Trakx

Handelsavgift

Insättninsgmetoder

Kryptos (0)

Trakx Review

What is Trakx?

Founded to set new standards for digital asset investing, Trakx is a regulated French platform specializing in crypto index trading. Unlike exchanges that focus on single tokens, Trakx offers the broadest range of Crypto Tradable Indices (CTIs) in the market, designed to give investors instant diversification, transparent methodologies, and risk-adjusted exposure.

The company is registered with the Autorité des Marchés Financiers (AMF) as a Digital Asset Service Provider, and its leadership team brings experience from Goldman Sachs, Bloomberg, Fidelity, and other top financial institutions.

By combining institutional-grade custody, regulatory oversight, and innovative index products, Trakx bridges the gap between traditional finance and the fast-moving crypto economy.

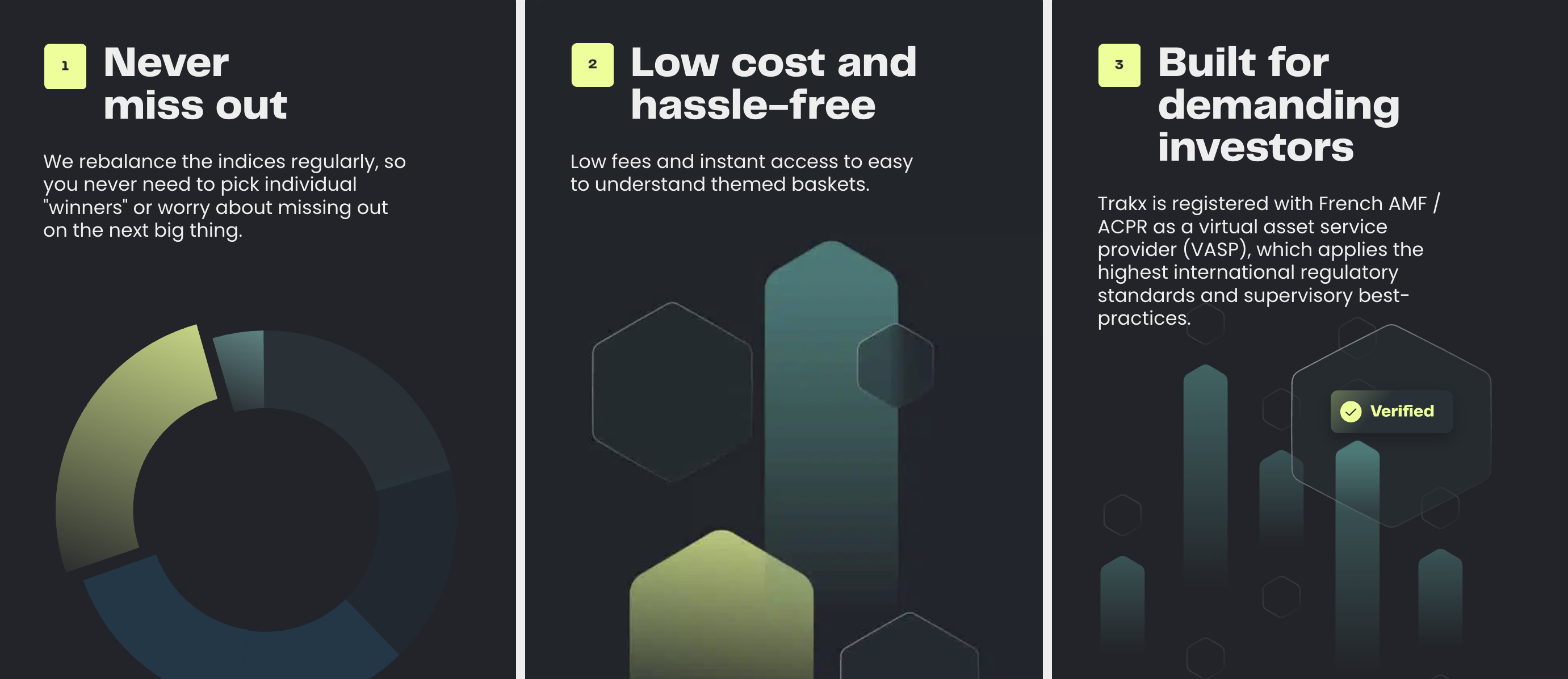

Crypto Tradable Indices (CTIs)

At the heart of Trakx is its unique product line: Crypto Tradable Indices. These indices bundle multiple tokens into rebalanced portfolios, tracking narratives, strategies, or risk profiles.

Instead of managing fragmented assets across wallets and exchanges, investors gain structured exposure through a single instrument.

Key Features

- 1:1 backed custody: Every CTI is fully collateralized with underlying assets.

- Methodology transparency: Public index rules, rebalancing schedules, and performance data.

- Liquidity: 24/7 trading with instant buy and redemption.

