Finst

Exchange Fees

Deposit Methods

Cryptos (0)

Finst Review

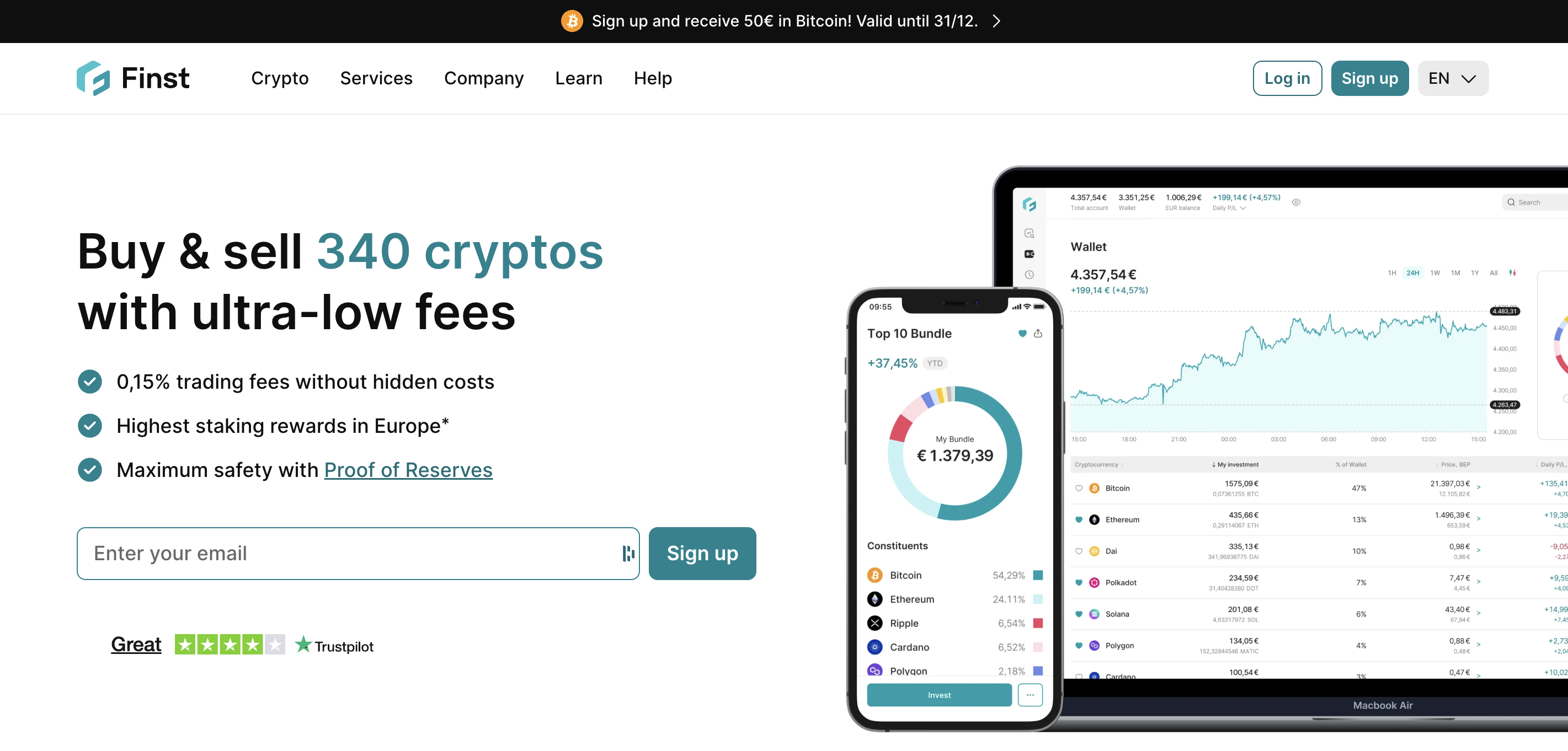

What is Finst?

Finst is a Netherlands-based cryptocurrency exchange designed for long-term investors rather than high-frequency traders. It focuses on simple spot trading, low fees, strong regulation and transparent asset protection. If you’re in Europe and want an easy, low-cost place to buy and hold crypto in EUR, Finst is built exactly for that use case.

Unlike the big global exchanges that push derivatives, 100x leverage and endless product lines, Finst intentionally keeps things tight: spot markets, staking, crypto bundles, auto-invest and basic portfolio tools. No perps, no options, no casinos.

