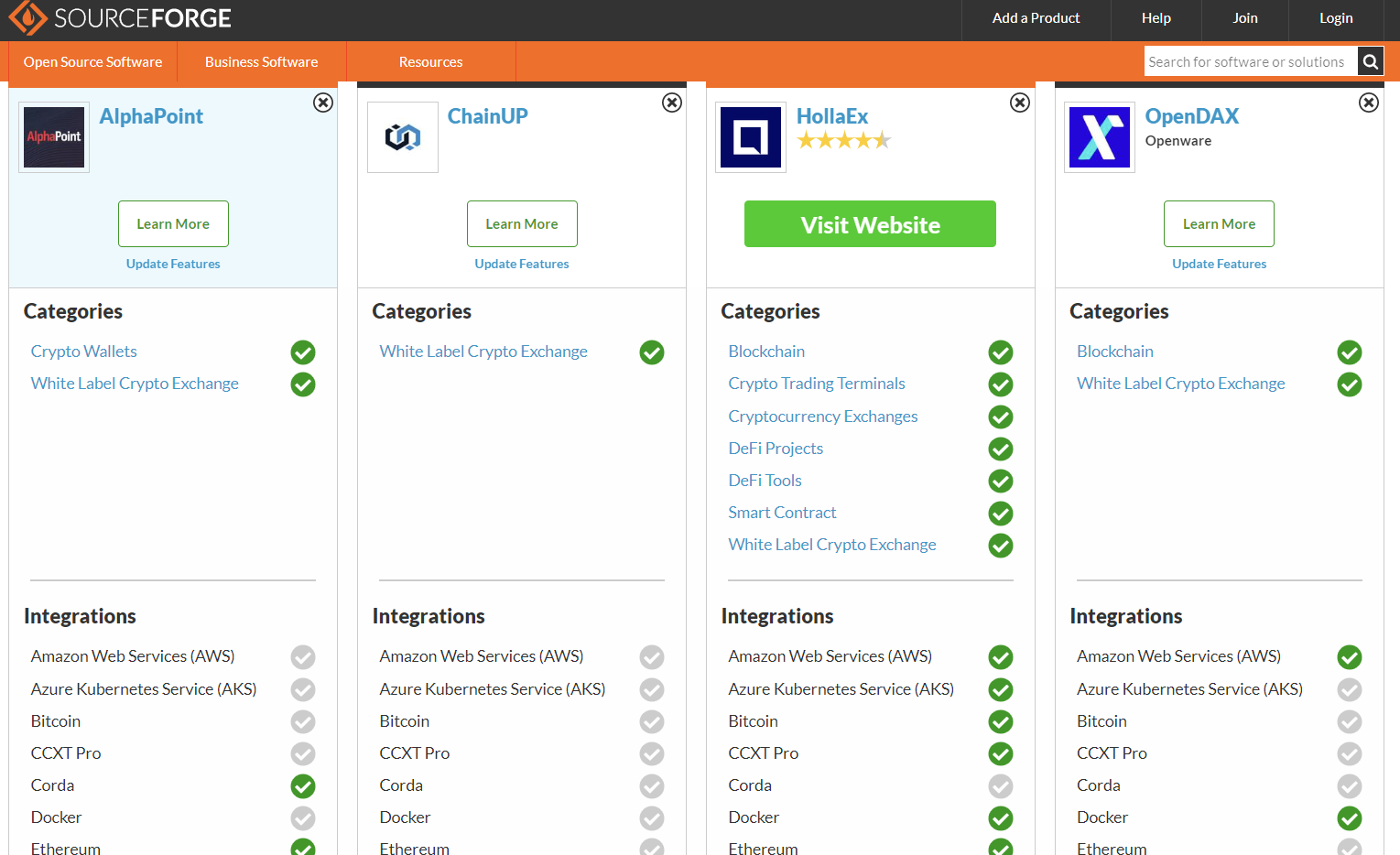

A study by McKinsey & Company estimates that automation has the potential to create a whopping $13 trillion economic impact, we are already seeing the impact in real-time with ChatGPT and the like. The study states that automation could raise productivity, stimulate economic growth, and create jobs, but it also highlights that the benefits and costs of automation will benefit certain sectors, countries, and individuals more. One specific area where automation is making an impact is in the use of white label tooling software for crypto exchanges. These powerful open-source crypto white label software such as HollaEx which allows anyone to open their own automated crypto coin vending machine online, thanks largely to the automatic nature of blockchains playing the part of a global cloud bank. Many of these white-labeled exchanges can be found on the largest software websites like ProductHunt, SourceForge, and G2.

In summary, the finance sector has gained a competitive advantage through the automation of blockchain technology, as evidenced by the exponential growth of crypto exchanges. Similar to the way vending machines utilize technology to enhance performance and reduce costs, advancements in finance technology have the potential to improve accessibility, visibility, and payment metrics. It is crucial for the financial industry to adopt automation and take advantage of the free and public blockchain technology available to them. By doing so, they can meet the evolving needs of modern consumers. Embracing public and open-source crypto software and blockchains is essential to achieving this automation, as they are evolving into decentralized banks in the cloud. Such blockchain-based systems offer a level of security and transparency that traditional financial systems cannot match.

***

DISCLAIMER

The views, the opinions and the positions expressed in this article are those of the author alone and do not necessarily represent those of https://www.cryptowisser.com/ or any company or individual affiliated with https://www.cryptowisser.com/. We do not guarantee the accuracy, completeness or validity of any statements made within this article. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author. Any liability with regards to infringement of intellectual property rights also remains with them.