CTI Categories

- Simple Access CTIs

Straightforward entry points such as Bitcoin–Ether 50/50 or Top 10 Crypto. Ideal for beginners seeking diversified exposure without complexity. - Smart Investing CTIs

Baskets built using advanced financial strategies like momentum weighting, volatility-adjusted allocations, or digital inflation hedges. These appeal to investors seeking optimized risk-adjusted returns. - Thematic CTIs

Indices following sector-specific or narrative-driven trends—AI, Gaming, Real World Assets, Cardano, DeFi, DePIN, Interoperability, NFT Metaverse, and even Memes. This breadth allows users to back emerging narratives without manually selecting individual tokens. - Risk-Profiled CTIs

Conservative, Balanced, and Growth portfolios tailored to different investor appetites, mirroring traditional wealth management offerings. - Staked & Yield CTIs

Products like USDc Earn or Staked MATIC that incorporate staking rewards or yield-bearing assets, designed for users looking to generate steady returns within a secure structure.

Supported Cryptocurrencies

Beyond its indices, Trakx also supports direct exposure to leading assets including: Bitcoin, Ethereum, Solana, XRP, Litecoin, USDT, and its native TRKX token. These can be combined into CTIs or accessed directly depending on user preference.

All index constituents are rebalanced automatically on daily, weekly, or monthly cycles according to index methodology.

Trading Experience

The Trakx platform is purpose-built for CTIs rather than single-asset trading. Each index page provides:

- Interactive charts with historical and live performance tracking.

- Breakdown of all component tokens and weightings.

- Methodology details including rebalancing rules.

Trades are executed with a simple one-click buy/sell module, removing the need to manage multiple tokens across different markets.

For navigation, indices are grouped by category (Simple Access, Smart Investing, Thematic, Risk-Profiled, Yield). This organization makes discovery intuitive, even for first-time users.

For active traders, the platform offers transparency and detailed index data, while long-term investors can treat CTIs like “ETF-style” products for steady portfolio exposure.

Institutional & Business Solutions

Trakx is not limited to retail users. It offers a suite of B2B and institutional-grade services:

- Trakx Solutions – Institutions, DAOs, and asset managers can create and launch their own custom crypto index funds with chosen components, weighting rules, and rebalance schedules.

- IFA Gateway – Independent Financial Advisors gain access to ready-made indices aligned with client risk profiles, enabling them to integrate professional crypto products into wealth management portfolios.

- B2B2C APIs & White-label Services – Launched in 2025, this allows fintechs, brokers, and neobanks to embed Trakx CTIs directly into their apps. This turnkey solution ensures compliance, preserves brand identity, and accelerates market entry.

Through these channels, Trakx positions itself as an infrastructure provider for the wider financial ecosystem, not just a retail platform.

TRKX Token Utility

The TRKX token powers the Trakx ecosystem and provides benefits for long-term holders:

- Trading discounts: Up to 50% off trading fees depending on staking levels.

- Exclusive rewards: Deposit bonuses, buybacks, referral boosters, and fee rebates.

- Governance: Token holders can vote on new indices and allocation rules.

- Access perks: Entry into private or advanced CTIs not available to non-holders.

By aligning platform growth with token-holder benefits, TRKX incentivizes engagement and loyalty.

Fees

Trakx uses a simple, transparent fee model:

- CTI Trading: 0.35% per trade (maker/taker).

- USDc Earn CTI: 0.1% per trade.

- Auto-Invest (DCA):

-

Under €250/month → 1%

-

€250–5,000/month → 0.7%

-

Over €5,000/month → 0.5%

-

- Withdrawals: 0% fees.

Holding TRKX tokens reduces costs further through tiered discounts. Importantly, there are no hidden fees, no leverage funding costs, and no liquidation penalties, which differentiates Trakx from derivatives exchanges.

Deposits & Withdrawals

Funding is supported in both crypto and fiat:

- Crypto: USDC (ERC20), ETH, and other major assets.

- Fiat: EUR and GBP via wire transfer or card payments (through Ramp).

- Recurring Investment: Auto-Invest allows users to schedule regular purchases into chosen CTIs, helping them build exposure steadily over time.

Security & Compliance

Trakx places strong emphasis on investor protection:

- Regulated in France as a Digital Asset Service Provider under AMF.

- Institutional custody with Fireblocks and Coinbase Custody, using cold storage and multi-sig protections.

- No leverage or margin trading, meaning all products are fully collateralized and risk-managed.

- Two-factor authentication and 24/7 monitoring.

- Yield products structured with protections against counterparty default, including bankruptcy-remote setups.

This combination of regulation + infrastructure + conservative product design reduces systemic risk and enhances trust.

Geographic Restrictions

Trakx is not available to residents of the United States and certain other restricted jurisdictions. Users must check the “Can I use Trakx in my country?” page before signing up.

Final Thoughts

Trakx is more than a trading venue—it is a specialized platform for diversified crypto investing, offering the broadest selection of crypto indices available today. Its regulated status, transparent methodologies, and institutional-grade custody make it a strong choice for both individual investors and financial professionals.

For newcomers, Trakx provides simple access to diversified baskets. For professionals, it delivers ETF-like exposure, governance tools, and customizable index creation. By focusing on indices instead of hype-driven token trading, Trakx offers a more structured, compliant, and long-term approach to digital assets.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!