Core Offering: Spot Trading With EUR

The heart of the platform is spot trading. You can buy, sell and swap more than 300 cryptocurrencies directly with euros. Funding the account is straightforward with support for SEPA transfers and common local European payment methods. The fee model is intentionally simple with a flat 0.15 percent fee applied to every trade. There are no hidden spreads, no maker or taker distinctions, and no volume based tiers. This keeps the experience clear for beginners and everyday investors.

Additional Services Beyond Simple Trading

Finst offers more tools that make it appealing to people who want to invest consistently or diversify their portfolio without doing everything manually.

Auto Invest (Recurring Purchases)

You can set up automatic purchases of individual coins or crypto bundles. This is ideal for users who want to follow a dollar cost averaging strategy. You choose the amount and frequency and Finst handles the rest. There is also an option to automatically withdraw the purchased coins to an external wallet.

Crypto Bundles (Diversified Portfolios)

Bundles allow you to invest in a pre built basket of assets with one click. Examples include a Top 5 or Top 10 bundle based on market cap, as well as themed bundles like ESG or category based sets. When you invest in a bundle, you directly own the underlying cryptocurrencies in your account. Finst rebalances the bundles periodically to maintain the intended allocation. Bundles carry a small monthly management fee.

Flexible Staking

Finst supports staking for a selection of proof of stake coins including ETH, SOL, ADA, DOT, ATOM, NEAR and others. Staking is flexible, meaning there are no long lockups and no minimum amounts required. Rewards are paid regularly and you can unstake or sell your assets at any time. This makes staking accessible to users who want passive income without using external wallets or DeFi tools.

Portfolio Tracking and Analytics

The platform includes built in tracking tools that show your performance, asset allocation and historical gains or losses. This helps you treat your crypto portfolio like a proper investment account rather than a simple wallet.

Customer Support and Help Center

Finst provides customer support through email and in app messaging. There is also a help center with guides on funding, trading, staking, bundles and general account management.

Trading and Products on Finst

Finst is built for spot trading and long term investing. The entire ecosystem is shaped around simplicity, clarity and ease of use. Instead of loading the platform with dozens of complex markets, Finst focuses on a tight set of features that help users buy, manage and grow their crypto portfolio.

Spot Trading

Spot trading is the core of Finst. You can buy, sell and swap more than 300 cryptocurrencies directly with euros. Everything is designed to be straightforward.

Key points:

- All trades use a single flat 0.15 percent fee

- No maker or taker system

- No volume based discounts or VIP tiers

- No hidden spread on top of the displayed price

- Buy, sell or swap coins instantly

The trading screen is intentionally simple. You get basic charts, price movements, order tickets and a clear summary that shows exactly what you are paying. This suits long term investors and casual traders who prefer clarity over complex tools.

Auto Invest (Recurring Purchases)

Auto Invest is one of the strongest features on Finst for long term portfolio building. You choose a coin or a bundle, set the amount and pick how often you want to buy. The platform automatically places the recurring order for you.

Useful scenarios:

- Dollar cost averaging into Bitcoin or Ethereum

- Building long term exposure to several coins without timing the market

- Setting up weekly or monthly purchases that fit your budget

You can also activate automatic withdrawals to an external wallet after each purchase if you prefer self custody.

Crypto Bundles

Bundles are a unique product on Finst that offer easy diversification. Instead of buying individual coins, you invest in a pre built basket that follows a theme or strategy.

Examples include:

- Top 5 or Top 10 by market cap

- ESG and sustainability themed bundles

- Category focused bundles such as layer 1 networks or Web3 tokens

When you buy a bundle on Finst, you actually own the underlying tokens in your account. This is not a synthetic instrument. Finst automatically rebalances the bundle to keep it aligned with its target allocation.

There is a small monthly management fee for holding a bundle since it requires ongoing maintenance and rebalancing.

Staking (Passive Income)

Finst integrates staking directly into the platform so users can earn passive yield without using external wallets or validator services.

Supported staking coins typically include:

- Ethereum

- Solana

- Cardano

- Polkadot

- Cosmos

- Near

- Polygon

Staking on Finst is flexible. There are no long lockups and no high minimum amounts. You can stake, unstake or sell at any time. Rewards are deposited regularly into your account and the displayed APY already includes the platform’s fee.

This makes staking accessible for beginners who want to grow their holdings without dealing with complex blockchain tooling.

Converting and Swapping

Beyond trading against EUR, you can also swap between pairs of supported crypto assets. This is helpful if you want to rebalance your portfolio, rotate from one asset into another or diversify without going back to fiat first.

The same flat 0.15 percent fee applies to swaps.

On Chain Deposits and Withdrawals

Finst supports crypto deposits and withdrawals for many major assets. You can send coins to an external wallet or another platform. Network support depends on the asset, but Finst generally supports the most common chains.

This allows users to use Finst as an entry and exit point for their on chain activity.

Portfolio Tracking and Analytics

Finst includes simple but effective tools to track:

- Portfolio value over time

- Unrealized and realized gains

- Asset allocation

- Historical performance of each coin

- The performance of bundles and auto invest plans

The focus is on clarity rather than advanced analytics. It feels closer to a traditional investment portfolio app than a trading terminal.

Mobile and Desktop Platforms

Finst is fully available on both mobile and desktop. The apps let you:

- Complete onboarding and verification

- Deposit and withdraw

- Trade and swap

- Stake and manage bundles

- Create and modify auto invest plans

- Track your portfolio

The design is lightweight and clean so new users can navigate it easily.

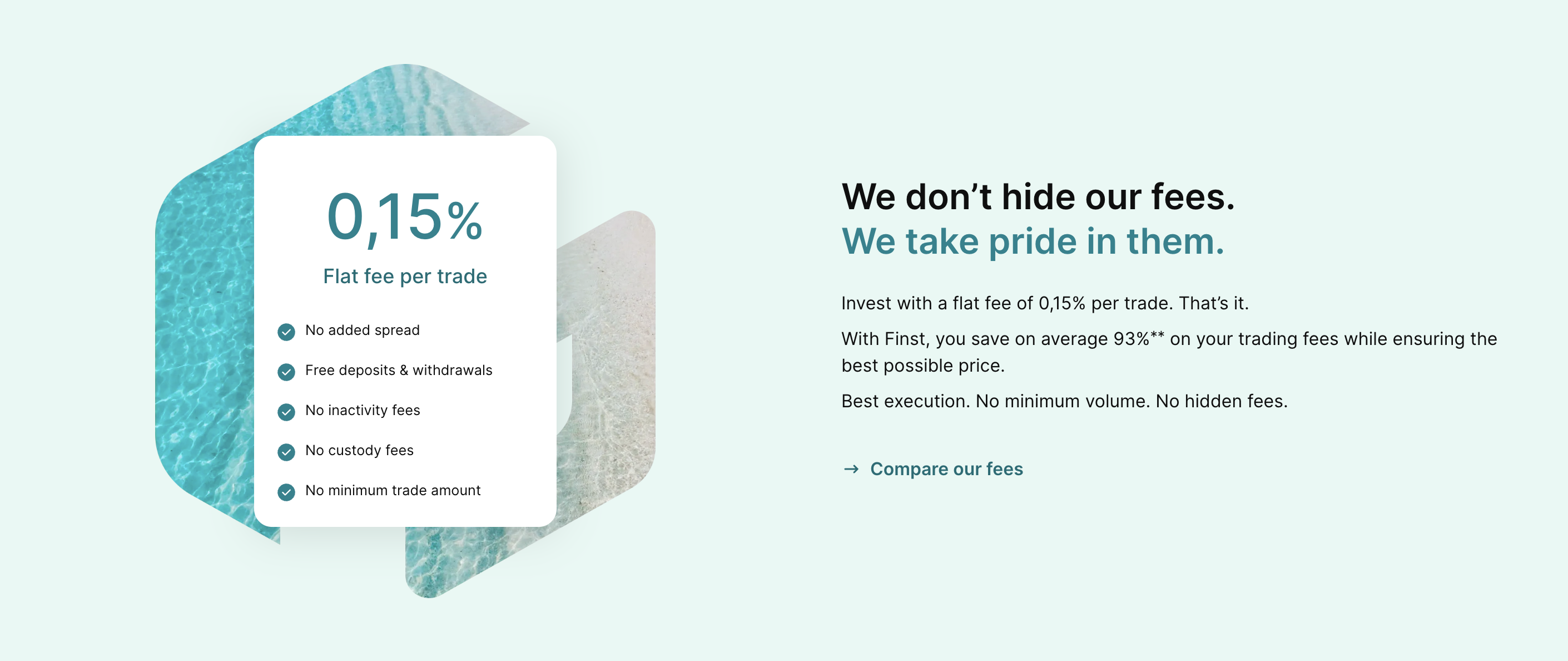

Fees on Finst

Finst uses one of the simplest fee structures in the European market. There are only a few types of fees to understand and they are all easy to identify. The platform positions itself as low cost, transparent and beginner friendly, so everything is kept as flat and predictable as possible.

Trading Fees

All buy, sell and swap orders on Finst use the same fee: a flat 0.15 percent applied to the trade amount. There are no maker or taker roles, no tiered discounts and no hidden spread built into the price. What you see on the order screen is what you pay. This makes the platform especially appealing to long term investors and casual users who do not want to calculate different fee structures or monitor changing spreads.

This flat fee structure means the cost ratio is always the same regardless of volume. High frequency traders may prefer exchanges with lower maker fees or volume based discounts, but Finst is not targeting that audience.

Fiat Deposit and Withdrawal Fees

Finst does not charge users for depositing or withdrawing euros. SEPA bank transfers and supported local European payment methods are free on the platform side. This is a strong advantage for European users who regularly move funds in and out of their investment account.

Your own bank may charge fees for certain transfers, but Finst itself does not impose costs on euro movements.

Crypto Withdrawal Fees

Crypto withdrawal fees are dynamic. Each asset has its own fee based on network conditions and the cost of processing the transaction. Some coins have fees close to standard network costs, while others come with a noticeable markup. These fees are shown before you confirm your withdrawal.

For users who rarely withdraw crypto on chain, this may not matter much. For users who regularly move assets to external wallets or other exchanges, it is worth checking the cost on the fee page before using Finst as your main withdrawal hub.

Fees for Crypto Bundles

Crypto Bundles come with a small ongoing management fee. This fee is charged monthly as a percentage of the bundle’s total value. It covers the cost of maintaining and rebalancing the bundle, since Finst adjusts the holdings over time to match its strategy.

The management fee is separate from the standard 0.15 percent trading fee that applies when you buy or sell bundle units.

No Extra Platform Charges

Finst does not add:

- Inactivity fees

- Custody fees

- Monthly subscription costs

- Hidden markups on fiat deposits or withdrawals

The only ongoing expense is the small bundle fee if you choose to invest in bundles.

Who Is Finst For?

Finst is built for a very specific type of user. The platform is not trying to cater to everyone in the crypto space. Instead, it focuses on people who want a clean, regulated, low effort way to invest in crypto using euros. The ideal Finst user values simplicity, fee transparency and long term portfolio management more than speculative trading.

Best Suited For

- European residents who fund with EUR - Finst is designed around SEPA transfers and local EU payment methods. If your financial life is already based in euros, the platform fits naturally into your routine and makes account funding effortless.

- Long term investors building a diversified portfolio - Finst is built for people who want to buy and hold crypto, gradually accumulate coins over time and grow their wealth with a balanced and steady approach. The platform has the right structure for this, including auto invest, bundles and staking.

- Beginners and casual investors - The user interface is simple and avoids unnecessary technical elements. There are no intimidating trading screens, no complex leverage tools and no specialist features. This makes Finst accessible for users who want a comfortable and safe environment.

- Users who want passive income through staking - Staking is integrated directly into the platform with flexible access and no lockups. People who want to earn rewards on their assets without learning how to run validators or interact with DeFi protocols will find this especially appealing.

- Investors who want clarity on fees and asset safety - The pricing model is flat and predictable. Client assets are held separately, supported by modern custody systems, and presented with a transparent approach. This makes the platform attractive to users who value a clear and trustworthy structure.

Not Ideal For

- Traders who need derivatives or leverage - Finst does not offer futures, margin trading, options or perpetual contracts. Anyone looking for high leverage speculation will find the platform too limited.

- High volume or professional traders - Without maker fee discounts or VIP tiers, active traders will not find the fee structure optimized for large scale trading.

- Users who want experimental small cap coins - Finst does support a wide list of assets, but it does not focus on ultra niche speculative tokens that appear on more aggressive exchanges.

- People outside the European market - Since the entire platform is built around EU banking, regulations and euro funding, it is not suitable for non European residents.

Final Verdict

Strengths

- Simple and low cost

- EUR friendly

- Good staking options

- Easy long term investing tools

- Clean mobile and desktop experience

Weak Points

- No leverage or futures

- No VIP fees

- Limited appeal for pro traders

- EU only access

Overall

Finst is a strong choice for European users who want a safe, simple and low fee platform for long term crypto investing. It is not built for advanced trading, but it excels at everything a regular investor needs.

Reviews

Log in to post a reivew

No reviews yet

Be the first to share your thoughts!